New Tech Cycles Purchases Unit Tot. Date QTY Cost Cost Oct. 1 Cost of Goods Sold Unit Tot. QTY Cost Cost Inventory on Hand Unit Tot. QTY Cost Cost

New Tech Cycles Purchases Unit Tot. Date QTY Cost Cost Oct. 1 Cost of Goods Sold Unit Tot. QTY Cost Cost Inventory on Hand Unit Tot. QTY Cost Cost

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 7PA: Selected data on merchandise inventory, purchases, and sales for Celebrity Tan Co. and Ranchworks...

Related questions

Question

New Tech

Cycles started

October

with

12

bicycles that cost

$42

each. On

October 16,

New Tech

purchased

40

bicycles at

$68

each. On

October 31,

New Tech

sold

28

bicycles for

$99

each.Requirements

|

1.

|

Prepare

New Tech

Cycle's perpetual inventory record assuming the company uses the FIFO inventory costing method. |

|

2.

|

Journalize the

October 16

purchase of merchandise inventory on account and the

October 31

sale of merchandise inventory on account. |

Transcribed Image Text:New Tech Cycles started October with 12 bicycles that cost $42 each.

On October 16, New Tech purchased 40 bicycles at $68 each. On

October 31, New Tech sold 28 bicycles for $99 each.

Requirements

Prepare New Tech Cycle's perpetual inventory record assuming

the company uses the FIFO inventory costing method.

1.

2.

Journalize the October 16 purchase of merchandise inventory on

account and the October 31 sale of merchandise inventory on

account.

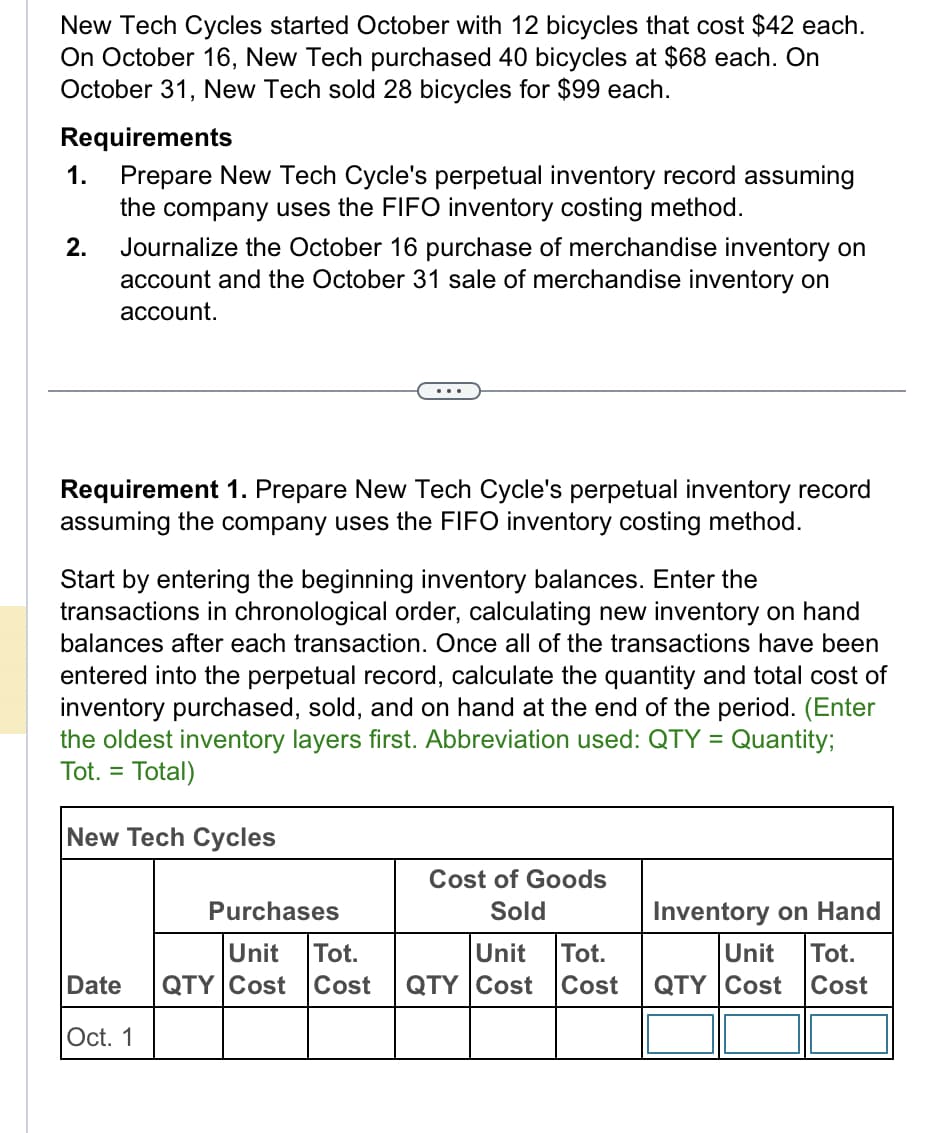

Requirement 1. Prepare New Tech Cycle's perpetual inventory record

assuming the company uses the FIFO inventory costing method.

Start by entering the beginning inventory balances. Enter the

transactions in chronological order, calculating new inventory on hand

balances after each transaction. Once all of the transactions have been

entered into the perpetual record, calculate the quantity and total cost of

inventory purchased, sold, and on hand at the end of the period. (Enter

the oldest inventory layers first. Abbreviation used: QTY = Quantity;

Tot. = Total)

New Tech Cycles

Purchases

Unit

Tot.

Date QTY Cost Cost

Oct. 1

Cost of Goods

Sold

Unit Tot.

QTY Cost Cost

Inventory on Hand

Unit Tot.

QTY |Cost Cost

Expert Solution

Step 1

The inventory valuation method refers to the method used by a company to value its inventory for accounting and financial reporting purposes.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning