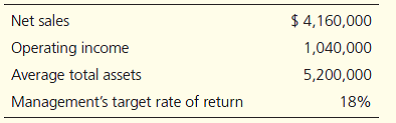

Net sales Operating income Average total assets Management's target rate of return $ 4,160,000 1,040,000 5,200,000 18%

Q: 12. Z Division of XYZ Corp. has the following information for 2002: $1,800,000 10% Assets available…

A: Target income = $1,800,000 x 10% = $180,000

Q: Assume the Residential Division of Kappy Faucets had the following results last year: Net sales…

A: Ratio analysis is a method of measuring the financial position of the organization with different…

Q: A company's divislon has sales of $6,000,000, Income of $240,000, and average assets of $4,800.000.…

A: Financial ratios are used to check different aspects of a company - liquidity, solvency, etc. They…

Q: Creative Business Solutions (CBS), a division of Doug Jorgenson CPA, buys and installs modular…

A: SEGMENT MARGIN FOR CBS : PARTICULARS AMOUNT $ SALES $9,000,000 VARIABLE OPERATING COST…

Q: The Millard Division's operating data for the past two years are provided below: Year 1 Year 2…

A: Return on investment is profitability ratio which shows operating income earned by investment…

Q: The Marine Division of Pacific Corp. has average invested assets of $110,000,000. Sales revenue of…

A: Residual income = Operating income - (Average invested assets x Hurdle rate)

Q: Division A of Kern Co. has sales of $350,000, cost of goods sold for $200,000, operating expenses of…

A: Formula Return on investment = (Sales-Cost of goods sold-Operating expenses)/Invested assets Where…

Q: The following are selected data for the division for the consumer products of ABC Corp for 2020:…

A: The answer for the multiple choice question and the calculation of return on investment for the…

Q: Division A of Ram Company has $1,000,000 of sales with a CM ratio of 35% and fixed expenses of…

A: ROI means Return on investment by the company which says that how much net income is earned on…

Q: The Hydride Division of Murdoch Corporation is an investment center. It has $1,000,000 of operating…

A: ROI = Net income /Operating assets Margin = Net income / Net sales

Q: Part I (1) What is residual income and how is it calculated? (2) Please use the information below…

A: The ratio analysis helps to analyze the financial statements of the business with various elements…

Q: The Computer Division's operating data for the past two years are provided below: Year 1…

A: The margin percentage shows the relationship between net income and sales, this percentage shows…

Q: Sales Net operating income Average operating assets $17,958,000 51,005,200 5 4,898,000 The…

A: Formula: Division return on investment = ( Net operating income / Average operating Assets ) x 100

Q: a. Using the DuPont formula for return on investment, determine the profit margin, investment…

A: The rate of return on investment is calculated as product of profit margin and investment turnover.…

Q: Use the following information to answer the questions. Company X $ 12,480,000 $ 3,120,000 2$ Company…

A: Return on Investment = Net Operating IncomeAverage Operating Assets Residual Income = Net…

Q: ROI, Residual IncomeThe following selected data pertain to the Argent Division for last year:Sales…

A: Calculation of Residual income Residual Income = Net Income - Minimum required amount of return…

Q: Assume the Residential Division of Kappy Faucets had the following results last year: Net sales…

A: Profit margin ratio: It is a profitability ratio calculated by the firm dividing operating income…

Q: Stuart Technologies, Inc. has three divisions. Stuart has a desired rate of return of 11.0 percent.…

A: Hi student Since there are multiple subparts, we will answer only first three subparts. If you want…

Q: Gator, Inc. has three operating divisions and requires a 12% return on all investments. Selected…

A: Step 1: a. Division A: Compute the operating assets as follows: Compute the revenue as…

Q: The Marine Division of Pacific Corp. has average invested assets of $120,000,000. Sales revenue of…

A: Return on investment = Operating income / Average invested assets where, Average invested assets =…

Q: Paints Division of PorEleben, Inc. had the following operation result in 2019: Sales: P12,000,000…

A: 1. Return on investment Investment=p2000000 ROI=2000000*30%=p600000 Net income=p600000

Q: Assume that Division Blue has achieved a yearly income from operations of $157,000 using $956,000 of…

A: Residual income: Residual income is the excess of income over the minimum acceptable return on…

Q: Cabell Products is a division of a major corporation. Last year the division had total sales of…

A: Formula: Margin = ( Net operating income / Sales ) x 100

Q: 1) Guerlane Fragrance Corporation has a perfume division, Essense, and a cologne division, Karisma.…

A: The following information Given in the question: Given Return on Investment =20% Average Operating…

Q: Assume the Residential Division of Kipper Faucets had the following results last year: What is the…

A:

Q: Consider the following data from two divisions of a company, P and Q: Divisional P Q Sales $…

A: Working: Calculation of Division P's residual income (RI): Residual income = Net operating income -…

Q: Consider the following data from two divisions of a company, P and Q: Divisional P Q Sales $…

A: The question is related to Residual Income or Retained Earnings. The return on investment is…

Q: Lumberton Home Maintenance Company (LHMC) earned operating income of $6,000,000 on operating assets…

A: Definition: Return on Investment tells about the percentage of return obtained on total investment.…

Q: The following information relates to last year's operations at the Dairy Division of Carrefour…

A: Given information: Turnover on operating assets= 6 times Sales= $9,70,000 Therefore, operating…

Q: Supply the missing data in the following table : Division A Division B Division C…

A: Residual income is the amount remaining out of the net income after deducting the equity charge. The…

Q: The following are selected data for the division for the consumer products of ABC Corp for 2020:…

A: Ratio analysis means where different ratio of various years of years companies has been compared and…

Q: Supply the missing data in the following table :…

A: Return on investment and residual income are two profitability ratios which shows how much net…

Q: For its three investment centers, Fantastic Company accumulates the following data: II III Sales…

A: Return on investment (ROI): This financial ratio evaluates how efficiently the assets are used in…

Q: Assume the Hiking Shoes division of the All About Shoes Corporation had the following results last…

A: Sales margin represent the amount or percentage of profit generated from sales.

Q: Dickonson Products is a division of a major corporation. The following data are for the last year of…

A: Given data:

Q: #1 The company had an overall return on investment (ROI) of 15% last year (considering all…

A: Introduction Margin: It is the ratio of net operating income divided by sales. It gives information…

Q: Assume a company with two divisions (A and B) prepared the following segmented income statement:…

A: Break even is the point at which an entity is just recovering its costs from the revenues but not…

Q: Assume the Residential Division of Krandell Faucets had the following results last year: Net sales…

A:

Q: Selected financial data for the Photocopies Division of Elizabeth's Business Machines is as follows:…

A: Residual Income = Operating Income - (Total Operating Assets x Required Rate of Return)

Q: Warren Company has two divisions with the following results: Ashland $ 442,000 $ 262,000 $ 180,000…

A: Investment turnover helps to determine the efficiency of the company by measuring the company's…

Q: Eacher Wares is a diviSion of a major corpora Dilowing data are for the latest year of operations:…

A: "Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: Assume that a division of MN Company has a 10% return on sales, income of $10,000, and an investment…

A: Formulas: Return on sales = Net income / Sales Investment turnover = Sales / Investment

Assume the Residential Division of Kipper Faucets had the following results last year:

What is the division’s RI?

a. $(140,000)

b. $104,000

c. $140,000

d. $(104,000)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Sales $1,519,621 Operating Income $108,450 Total Assets (investment) $583,662 Target Rate of Return (Cost of Capital) 10% What is return on investment? Input your answer to 1 decimal place. For example if you calculate .1892 enter 18.9.a. D supplied following data are for the latest year of operations: Sales ₱24,480,000; Operating income ₱1,738,080; Average operating assets ₱6,000,000. Required rate of return 16% 1. What is D's ROI? 1. What is D's residual income?Provide the missing data in the following tabulation: Division Alpha Bravo Charlie Revenue 11500000 Operating profit 920000 210000 Average operating assets 800000 Margin 4,00% 7,00% Turnover 5 Return on investment (ROI) 20% 14%

- Q23 Selected data from Box Division's accounting records revealed the following: Sales $ 345,060 Average investment $ 200,100 Net operating income $ 24,300 Minimum rate of return (divisional cost of capital) 11% Box Division's return on sales (ROS) is: (Round your percentages to one decimal place.) Multiple Choice 11.1%. 4.1%. 7.0%. 19.2%. 12.1%.Data Sales $25,000,000 Net operating income $3,000,000 Average operating assets $9,000,000 Minimum required rate of return 25% Enter a formula into each of the cells marked with a ? below Review Problem: Return on Investment (ROI) and Residual Income Compute the ROI Margin ? Turnover ? ROI ? Compute the residual income Average operating assets ? Net operating income ? Minimum required return ? Residual income ?Selected data from an investment center of IROL Inc. follow:Sales $8,000,000Net book value of assets, beginning 2,500,000Net book value of assets, ending 2,600,000Net operating income 640,000Minimum rate of return 12%Required1. Calculate return on sales (ROS), asset turnover (AT), and return on investment (ROI).2. Calculate residual income (RI).

- Solvency and Profitability Trend Analysis Addai Company has provided the following comparative information: 20Y8 20Y7 20Y6 20Y5 20Y4 Net income $273,406 $367,976 $631,176 $884,000 $800,000 Interest expense 616,047 572,003 528,165 495,000 440,000 Income tax expense 31,749 53,560 106,720 160,000 200,000 Total assets (ending balance) 4,417,178 4,124,350 3,732,443 3,338,500 2,750,000 Total stockholders’ equity (ending balance) 3,706,557 3,433,152 3,065,176 2,434,000 1,550,000 Average total assets 4,270,764 3,928,396 3,535,472 3,044,250 2,475,000 Average total stockholders' equity 3,569,855 3,249,164 2,749,588 1,992,000 1,150,000 You have been asked to evaluate the historical performance of the company over the last five years. Selected industry ratios have remained relatively steady at the following levels for the last five years: 20Y4–20Y8 Return on total assets 28%…Solvency and Profitability Trend Analysis Addai Company has provided the following comparative information: 20Y8 20Y7 20Y6 20Y5 20Y4 Net income $273,406 $367,976 $631,176 $884,000 $800,000 Interest expense 616,047 572,003 528,165 495,000 440,000 Income tax expense 31,749 53,560 106,720 160,000 200,000 Total assets (ending balance) 4,417,178 4,124,350 3,732,443 3,338,500 2,750,000 Total stockholders’ equity (ending balance) 3,706,557 3,433,152 3,065,176 2,434,000 1,550,000 Average total assets 4,270,764 3,928,396 3,535,472 3,044,250 2,475,000 Average total stockholders' equity 3,569,855 3,249,164 2,749,588 1,992,000 1,150,000 You have been asked to evaluate the historical performance of the company over the last five years. Selected industry ratios have remained relatively steady at the following levels for the last five years: 20Y4–20Y8 Return on total assets 28%…Solvency and Profitability Trend Analysis Addai Company has provided the following comparative information: 20Y8 20Y7 20Y6 20Y5 20Y4 Net income $273,406 $367,976 $631,176 $884,000 $800,000 Interest expense 616,047 572,003 528,165 495,000 440,000 Income tax expense 31,749 53,560 106,720 160,000 200,000 Total assets (ending balance) 4,417,178 4,124,350 3,732,443 3,338,500 2,750,000 Total stockholders’ equity (ending balance) 3,706,557 3,433,152 3,065,176 2,434,000 1,550,000 Average total assets 4,270,764 3,928,396 3,535,472 3,044,250 2,475,000 Average total stockholders' equity 3,569,855 3,249,164 2,749,588 1,992,000 1,150,000 You have been asked to evaluate the historical performance of the company over the last five years. Selected industry ratios have remained relatively steady at the following levels for the last five years: 20Y4–20Y8 Return on total assets 28%…

- Simple ROI and Residual Income Calculations. Consider the following data: 1.) DIVISION X Y Z Invested Capital P2,000,000 (1)1,300,000 P1,250,000 Income (2) 100,000 P182,000 P 150,000 Revenue P4,000,000 P3,640,000 (3) 3,750,000 Income Percentage of Revenue 2.5% (4) 5% (5) 4% Capital Turnover (6) 2 (7) 2.8 3 Rate of Return on Invested Capital (8) 5% 14% (9) 12% Required: 1. Which division is the best performer 2. Suppose each division is assessed an imputed interest rate of 20% on invested capital. Compute the residual income for each division.Sales : $250,000Costs : $134,000Depreciation : $10,200Operating expenses : $6,000Interest expenses : $20,700Taxes : $18,420Dividends : $10,600Addition to Retained Earnings : $50,080Long term debt repaid : $9,300New Equity issued : $8,470New fixed assets acquired : $15,000 You are required to:iv) Calculate the cash flow from assets v) Calculate net capital spending vi) Calculate change in NWCGiven the following information:SalesFixed ExpensesVariable Expensess5,0002,0001,750What would expected operating profit be if the company experienced a 10% increase in fixedcosts and a 100/0 increase m sales volume? a) $1,375. b) $1,550. c) $1,250. d) $1,750.