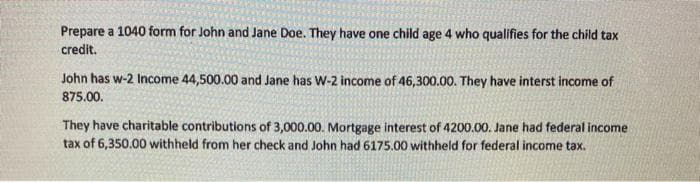

Prepare a 1040 form for John and Jane Doe. They have one child age 4 who qualifies for the child tax credit. John has w-2 Income 44,500.00 and Jane has W-2 income of 46,300.00. They have interst income of 875.00. They have charitable contributions of 3,000.00. Mortgage interest of 4200.00. Jane had federal income tax of 6,350.00 withheld from her check and John had 6175.00 withheld for federal income tax.

Prepare a 1040 form for John and Jane Doe. They have one child age 4 who qualifies for the child tax credit. John has w-2 Income 44,500.00 and Jane has W-2 income of 46,300.00. They have interst income of 875.00. They have charitable contributions of 3,000.00. Mortgage interest of 4200.00. Jane had federal income tax of 6,350.00 withheld from her check and John had 6175.00 withheld for federal income tax.

Chapter8: Taxation Of Individuals

Section: Chapter Questions

Problem 29P: Arthur and Cora are married and have 2 dependent children. They have a gross income of 95,000. Their...

Related questions

Question

100%

Transcribed Image Text:Prepare a 1040 form for John and Jane Doe. They have one child age 4 who qualifies for the child tax

credit.

John has w-2 Income 44,500.00 and Jane has W-2 income of 46,300.00. They have interst income of

875.00.

They have charitable contributions of 3,000.00. Mortgage interest of 4200.00. Jane had federal income

tax of 6,350.00 withheld from her check and John had 6175.00 withheld for federal income tax.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT