nswers

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 6PB: Edward Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1,...

Related questions

Question

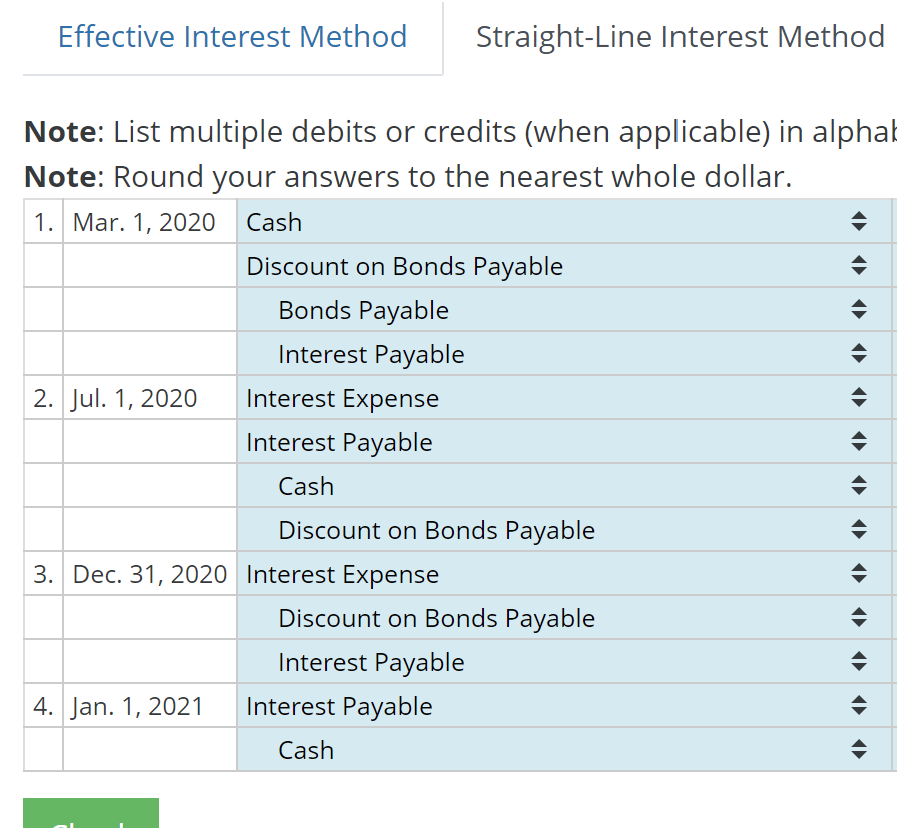

Transcribed Image Text:Effective Interest Method

Straight-Line Interest Method

Note: List multiple debits or credits (when applicable) in alphab

Note: Round your answers to the nearest whole dollar.

1. Mar. 1, 2020

Cash

Discount on Bonds Payable

Bonds Payable

Interest Payable

2. Jul. 1, 2020

Interest Expense

Interest Payable

Cash

Discount on Bonds Payable

3. Dec. 31, 2020 Interest Expense

Discount on Bonds Payable

Interest Payable

4. Jan. 1, 2021

Interest Payable

Cash

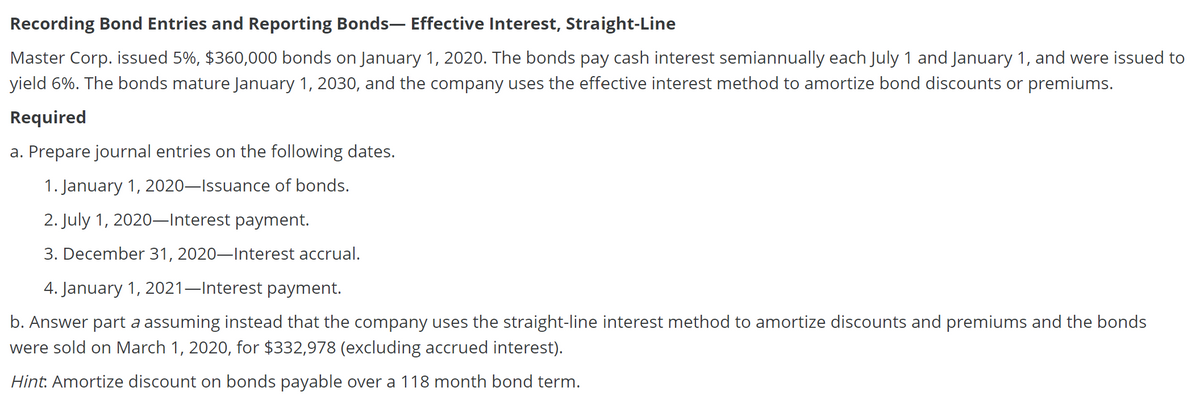

Transcribed Image Text:Recording Bond Entries and Reporting Bonds- Effective Interest, Straight-Line

Master Corp. issued 5%, $360,000 bonds on January 1, 2020. The bonds pay cash interest semiannually each July 1 and January 1, and were issued to

yield 6%. The bonds mature January 1, 2030, and the company uses the effective interest method to amortize bond discounts or premiums.

Required

a. Prepare journal entries on the following dates.

1. January 1, 2020–Issuance of bonds.

2. July 1, 2020–Interest payment.

3. December 31, 2020–Interest accrual.

4. January 1, 2021–Interest payment.

b. Answer part a assuming instead that the company uses the straight-line interest method to amortize discounts and premiums and the bonds

were sold on March 1, 2020, for $332,978 (excluding accrued interest).

Hint. Amortize discount on bonds payable over a 118 month bond term.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 7 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT