Beacon Corporation issued a 3 percent stock dividend on 37,000 shares of its $7 par common stock. At the time of the dividend, the market value of the stock was $26 per share. Required a. Compute the amount of the stock dividend. b. Show the effects of the stock dividend on the financial statements using a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA). investing activity (A), or financing activity (FA). If an element was not affected by the event, leave the cell blank Complete this question by entering your answers in the tabs below. Required A Required B Compute the amount of the stock dividend. Stock dividend Required

Beacon Corporation issued a 3 percent stock dividend on 37,000 shares of its $7 par common stock. At the time of the dividend, the market value of the stock was $26 per share. Required a. Compute the amount of the stock dividend. b. Show the effects of the stock dividend on the financial statements using a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA). investing activity (A), or financing activity (FA). If an element was not affected by the event, leave the cell blank Complete this question by entering your answers in the tabs below. Required A Required B Compute the amount of the stock dividend. Stock dividend Required

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter12: Statement Of Stockholders’ Equity (stockeq)

Section: Chapter Questions

Problem 2R: Chen Corporation began 2012 with the following stockholders equity balances: The following selected...

Related questions

Question

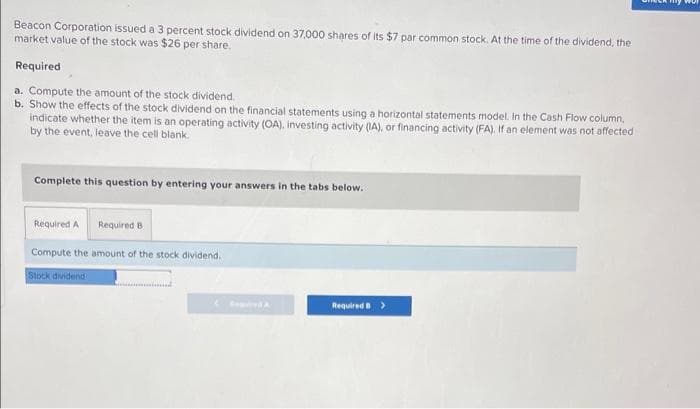

Transcribed Image Text:Beacon Corporation issued a 3 percent stock dividend on 37,000 shares of its $7 par common stock. At the time of the dividend, the

market value of the stock was $26 per share.

Required

a. Compute the amount of the stock dividend.

b. Show the effects of the stock dividend on the financial statements using a horizontal statements model. In the Cash Flow column,

indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected

by the event, leave the cell blank.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Compute the amount of the stock dividend.

Stock dividend

Required >

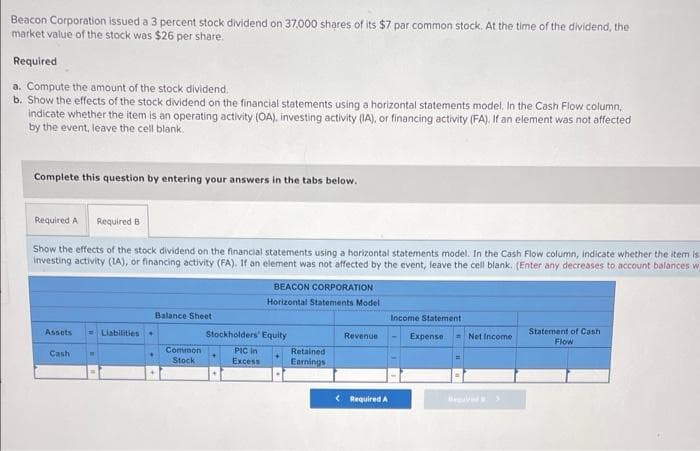

Transcribed Image Text:Beacon Corporation issued a 3 percent stock dividend on 37,000 shares of its $7 par common stock. At the time of the dividend, the

market value of the stock was $26 per share.

Required

a. Compute the amount of the stock dividend,

b. Show the effects of the stock dividend on the financial statements using a horizontal statements model. In the Cash Flow column,

indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected

by the event, leave the cell blank.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Show the effects of the stock dividend on the financial statements using a horizontal statements model. In the Cash Flow column, indicate whether the item is

Investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. (Enter any decreases to account balances w

BEACON CORPORATION

Horizontal Statements Model

Balance Sheet

Income Statement

= Liabilities

Statement of Cash

Flow

Assets

Stockholders' Equity

Revenue

Expense

= Net Income

Common

PIC in

Excess

Retained

Earnings

Cash

Stock

< Required A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning