ntory turnover e the effect of the on current ratio. E6-11 Deere & Company is a global manufacturer and distributor of agricultural, con- struction, and forestry equipment. Suppose it reported the following information in its 2014 annual report. Exercise (in millions) 2014 2013 Inventories (LIFO) $ 2,397 $3,042 30,857 12,753 1,367 16,255 Current assets Current liabilities LIFO reserve Cost of goods sold Instructions a) Compute Deere's inventory turnover and days in inventory for 2014. (b) Compute Deere's current ratio using the 2014 data as presented, and then again after adjusting for the LIFO reserve. (c) Comment on how ignoring the LIFO reserve might affect your evaluation of Deere's liquidity.

ntory turnover e the effect of the on current ratio. E6-11 Deere & Company is a global manufacturer and distributor of agricultural, con- struction, and forestry equipment. Suppose it reported the following information in its 2014 annual report. Exercise (in millions) 2014 2013 Inventories (LIFO) $ 2,397 $3,042 30,857 12,753 1,367 16,255 Current assets Current liabilities LIFO reserve Cost of goods sold Instructions a) Compute Deere's inventory turnover and days in inventory for 2014. (b) Compute Deere's current ratio using the 2014 data as presented, and then again after adjusting for the LIFO reserve. (c) Comment on how ignoring the LIFO reserve might affect your evaluation of Deere's liquidity.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.2.2P

Related questions

Question

Practice Pack

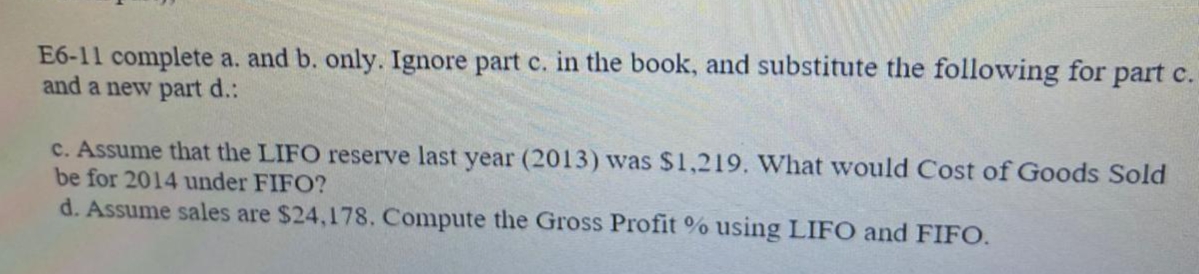

Transcribed Image Text:E6-11 complete a. and b. only. Ignore part c. in the book, and substitute the following for part c.

and a new part d.:

c. Assume that the LIFO reserve last year (2013) was $1,219. What would Cost of Goods Sold

be for 2014 under FIFO?

d. Assume sales are $24,178. Compute the Gross Profit % using LIFO and FIFO.

Transcribed Image Text:for 2012, 2013, and 2014.

ent on any i

ventory turnover

ne the effect of the

e on current ratio.

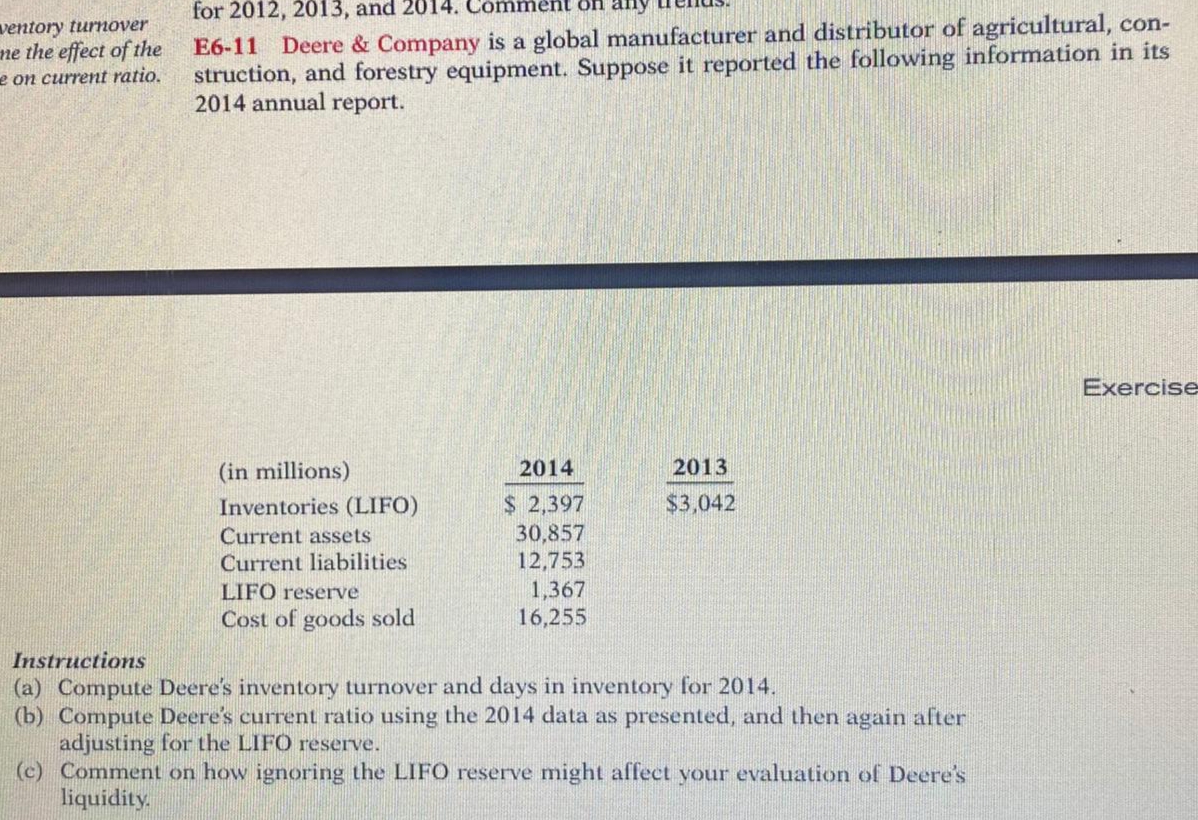

E6-11 Deere & Company is a global manufacturer and distributor of agricultural, con-

struction, and forestry equipment. Suppose it reported the following information in its

2014 annual report.

Exercise

(in millions)

2014

2013

$ 2,397

30,857

12,753

1,367

16,255

Inventories (LIFO)

$3,042

Current assets

Current liabilities

LIFO reserve

Cost of goods sold

Instructions

(a) Compute Deere's inventory turnover and days in inventory for 2014.

(b) Compute Deere's current ratio using the 2014 data as presented, and then again after

adjusting for the LIFO reserve.

(c) Comment on how ignoring the LIFO reserve might affect your evaluation of Deere's

liquidity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning