nnis has a short-term capital loss in the amount of $ 4,600 x .

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 57P

Related questions

Question

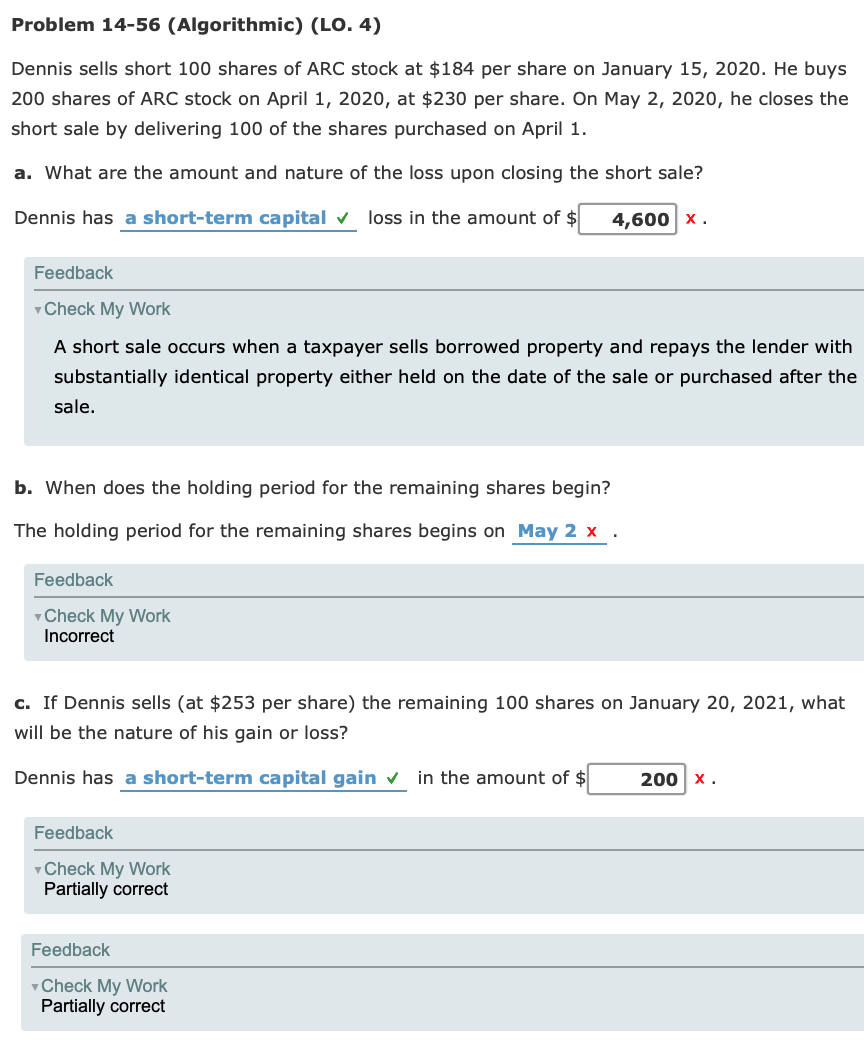

Transcribed Image Text:Problem 14-56 (Algorithmic) (LO. 4)

Dennis sells short 100 shares of ARC stock at $184 per share on January 15, 2020. He buys

200 shares of ARC stock on April 1, 2020, at $230 per share. On May 2, 2020, he closes the

short sale by delivering 100 of the shares purchased on April 1.

a. What are the amount and nature of the loss upon closing the short sale?

Dennis has a short-term capital v loss in the amount of $

4,600 x.

Feedback

vCheck My Work

A short sale occurs when a taxpayer sells borrowed property and repays the lender with

substantially identical property either held on the date of the sale or purchased after the

sale.

b. When does the holding period for the remaining shares begin?

The holding period for the remaining shares begins on May 2 x .

Feedback

Check My Work

Incorrect

c. If Dennis sells (at $253 per share) the remaining 100 shares on January 20, 2021, what

will be the nature of his gain or loss?

Dennis has a short-term capital gain v in the amount of $

200 x .

Feedback

Check My Work

Partially correct

Feedback

vCheck My Work

Partially correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT