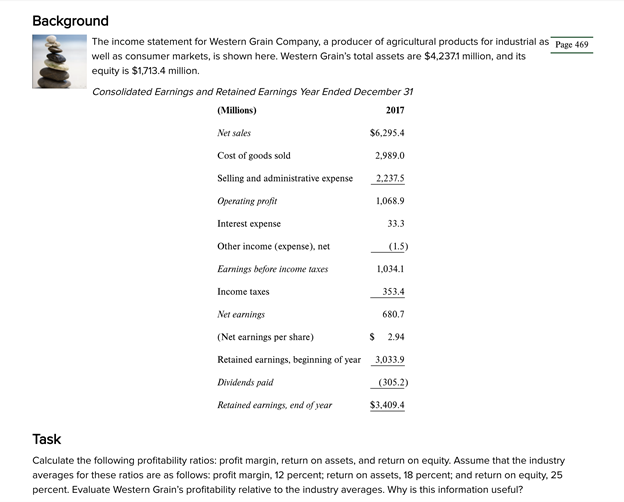

Background The income statement for Western Grain Company, a producer of agricultural products for industrial as Pase 469 well as consumer markets, is shown here. Western Grain's total assets are $4,2371 million, and its equity is $1,713.4 million. Consolidated Earnings and Retained Earnings Year Ended December 31 (Milions) 2017 Net sales $6.295.4 Cost of goods sold 2.989.0 Selling and administrative expense 2.237.5 Operating profit 1,068.9 Interest expense 33.3 Other income (expense), net (15) Earnings before income taxes 1,034.1 Income taxes 353.4 Net earnings 680.7 (Net earnings per share) $ 294 Retained earnings. beginning of year 3033.9 Dividends paid (305.2) Retained carnings, end of syear $3,409.4 Task Calculate the following profitability ratios: profit margin, return on assets, and return on equity. Assume that the industry averages for these ratios are as follows: profit margin, 12 percent; return on assets, 18 percent; and return on equity. 25 percent. Evaluate Western Grain's profitability relative to the industry averages. Why is this information useful?

Background The income statement for Western Grain Company, a producer of agricultural products for industrial as Pase 469 well as consumer markets, is shown here. Western Grain's total assets are $4,2371 million, and its equity is $1,713.4 million. Consolidated Earnings and Retained Earnings Year Ended December 31 (Milions) 2017 Net sales $6.295.4 Cost of goods sold 2.989.0 Selling and administrative expense 2.237.5 Operating profit 1,068.9 Interest expense 33.3 Other income (expense), net (15) Earnings before income taxes 1,034.1 Income taxes 353.4 Net earnings 680.7 (Net earnings per share) $ 294 Retained earnings. beginning of year 3033.9 Dividends paid (305.2) Retained carnings, end of syear $3,409.4 Task Calculate the following profitability ratios: profit margin, return on assets, and return on equity. Assume that the industry averages for these ratios are as follows: profit margin, 12 percent; return on assets, 18 percent; and return on equity. 25 percent. Evaluate Western Grain's profitability relative to the industry averages. Why is this information useful?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 2PB

Related questions

Question

Transcribed Image Text:Background

The income statement for Western Grain Company, a producer of agricultural products for industrial as Page 469

well as consumer markets, is shown here. Western Grain's total assets are $4,237.1 million, and its

equity is $1,713.4 million.

Consolidated Earnings and Retained Earnings Year Ended December 31

(Millions)

2017

Net sales

$6,295.4

Cost of goods sold

2,989.0

Selling and administrative expense

2.237.5

Operating profit

1,068.9

Interest expense

33.3

Other income (expense), net

(1.5)

Earnings before income taxes

1,034.1

Income taxes

353.4

Net earnings

680.7

(Net earnings per share)

$ 2.94

Retained earnings, beginning of year 3,033.9

Dividends paid

(305.2)

Retained earnings, end of year

$3.409.4

Task

Calculate the following profitability ratios: profit margin, return on assets, and return on equity. Assume that the industry

averages for these ratios are as follows: profit margin, 12 percent; return on assets, 18 percent; and return on equity. 25

percent. Evaluate Western Grain's profitability relative to the industry averages. Why is this information useful?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT