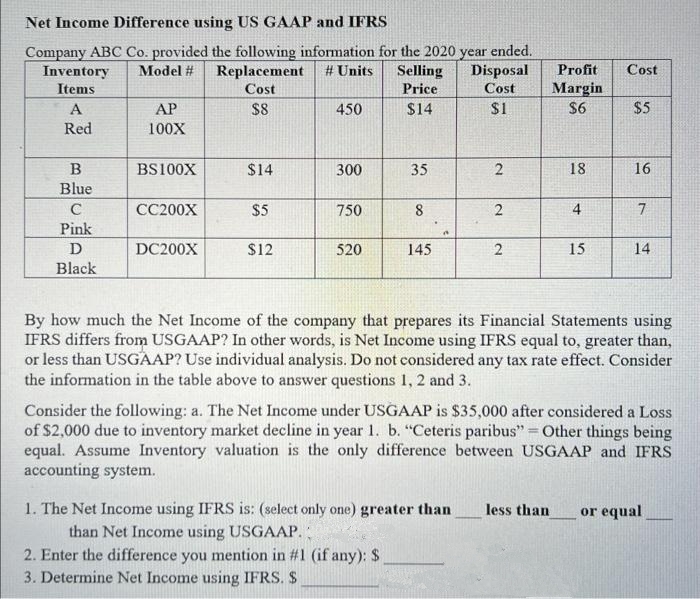

Net Income Difference using US GAAP and IFRS Company ABC Co. provided the following information for the 2020 year ended. Model # Replacement # Units Cost $8 Inventory Items A Red B Blue C Pink D Black AP 100X BS100X CC200X DC200X $14 $5 $12 450 300 750 520 Selling Disposal Price Cost $14 $1 35 8 2. Enter the difference you mention in #1 (if any): S 3. Determine Net Income using IFRS. $ 145 2 2 2 Profit Cost Margin $6 1. The Net Income using IFRS is: (select only one) greater than less than than Net Income using USGAAP.; 18 4 15 $5 16 7 By how much the Net Income of the company that prepares its Financial Statements using IFRS differs from USGAAP? In other words, is Net Income using IFRS equal to, greater than, or less than USGAAP? Use individual analysis. Do not considered any tax rate effect. Consider the information in the table above to answer questions 1, 2 and 3. 14 Consider the following: a. The Net Income under USGAAP is $35,000 after considered a Loss of $2,000 due to inventory market decline in year 1. b. "Ceteris paribus" = Other things being equal. Assume Inventory valuation is the only difference between USGAAP and IFRS accounting system. or equal

Net Income Difference using US GAAP and IFRS Company ABC Co. provided the following information for the 2020 year ended. Model # Replacement # Units Cost $8 Inventory Items A Red B Blue C Pink D Black AP 100X BS100X CC200X DC200X $14 $5 $12 450 300 750 520 Selling Disposal Price Cost $14 $1 35 8 2. Enter the difference you mention in #1 (if any): S 3. Determine Net Income using IFRS. $ 145 2 2 2 Profit Cost Margin $6 1. The Net Income using IFRS is: (select only one) greater than less than than Net Income using USGAAP.; 18 4 15 $5 16 7 By how much the Net Income of the company that prepares its Financial Statements using IFRS differs from USGAAP? In other words, is Net Income using IFRS equal to, greater than, or less than USGAAP? Use individual analysis. Do not considered any tax rate effect. Consider the information in the table above to answer questions 1, 2 and 3. 14 Consider the following: a. The Net Income under USGAAP is $35,000 after considered a Loss of $2,000 due to inventory market decline in year 1. b. "Ceteris paribus" = Other things being equal. Assume Inventory valuation is the only difference between USGAAP and IFRS accounting system. or equal

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13MJ: Mornin' Joe

Section: Chapter Questions

Problem 3IFRS

Related questions

Question

Transcribed Image Text:Net Income Difference using US GAAP and IFRS

Company ABC Co. provided the following information for the 2020 year ended.

Inventory Model # Replacement # Units Selling Disposal

Items

Cost

Price

Cost

A

$8

$14

$1

Red

B

Blue

C

Pink

D

Black

AP

100X

BS100X

CC200X

DC200X

$14

$5

$12

450

300

750

520

35

8

145

2

2

2

Profit Cost

Margin

$6

18

1. The Net Income using IFRS is: (select only one) greater than less than

than Net Income using USGAAP.

2. Enter the difference you mention in #1 (if any): $

3. Determine Net Income using IFRS. S

4

15

$5

16

7

14

By how much the Net Income of the company that prepares its Financial Statements using

IFRS differs from USGAAP? In other words, is Net Income using IFRS equal to, greater than,

or less than USGAAP? Use individual analysis. Do not considered any tax rate effect. Consider

the information in the table above to answer questions 1, 2 and 3.

Consider the following: a. The Net Income under USGAAP is $35,000 after considered a Loss

of $2,000 due to inventory market decline in year 1. b. "Ceteris paribus" = Other things being

equal. Assume Inventory valuation is the only difference between USGAAP and IFRS

accounting system.

or equal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning