Atter Flat tax. Steve Forbes ran for U.S. president in 1996 and 2000 on a platform proposing a 17% flat tax, that is, an income tax that would simply be 17% of each tax payer's taxable income. Suppose that Alice was single in the year 2020 with a taxable income of $30,000 and that Joe was single in the year 2020 with a taxable income of $300,000. 2020 Tax Table for Singles If Taxable Income Is over $0 9876 40, 126 85,526 163,301 207,351 But not over $9875 40, 125 85,525 163,300 207,350 518,400 This amount $987.50 4617.50 14,605.50 33, 271.50 47,367.50 The Tax is Plus this % 10% 12% 22% 24% 32% 35% of the excess over $0 9875 40, 125 85,525 163,300 207,350

Atter Flat tax. Steve Forbes ran for U.S. president in 1996 and 2000 on a platform proposing a 17% flat tax, that is, an income tax that would simply be 17% of each tax payer's taxable income. Suppose that Alice was single in the year 2020 with a taxable income of $30,000 and that Joe was single in the year 2020 with a taxable income of $300,000. 2020 Tax Table for Singles If Taxable Income Is over $0 9876 40, 126 85,526 163,301 207,351 But not over $9875 40, 125 85,525 163,300 207,350 518,400 This amount $987.50 4617.50 14,605.50 33, 271.50 47,367.50 The Tax is Plus this % 10% 12% 22% 24% 32% 35% of the excess over $0 9875 40, 125 85,525 163,300 207,350

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 33DQ

Related questions

Question

Transcribed Image Text:What was Alice's tax?

(Enter your answer to the nearest cent. Hint: Use the 2020 Tax Table.)

Alice's tax was $

Transcribed Image Text:Atters

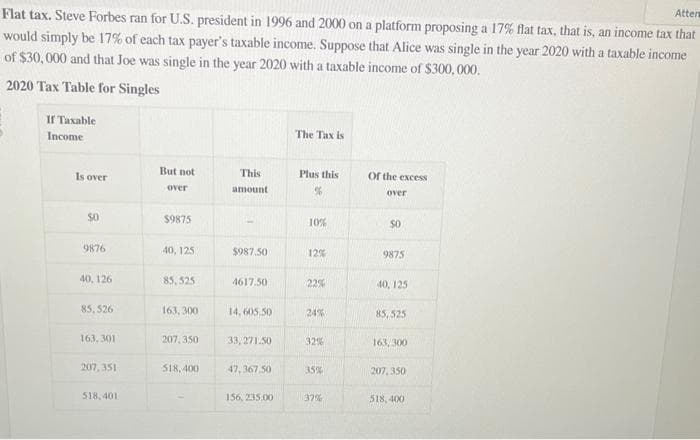

Flat tax. Steve Forbes ran for U.S. president in 1996 and 2000 on a platform proposing a 17% flat tax, that is, an income tax that

would simply be 17% of each tax payer's taxable income. Suppose that Alice was single in the year 2020 with a taxable income

of $30,000 and that Joe was single in the year 2020 with a taxable income of $300,000.

2020 Tax Table for Singles

If Taxable

Income

Is over

$0

9876

40, 126

85,526

163, 301

207,351

518, 401

But not

over

$9875

40, 125

85,525

163,300

207,350

518,400

This

amount

$987.50

4617.50

14,605.50

33, 271.50

47,367.50

156, 235.00

The Tax is

Plus this

%

10%

12%

22%

24%

32%

35%

37%

of the excess

over

$0

9875

40, 125

85,525

163,300

207,350

518, 400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning