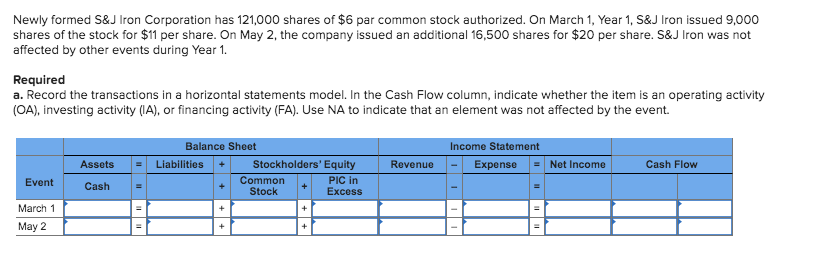

Newly formed S&J Iron Corporation has 121,000 shares of $6 par common stock authorized. On March 1, Year 1, S&J Iron issued 9,000 shares of the stock for $11 per share. On May 2, the company issued an additional 16,500 shares for $20 per share. S&J Iron was not affected by other events during Year 1. Required a. Record the transactions in a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Use NA to indicate that an element was not affected by the event. Balance Sheet Income Statement Expense Cash Flow Stockholders' Equity Common Stock Revenue Net Income Assets Cash Liabilities PIC in Excess Event March 1 May 2

Newly formed S&J Iron Corporation has 121,000 shares of $6 par common stock authorized. On March 1, Year 1, S&J Iron issued 9,000 shares of the stock for $11 per share. On May 2, the company issued an additional 16,500 shares for $20 per share. S&J Iron was not affected by other events during Year 1. Required a. Record the transactions in a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Use NA to indicate that an element was not affected by the event. Balance Sheet Income Statement Expense Cash Flow Stockholders' Equity Common Stock Revenue Net Income Assets Cash Liabilities PIC in Excess Event March 1 May 2

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.1P

Related questions

Question

Transcribed Image Text:Newly formed S&J Iron Corporation has 121,000 shares of $6 par common stock authorized. On March 1, Year 1, S&J Iron issued 9,000

shares of the stock for $11 per share. On May 2, the company issued an additional 16,500 shares for $20 per share. S&J Iron was not

affected by other events during Year 1.

Required

a. Record the transactions in a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity

(OA), investing activity (IA), or financing activity (FA). Use NA to indicate that an element was not affected by the event.

Balance Sheet

Income Statement

Expense

Cash Flow

Stockholders' Equity

Common

Stock

Revenue

Net Income

Assets

Cash

Liabilities

PIC in

Excess

Event

March 1

May 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning