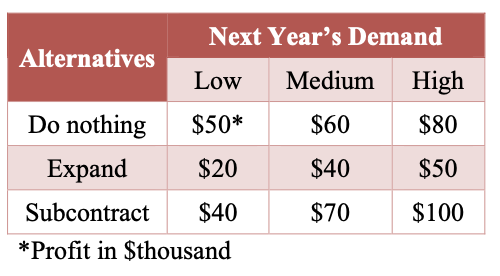

Niue Vanilla has had two successive years in which the Vanilla bean harvest has stretched the firm’s capacity within their drying sheds. Pita, the manger for the drying operation must now make a decision on capacity for next year. Estimated profits under each of the three possible states of nature are as shown in the table below, along with 3 possible alternatives he is considering: Do Nothing, Expand the Drying Shed operation, or Subcontract to a local farmer group who can do some of the drying. Suppose after a certain amount of discussion, Pita is able to subjectively assess the probabilities of low, medium and high demand: P(low) = 0.2, P(Medium) = 0.35 and P(high) = 0.45 Determine the expected profit of each alternative. Which alternative is best? Why? Analyse the problem using a decision tree. Show the expected profit of each alternative on the tree.

Niue Vanilla has had two successive years in which the Vanilla bean harvest has stretched the firm’s capacity within their drying sheds. Pita, the manger for the drying operation must now make a decision on capacity for next year. Estimated profits under each of the three possible states of nature are as shown in the table below, along with 3 possible alternatives he is considering: Do Nothing, Expand the Drying Shed operation, or Subcontract to a local farmer group who can do some of the drying.

Suppose after a certain amount of discussion, Pita is able to subjectively assess the probabilities of low, medium and high demand: P(low) = 0.2, P(Medium) = 0.35 and P(high) = 0.45

-

Determine the expected profit of each alternative. Which alternative is best? Why?

-

Analyse the problem using a decision tree. Show the expected profit of each alternative on the tree.

Step by step

Solved in 2 steps with 1 images