nges in interest rates, the bond's market price has fallen to $890.20. The capital gains yield last year was -10.98%. o maturity? Do not round intermediate calculations. Round your answer to two decimal places. r, what are the expected current and capital gains yields? (Hint: Refer to Footnote 6 for the definition of the current y intermediate calculations. Round your answers to two decimal places. ield: % ains yield: % ized yields be equal to the expected yields if interest rates change? If not, how will they differ? s promised coupon payments are made, the current yield will change as a result of changing interest rates. However, e the price to change and as a result, the realized return to investors will differ from the YTM. s promised coupon payments are made, the current yield will not change as a result of changing interest rates. Howe cause the price to change and as a result, the realized return to investors should equal the YTM. s promised coupon payments are made, the current yield will change as a result of changing interest rates. However, e the price to change and as a result, the realized return to investors should equal the YTM. s promised coupon payments are made, the current yield will change as a result of changing interest rates. However, ause the price to change and as a result, the realized return to investors should equal the YTM. change they will cause the end-of-year price to change and thus the realized capital gains yield to change. As a result investors will differ from the YTM.

nges in interest rates, the bond's market price has fallen to $890.20. The capital gains yield last year was -10.98%. o maturity? Do not round intermediate calculations. Round your answer to two decimal places. r, what are the expected current and capital gains yields? (Hint: Refer to Footnote 6 for the definition of the current y intermediate calculations. Round your answers to two decimal places. ield: % ains yield: % ized yields be equal to the expected yields if interest rates change? If not, how will they differ? s promised coupon payments are made, the current yield will change as a result of changing interest rates. However, e the price to change and as a result, the realized return to investors will differ from the YTM. s promised coupon payments are made, the current yield will not change as a result of changing interest rates. Howe cause the price to change and as a result, the realized return to investors should equal the YTM. s promised coupon payments are made, the current yield will change as a result of changing interest rates. However, e the price to change and as a result, the realized return to investors should equal the YTM. s promised coupon payments are made, the current yield will change as a result of changing interest rates. However, ause the price to change and as a result, the realized return to investors should equal the YTM. change they will cause the end-of-year price to change and thus the realized capital gains yield to change. As a result investors will differ from the YTM.

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter7: Exponents And Exponential Functions

Section: Chapter Questions

Problem 68SGR

Related questions

Question

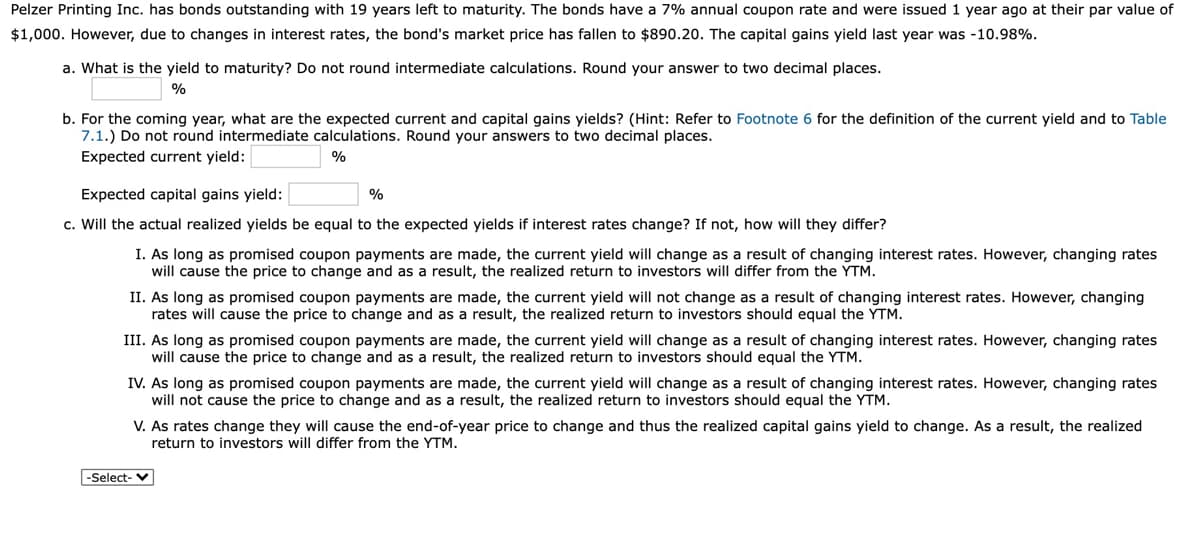

Transcribed Image Text:Pelzer Printing Inc. has bonds outstanding with 19 years left to maturity. The bonds have a 7% annual coupon rate and were issued 1 year ago at their par value of

$1,000. However, due to changes in interest rates, the bond's market price has fallen to $890.20. The capital gains yield last year was -10.98%.

a. What is the yield to maturity? Do not round intermediate calculations. Round your answer to two decimal places.

%

b. For the coming year, what are the expected current and capital gains yields? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table

7.1.) Do not round intermediate calculations. Round your answers to two decimal places.

Expected current yield:

%

Expected capital gains yield:

%

c. Will the actual realized yields be equal to the expected yields if interest rates change? If not, how will they differ?

I. As long as promised coupon payments are made, the current yield will change as a result of changing interest rates. However, changing rates

will cause the price to change and as a result, the realized return to investors will differ from the YTM.

II. As long as promised coupon payments are made, the current yield will not change as a result of changing interest rates. However, changing

rates will cause the price to change and as a result, the realized return to investors should equal the YTM.

III. As long as promised coupon payments are made, the current yield will change as a result of changing interest rates. However, changing rates

will cause the price to change and as a result, the realized return to investors should equal the YTM.

IV. As long as promised coupon payments are made, the current yield will change as a result of changing interest rates. However, changing rates

will not cause the price to change and as a result, the realized return to investors should equal the YTM.

V. As rates change they will cause the end-of-year price to change and thus the realized capital gains yield to change. As a result, the realized

return to investors will differ from the YTM.

-Select- V

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill