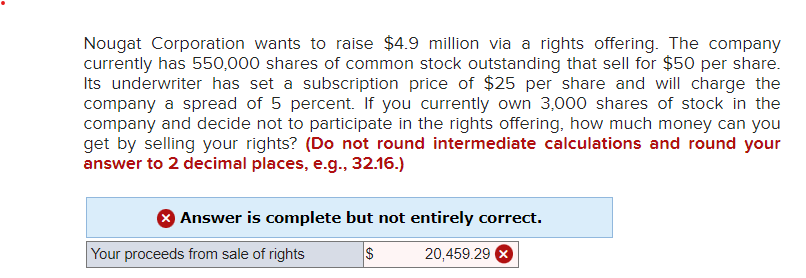

Nougat Corporation wants to raise $4.9 million via a rights offering. The company currently has 550,000 shares of common stock outstanding that sell for $50 per share. Its underwriter has set a subscription price of $25 per share and will charge the company a spread of 5 percent. If you currently own 3,000 shares of stock in the company and decide not to participate in the rights offering, how much money can you get by selling your rights? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. $ 20,459.29 Your proceeds from sale of rights

Nougat Corporation wants to raise $4.9 million via a rights offering. The company currently has 550,000 shares of common stock outstanding that sell for $50 per share. Its underwriter has set a subscription price of $25 per share and will charge the company a spread of 5 percent. If you currently own 3,000 shares of stock in the company and decide not to participate in the rights offering, how much money can you get by selling your rights? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. $ 20,459.29 Your proceeds from sale of rights

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 12P

Related questions

Question

100%

Nougat Corporation wants to raise $4.9 million via a rights offering. The company currently has 550,000 shares of common stock outstanding that sell for $50 per share. Its underwriter has set a subscription price of $25 per share and will charge the company a spread of 5 percent. If you currently own 3,000 shares of stock in the company and decide not to participate in the rights offering, how much money can you get by selling your rights? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

I keep getting the wrong answer, I get $2,430 and its not correct, the answer 20130 is also not correct, and the answer 20459.29 is also not correct

Transcribed Image Text:Nougat Corporation wants to raise $4.9 million via a rights offering. The company

currently has 550,000 shares of common stock outstanding that sell for $50 per share.

Its underwriter has set a subscription price of $25 per share and will charge the

company a spread of 5 percent. If you currently own 3,000 shares of stock in the

company and decide not to participate in the rights offering, how much money can you

get by selling your rights? (Do not round intermediate calculations and round your

answer to 2 decimal places, e.g., 32.16.)

> Answer is complete but not entirely correct.

$

20,459.29

Your proceeds from sale of rights

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning