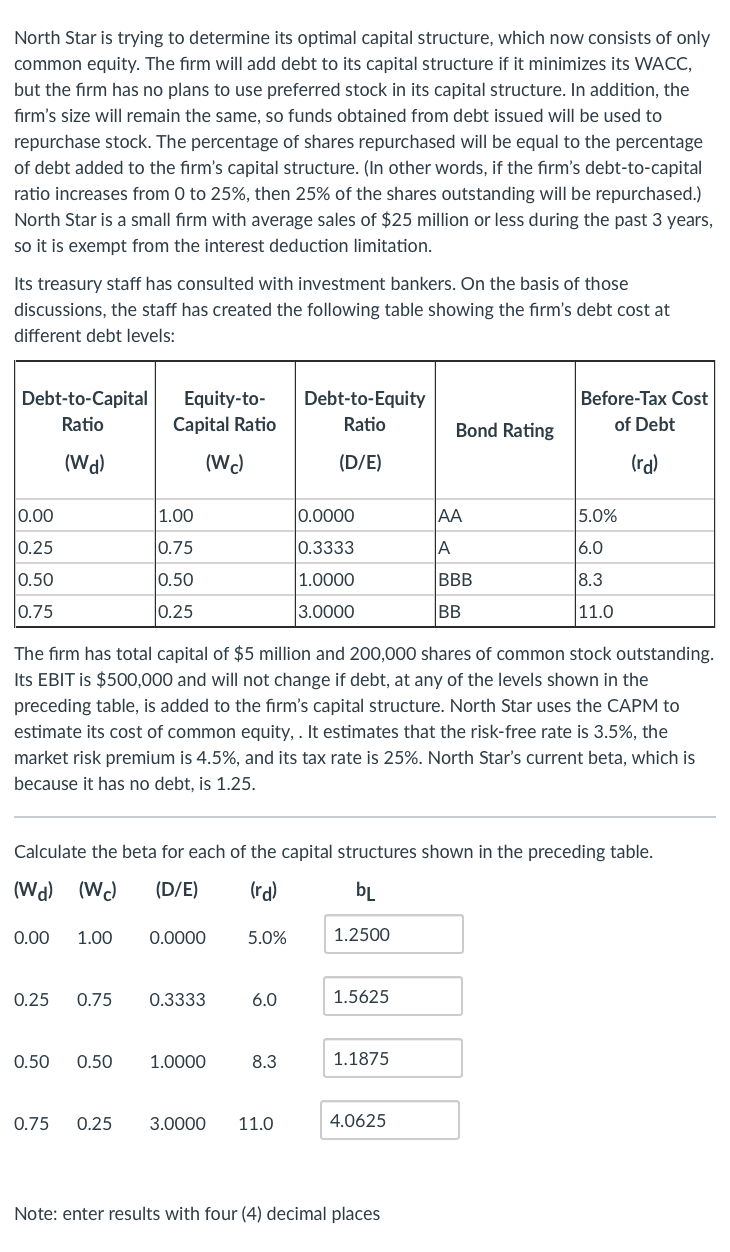

North Star is trying to determine its optimal capital structure, which now consists of only common equity. The firm will add debt to its capital structure if it minimizes its WACC, but the firm has no plans to use preferred stock in its capital structure. In addition, the fırm's size will remain the same, so funds obtained from debt issued will be used to repurchase stock. The percentage of shares repurchased will be equal to the percentage of debt added to the firm's capital structure. (In other words, if the firm's debt-to-capital ratio increases from 0 to 25%, then 25% of the shares outstanding will be repurchased.) North Star is a small firm with average sales of $25 million or less during the past 3 years, so it is exempt from the interest deduction limitation. Its treasury staff has consulted with investment bankers. On the basis of those discussions, the staff has created the following table showing the firm's debt cost at different debt levels: Debt-to-Capital Equity-to- Debt-to-Equity Before-Tax Cost Ratio Capital Ratio Ratio Bond Rating of Debt (Wd) (W) (D/E) (ra) 0.00 1.00 0.0000 AA 5.0% 0.25 0.75 0.3333 A |6.0 0.50 0.50 |1.0000 BBB 8.3 0.75 0.25 3.0000 BB 11.0 The firm has total capital of $5 million and 200,000 shares of common stock outstanding. Its EBIT is $500,000 and will not change if debt, at any of the levels shown in the preceding table, is added to the firm's capital structure. North Star uses the CAPM to estimate its cost of common equity, . It estimates that the risk-free rate is 3.5%, the market risk premium is 4.5%, and its tax rate is 25%. North Star's current beta, which is because it has no debt, is 1.25. Calculate the beta for each of the capital structures shown in the preceding table. (Wa) (W) (D/E) (rd) bL 0.00 1.00 0.0000 5.0% 1.2500 0.25 0.75 0.3333 6.0 1.5625 0.50 0.50 1.0000 8.3 1.1875 0.75 0.25 3.0000 11.0 4.0625 Note: enter results with four (4) decimal places

North Star is trying to determine its optimal capital structure, which now consists of only common equity. The firm will add debt to its capital structure if it minimizes its WACC, but the firm has no plans to use preferred stock in its capital structure. In addition, the fırm's size will remain the same, so funds obtained from debt issued will be used to repurchase stock. The percentage of shares repurchased will be equal to the percentage of debt added to the firm's capital structure. (In other words, if the firm's debt-to-capital ratio increases from 0 to 25%, then 25% of the shares outstanding will be repurchased.) North Star is a small firm with average sales of $25 million or less during the past 3 years, so it is exempt from the interest deduction limitation. Its treasury staff has consulted with investment bankers. On the basis of those discussions, the staff has created the following table showing the firm's debt cost at different debt levels: Debt-to-Capital Equity-to- Debt-to-Equity Before-Tax Cost Ratio Capital Ratio Ratio Bond Rating of Debt (Wd) (W) (D/E) (ra) 0.00 1.00 0.0000 AA 5.0% 0.25 0.75 0.3333 A |6.0 0.50 0.50 |1.0000 BBB 8.3 0.75 0.25 3.0000 BB 11.0 The firm has total capital of $5 million and 200,000 shares of common stock outstanding. Its EBIT is $500,000 and will not change if debt, at any of the levels shown in the preceding table, is added to the firm's capital structure. North Star uses the CAPM to estimate its cost of common equity, . It estimates that the risk-free rate is 3.5%, the market risk premium is 4.5%, and its tax rate is 25%. North Star's current beta, which is because it has no debt, is 1.25. Calculate the beta for each of the capital structures shown in the preceding table. (Wa) (W) (D/E) (rd) bL 0.00 1.00 0.0000 5.0% 1.2500 0.25 0.75 0.3333 6.0 1.5625 0.50 0.50 1.0000 8.3 1.1875 0.75 0.25 3.0000 11.0 4.0625 Note: enter results with four (4) decimal places

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter13: Capital Structure And Leverage

Section: Chapter Questions

Problem 14SP: WACC AND OPTIMAL CAPITAL STRUCTURE Elliott Athletics is trying to determine its optimal capital...

Related questions

Question

Transcribed Image Text:North Star is trying to determine its optimal capital structure, which now consists of only

common equity. The firm will add debt to its capital structure if it minimizes its WACC,

but the firm has no plans to use preferred stock in its capital structure. In addition, the

firm's size will remain the same, so funds obtained from debt issued will be used to

repurchase stock. The percentage of shares repurchased will be equal to the percentage

of debt added to the firm's capital structure. (In other words, if the firm's debt-to-capital

ratio increases from 0 to 25%, then 25% of the shares outstanding will be repurchased.)

North Star is a small firm with average sales of $25 million or less during the past 3 years,

so it is exempt from the interest deduction limitation.

Its treasury staff has consulted with investment bankers. On the basis of those

discussions, the staff has created the following table showing the firm's debt cost at

different debt levels:

Debt-to-Capital

Equity-to-

Debt-to-Equity

Before-Tax Cost

Ratio

Capital Ratio

Ratio

Bond Rating

of Debt

(Wa)

(W)

(D/E)

(ra)

0.00

|1.00

0.0000

AA

5.0%

0.25

0.75

0.3333

A

|6.0

0.50

0.50

1.0000

BBB

8.3

0.75

0.25

3.0000

BB

11.0

The firm has total capital of $5 million and 200,000 shares of common stock outstanding.

Its EBIT is $500,000 and will not change if debt, at any of the levels shown in the

preceding table, is added to the firm's capital structure. North Star uses the CAPM to

estimate its cost of common equity, . It estimates that the risk-free rate is 3.5%, the

market risk premium is 4.5%, and its tax rate is 25%. North Star's current beta, which is

because it has no debt, is 1.25.

Calculate the beta for each of the capital structures shown in the preceding table.

(Wa) (W)

(D/E)

(ra)

bL

0.00

1.00

0.0000

5.0%

1.2500

0.25

0.75

0.3333

6.0

1.5625

0.50

0.50

1.0000

8.3

1.1875

0.75

0.25

3.0000

11.0

4.0625

Note: enter results with four (4) decimal places

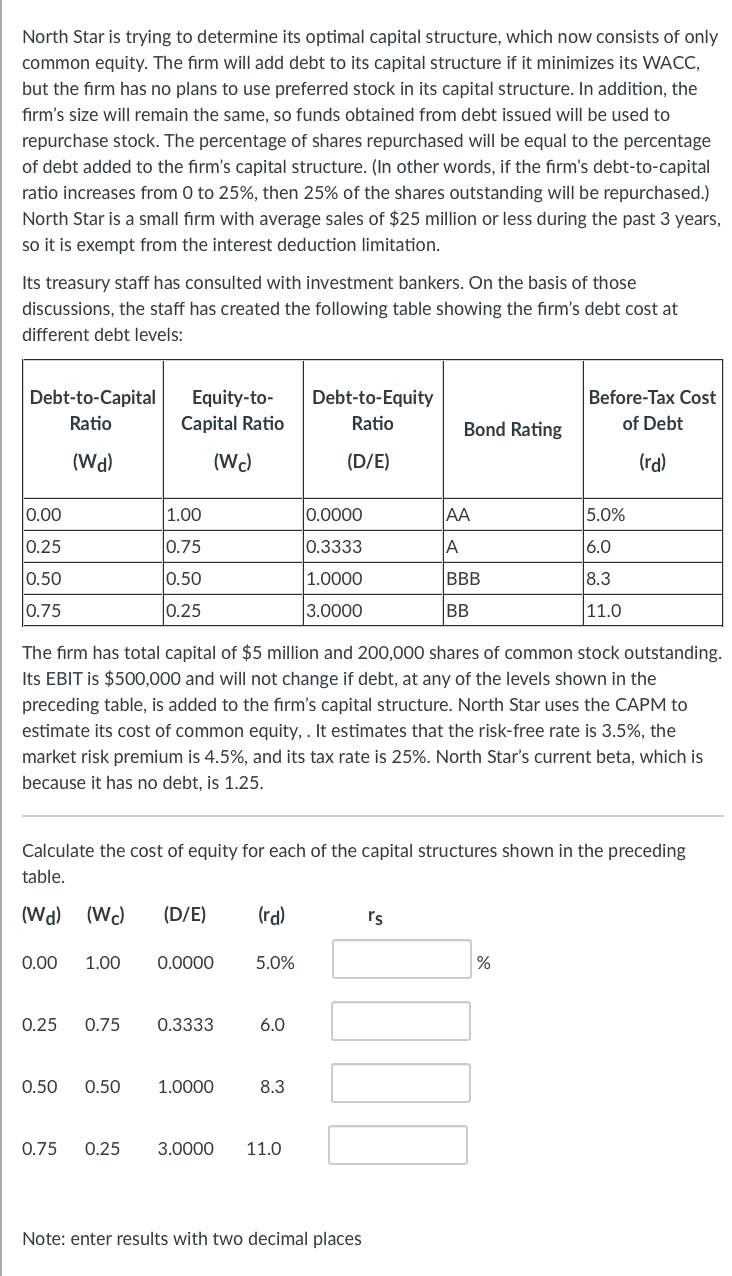

Transcribed Image Text:North Star is trying to determine its optimal capital structure, which now consists of only

common equity. The firm will add debt to its capital structure if it minimizes its WACC,

but the firm has no plans to use preferred stock in its capital structure. In addition, the

firm's size will remain the same, so funds obtained from debt issued will be used to

repurchase stock. The percentage of shares repurchased will be equal to the percentage

of debt added to the firm's capital structure. (In other words, if the firm's debt-to-capital

ratio increases from 0 to 25%, then 25% of the shares outstanding will be repurchased.)

North Star is a small fırm with average sales of $25 million or less during the past 3 years,

so it is exempt from the interest deduction limitation.

Its treasury staff has consulted with investment bankers. On the basis of those

discussions, the staff has created the following table showing the firm's debt cost at

different debt levels:

Debt-to-Capital

Equity-to-

Debt-to-Equity

Before-Tax Cost

Ratio

Capital Ratio

Ratio

Bond Rating

of Debt

(Wa)

(W)

(D/E)

0.00

1.00

0.0000

AA

5.0%

0.25

0.75

0.3333

A

6.0

0.50

0.50

1.0000

BBB

8.3

0.75

0.25

3.0000

BB

|11.0

The firm has total capital of $5 million and 200,000 shares of common stock outstanding.

Its EBIT is $500,000 and will not change if debt, at any of the levels shown in the

preceding table, is added to the firm's capital structure. North Star uses the CAPM to

estimate its cost of common equity, . It estimates that the risk-free rate is 3.5%, the

market risk premium is 4.5%, and its tax rate is 25%. North Star's current beta, which is

because it has no debt, is 1.25.

Calculate the cost of equity for each of the capital structures shown in the preceding

table.

(Wd) (W)

(D/E)

(rd)

's

0.00

1.00

0.0000

5.0%

%

0.25

0.75

0.3333

6.0

0.50

0.50

1.0000

8.3

0.75

0.25

3.0000

11.0

Note: enter results with two decimal places

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning