ng Dependents (LO 1.6) of the following situations, determine whether the taxpayer(s) has/have a dependent and if so, ent credit for 2021 (assuming no advance payments or limitations apply). ount is zero, enter "0". Depend- (Yes/M onna, a 20-year-old single taxpayer, supports her mother, who lives in her own Yes me. Her mother has income of $1,350.

ng Dependents (LO 1.6) of the following situations, determine whether the taxpayer(s) has/have a dependent and if so, ent credit for 2021 (assuming no advance payments or limitations apply). ount is zero, enter "0". Depend- (Yes/M onna, a 20-year-old single taxpayer, supports her mother, who lives in her own Yes me. Her mother has income of $1,350.

Chapter13: Tax Credits And Payment Procedures

Section: Chapter Questions

Problem 30P

Related questions

Question

100%

I need to answer on C

Transcribed Image Text:Problem 1-21

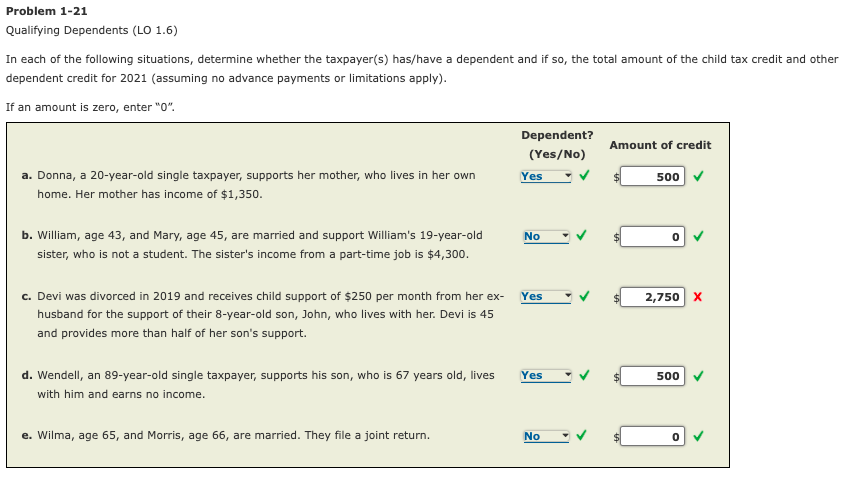

Qualifying Dependents (LO 1.6)

In each of the following situations, determine whether the taxpayer(s) has/have a dependent and if so, the total amount of the child tax credit and other

dependent credit for 2021 (assuming no advance payments or limitations apply).

If an amount is zero, enter "0".

Dependent?

Amount of credit

(Yes/No)

a. Donna, a 20-year-old single taxpayer, supports her mother, who lives in her own

Yes

500

home. Her mother has income of $1,350.

b. William, age 43, and Mary, age 45, are married and support William's 19-year-old

No

sister, who is not a student. The sister's income from a part-time job is $4,300.

c. Devi was divorced in 2019 and receives child support of $250 per month from her ex- Yes

2,750 x

husband for the support of their 8-year-old son, John, who lives with her. Devi is 45

and provides more than half of her son's support.

d. Wendell, an 89-year-old single taxpayer, supports his son, who is 67 years old, lives

Yes

500

with him and earns no income.

e. Wilma, age 65, and Morris, age 66, are married. They file a joint return.

No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning