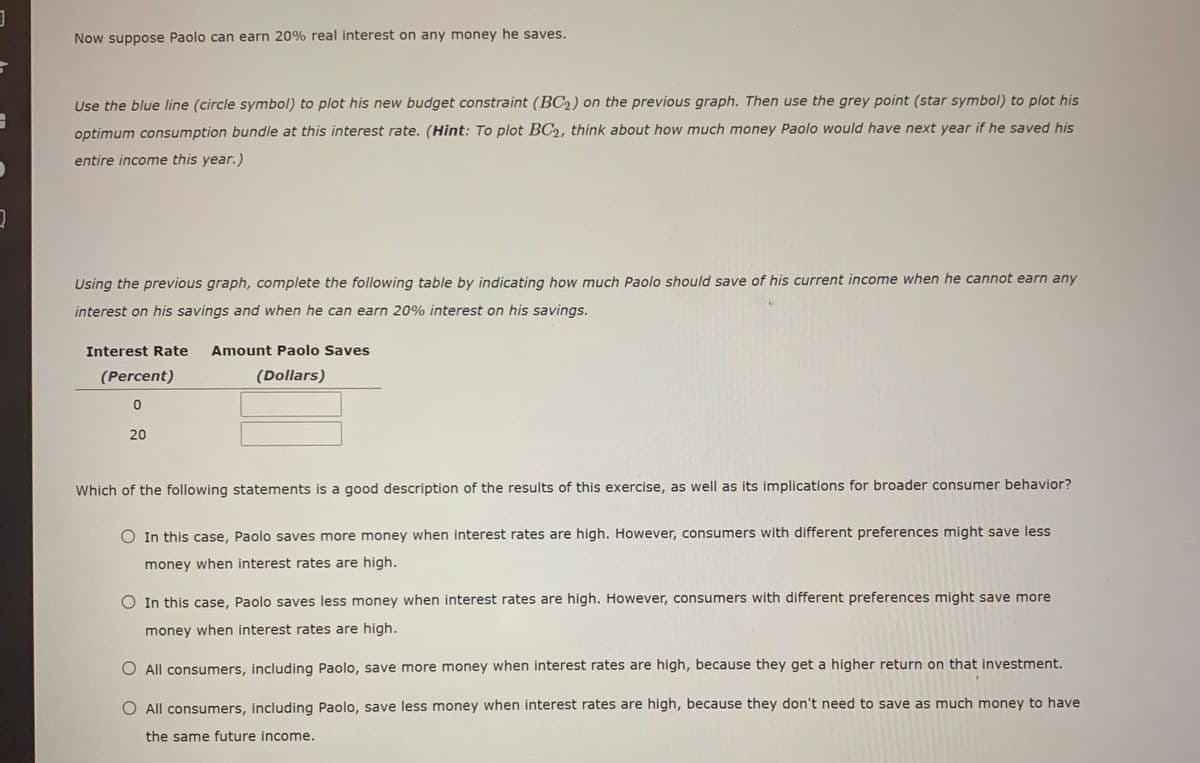

Now suppose Paolo can earn 20% real interest on any money he saves. Use the blue line (circle symbol) to plot his new budget constraint (BC2) on the previous graph. Then use the grey point (star symbol) to plot his optimum consumption bundle at this interest rate. (Hint: To plot BC2, think about how much money Paolo would have next year if he saved his entire income this year.) Using the previous graph, complete the following table by indicating how much Paolo should save of his current income when he cannot earn any interest on his savings and when he can earn 20% interest on his savings. Interest Rate Amount Paolo Saves (Percent) (Dollars) 20 Which of the following statements is a good description of the results of this exercise, as well as its implications for broader consumer behavior? O In this case, Paolo saves more money when interest rates are high. However, consumers with different preferences might save less money when interest rates are high. O In this case, Paolo saves less money when interest rates are high. However, consumers with different preferences might save more money when interest rates are high. All consumers, including Paolo, save more money when interest rates are high, because they get a higher return on that investment. O All consumers, including Paolo, save less money when interest rates are high, because they don't need to save as much money to have the same future income.

Now suppose Paolo can earn 20% real interest on any money he saves. Use the blue line (circle symbol) to plot his new budget constraint (BC2) on the previous graph. Then use the grey point (star symbol) to plot his optimum consumption bundle at this interest rate. (Hint: To plot BC2, think about how much money Paolo would have next year if he saved his entire income this year.) Using the previous graph, complete the following table by indicating how much Paolo should save of his current income when he cannot earn any interest on his savings and when he can earn 20% interest on his savings. Interest Rate Amount Paolo Saves (Percent) (Dollars) 20 Which of the following statements is a good description of the results of this exercise, as well as its implications for broader consumer behavior? O In this case, Paolo saves more money when interest rates are high. However, consumers with different preferences might save less money when interest rates are high. O In this case, Paolo saves less money when interest rates are high. However, consumers with different preferences might save more money when interest rates are high. All consumers, including Paolo, save more money when interest rates are high, because they get a higher return on that investment. O All consumers, including Paolo, save less money when interest rates are high, because they don't need to save as much money to have the same future income.

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

100%

Transcribed Image Text:Now suppose Paolo can earn 20% real interest on any money he saves.

Use the blue line (circle symbol) to plot his new budget constraint (BC2) on the previous graph. Then use the grey point (star symbol) to plot his

optimum consumption bundle at this interest rate. (Hint: To plot BC2, think about how much money Paolo would have next year if he saved his

entire income this year.)

Using the previous graph, complete the following table by indicating how much Paolo should save of his current income when he cannot earn any

interest on his savings and when he can earn 20% interest on his savings.

Interest Rate

Amount Paolo Saves

(Percent)

(Dollars)

20

Which of the following statements is a good description of the results of this exercise, as well as its implications for broader consumer behavior?

O In this case, Paolo saves more money when interest rates are high. However, consumers with different preferences might save less

money when interest rates are high.

O In this case, Paolo saves less money when interest rates are high. However, consumers with different preferences might save more

money when interest rates are high.

O All consumers, including Paolo, save more money when interest rates are high, because they get a higher return on that investment.

O All consumers, including Paolo, save less money when interest rates are high, because they don't need to save as much money to have

the same future income.

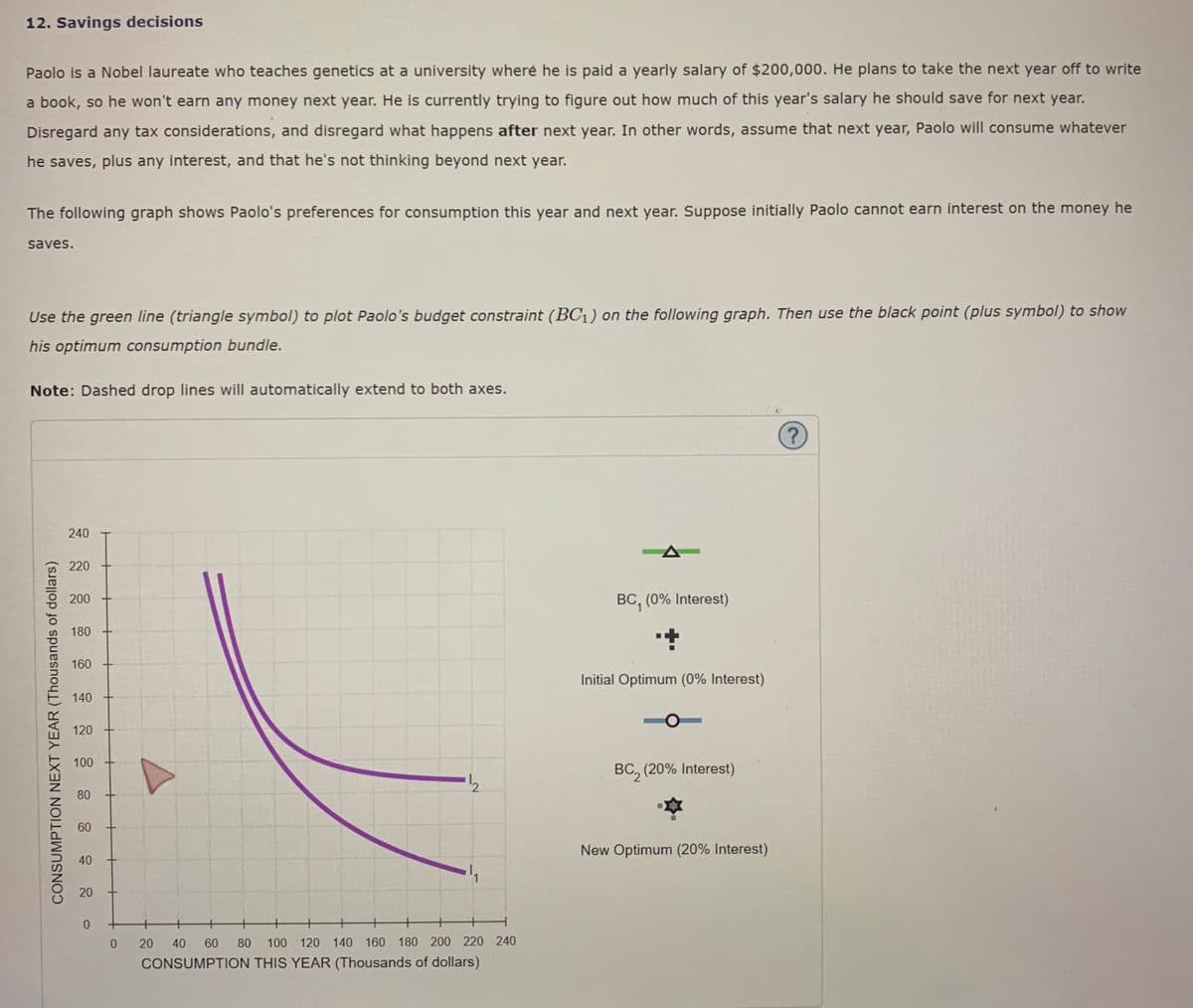

Transcribed Image Text:12. Savings decisions

Paolo is a Nobel laureate who teaches genetics at a university wheré he is paid a yearly salary of $200,000. He plans to take the next year off to write

a book, so he won't earn any money next year. He is currently trying to figure out how much of this year's salary he should save for next year.

Disregard any tax considerations, and disregard what happens after next year. In other words, assume that next year, Paolo will consume whatever

he saves, plus any interest, and that he's not thinking beyond next year.

The following graph shows Paolo's preferences for consumption this year and next year. Suppose initially Paolo cannot earn interest on the money he

saves.

Use the green line (triangle symbol) to plot Paolo's budget constraint (BC1) on the following graph. Then use the black point (plus symbol) to show

his optimum consumption bundle.

Note: Dashed drop lines will automatically extend to both axes.

240

220

200

BC, (0% Interest)

180

160

Initial Optimum (0% Interest)

140

120

100

BC, (20% Interest)

80

60

New Optimum (20% Interest)

40

20

0.

20

40

60

80

100 120 140 160 180 200 220 240

CONSUMPTION THIS YEAR (Thousands of dollars)

CONSUMPTION NEXT YEAR (Thousands of dollars)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman