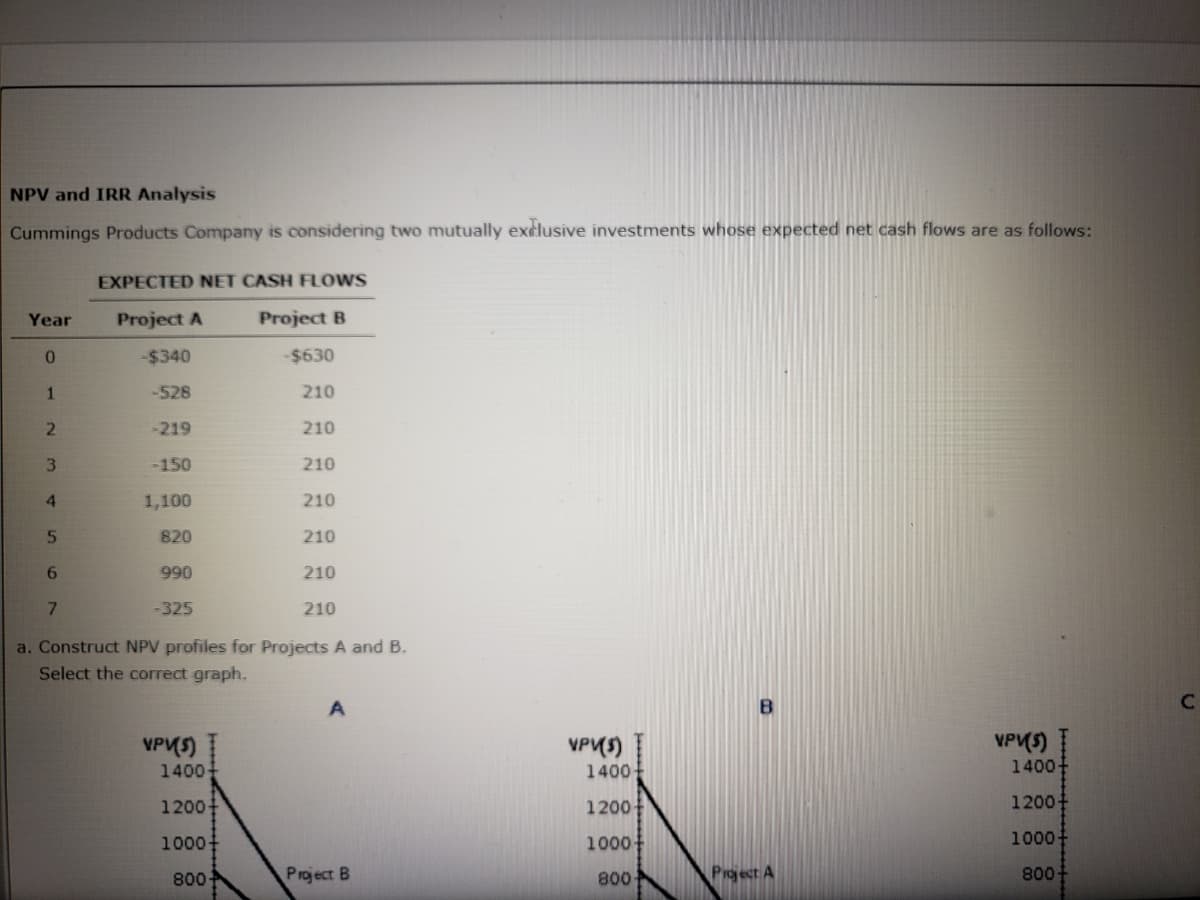

NPV and IRR Analysis Cummings Products Company is considering two mutually exelusive investments whose expected net cash flows are as follows: EXPECTED NET CASH FLOWS Year Project A Project B 0. -$340 -$630 1 -528 210 2. -219 210 3. -150 210 4. 1,100 210 5. 820 210 990 210 -325 210 a. Construct NPV profiles for Projects A and B. Select the correct graph. VPV5)T 1400- VPVS) I VPVS) 1400 1400 1200 1200 1200 1000 1000 1000 800 Project B 800 Pioject A 800

NPV and IRR Analysis Cummings Products Company is considering two mutually exelusive investments whose expected net cash flows are as follows: EXPECTED NET CASH FLOWS Year Project A Project B 0. -$340 -$630 1 -528 210 2. -219 210 3. -150 210 4. 1,100 210 5. 820 210 990 210 -325 210 a. Construct NPV profiles for Projects A and B. Select the correct graph. VPV5)T 1400- VPVS) I VPVS) 1400 1400 1200 1200 1200 1000 1000 1000 800 Project B 800 Pioject A 800

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:NPV and IRR Analysis

Cummings Products Company is considering two mutually exclusive investments whose expected net cash flows are as follows:

EXPECTED NET CASH FLOWS

Year

Project A

Project B

-$340

-$630

-528

210

-219

210

3.

-150

210

4.

1,100

210

820

210

6.

990

210

7.

-325

210

a. Construct NPV profiles for Projects A and B.

Select the correct graph.

VPVS)

1400

VPVS)

VPVS)

1400

1400

1200

1200

1200+

1000

1000

1000

800

Project B

800

Pioject A

800+

C1

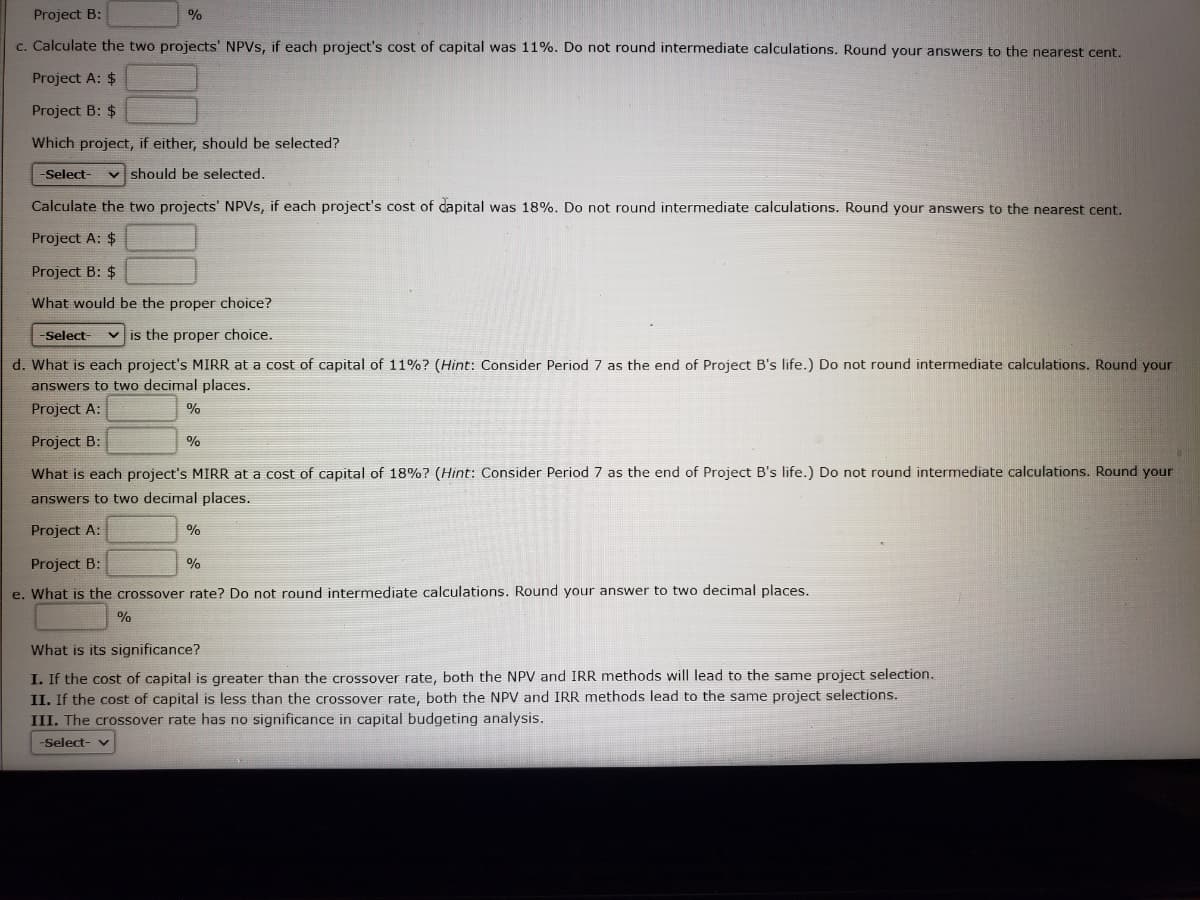

Transcribed Image Text:Project B:

%

c. Calculate the two projects' NPVS, if each project's cost of capital was 11%. Do not round intermediate calculations. Round your answers to the nearest cent.

Project A: $

Project B: $

Which project, if either, should be selected?

-Select-

v should be selected.

Calculate the two projects' NPVS, if each project's cost of dapital was 18%. Do not round intermediate calculations. Round your answers to the nearest cent.

Project A: $

Project B: $

What would be the proper choice?

Select-

v is the proper choice.

d. What is each project's MIRR at a cost of capital of 11%? (Hìnt: Consider Period 7 as the end of Project B's life.) Do not round intermediate calculations. Round your

answers to two decimal places.

Project A:

%

Project B:

%

What is each project's MIRR at a cost of capital of 18%? (Hint: Consider Period 7 as the end of Project B's life.) Do not round intermediate calculations. Round your

answers to two decimal places.

Project A:

%

Project B:

%

e. What is the crossover rate? Do not round intermediate calculations. Round your answer to two decimal places.

%

What is its significance?

I. If the cost of capital is greater than the crossover rate, both the NPV and IRR methods will lead to the same project selection.

II. If the cost of capital is less than the crossover rate, both the NPV and IRR methods lead to the same project selections.

III. The crossover rate has no significance in capital budgeting analysis.

-Select- v

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning