Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter3: Analysis Of Financial Statements

Section: Chapter Questions

Problem 14P: The Jimenez Corporation’s forecasted 2020 financial statements follow, along with some industry...

Related questions

Question

answers to questions b, d & e please

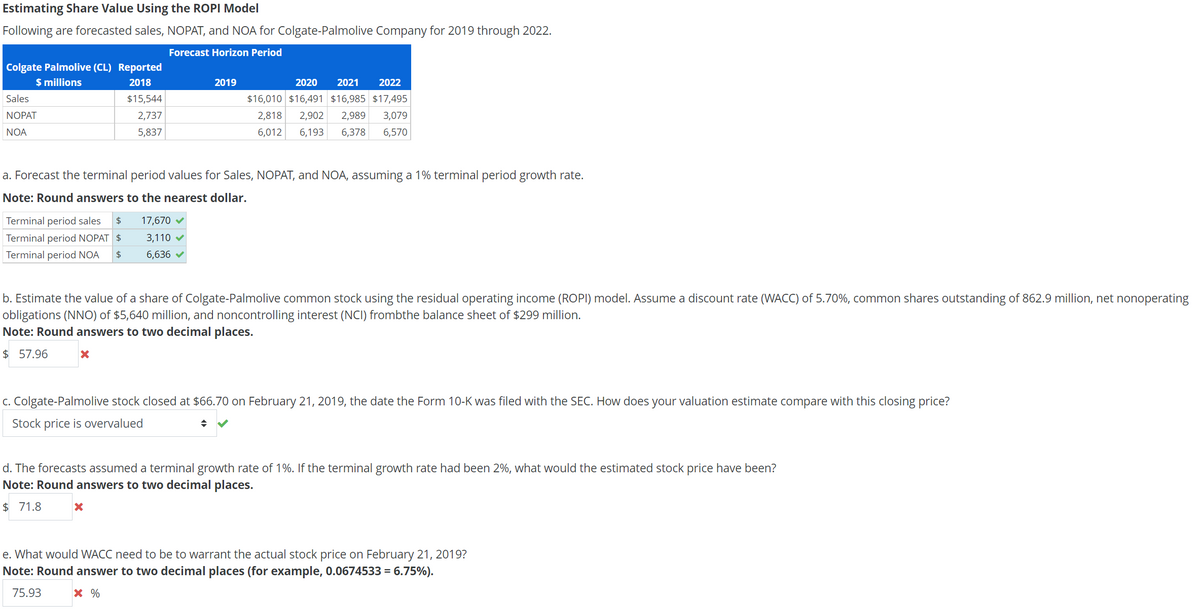

Transcribed Image Text:Estimating Share Value Using the ROPI Model

Following are forecasted sales, NOPAT, and NOA for Colgate-Palmolive Company for 2019 through 2022.

Forecast Horizon Period

Colgate Palmolive (CL) Reported

$ millions

2018

2019

2020

2021

2022

Sales

$15,544

$16,010 $16,491 $16,985 $17,495

NOPAT

2,737

2,818

2,902

2,989

3,079

NOA

5,837

6,012

6,193

6,378

6,570

a. Forecast the terminal period values for Sales, NOPAT, and NOA, assuming a 1% terminal period growth rate.

Note: Round answers to the nearest dollar.

Terminal period sales

2$

17,670

Terminal period NOPAT $

3,110 v

Terminal period NOA

24

6,636 v

b. Estimate the value of a share of Colgate-Palmolive common stock using the residual operating income (ROPI) model. Assume a discount rate (WACC) of 5.70%, common shares outstanding of 862.9 million, net nonoperating

obligations (NNO) of $5,640 million, and noncontrolling interest (NCI) frombthe balance sheet of $299 million.

Note: Round answers to two decimal places.

$ 57.96

c. Colgate-Palmolive stock closed at $66.70 on February 21, 2019, the date the Form 10-K was filed with the SEC. How does your valuation estimate compare with this closing price?

Stock price is overvalued

d. The forecasts assumed a terminal growth rate of 1%. If the terminal growth rate had been 2%, what would the estimated stock price have been?

Note: Round answers to two decimal places.

$ 71.8

e. What would WACC need to be to warrant the actual stock price on February 21, 2019?

Note: Round answer to two decimal places (for example, 0.0674533 = 6.75%).

75.93

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning