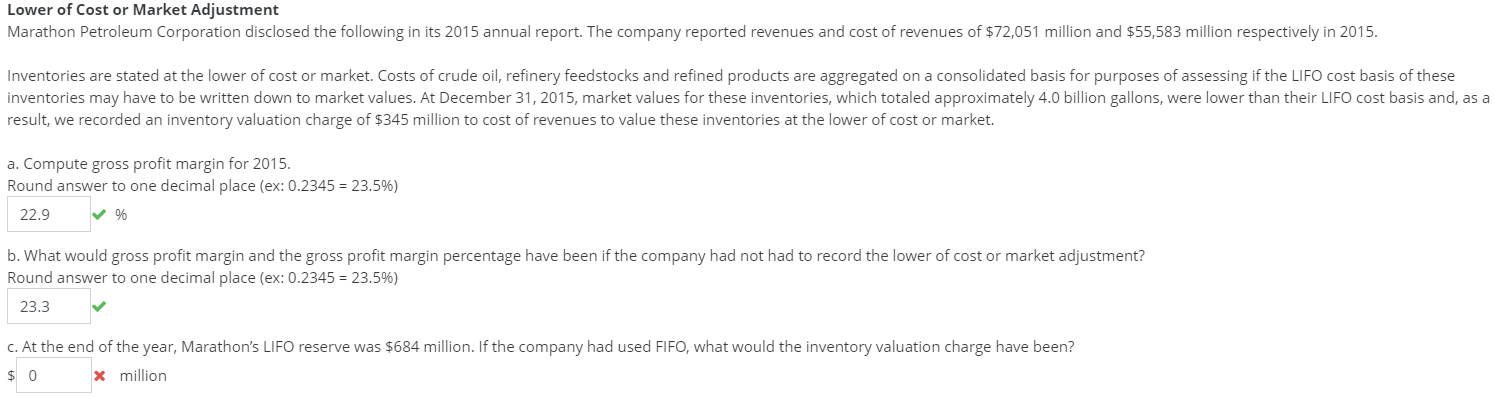

Lower of Cost or Market Adjustment Marathon Petroleum Corporation disclosed the following in its 2015 annual report. The company reported revenues and cost of revenues of $72,051 million and $55,583 million respectively in 2015. Inventories are stated at the lower of cost or market. Costs of crude oil, refinery feedstocks and refined products are aggregated on a consolidated basis for purposes of assessing if the LIFO cost basis of these inventories may have to be written down to market values. At December 31, 2015, market values for these inventories, which totaled approximately 4.0 billion gallons, were lower than their LIFO cost basis and, as a result, we recorded an inventory valuation charge of $345 million to cost of revenues to value these inventories at the lower of cost or market. a. Compute gross profit margin for 2015. Round answer to one decimal place (ex: 0.2345 = 23.5%) 22.9 % b. What would gross profit margin and the gross profit margin percentage have been if the company had not had to record the lower of cost or market adjustment? Round answer to one decimal place (ex: 0.2345 23.5%) 23.3 c. At the end of the year, Marathon's LIFO reserve was $684 million. If the company had used FlFO, what would the inventory valuation charge have been? x million 0

Lower of Cost or Market Adjustment Marathon Petroleum Corporation disclosed the following in its 2015 annual report. The company reported revenues and cost of revenues of $72,051 million and $55,583 million respectively in 2015. Inventories are stated at the lower of cost or market. Costs of crude oil, refinery feedstocks and refined products are aggregated on a consolidated basis for purposes of assessing if the LIFO cost basis of these inventories may have to be written down to market values. At December 31, 2015, market values for these inventories, which totaled approximately 4.0 billion gallons, were lower than their LIFO cost basis and, as a result, we recorded an inventory valuation charge of $345 million to cost of revenues to value these inventories at the lower of cost or market. a. Compute gross profit margin for 2015. Round answer to one decimal place (ex: 0.2345 = 23.5%) 22.9 % b. What would gross profit margin and the gross profit margin percentage have been if the company had not had to record the lower of cost or market adjustment? Round answer to one decimal place (ex: 0.2345 23.5%) 23.3 c. At the end of the year, Marathon's LIFO reserve was $684 million. If the company had used FlFO, what would the inventory valuation charge have been? x million 0

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter9: Working Capital

Section: Chapter Questions

Problem 30E

Related questions

Question

Please see the attached image and answer letter C. Please show how FIFO and LIFO is calclulated as well as the answer to c.

Thanks

Transcribed Image Text:Lower of Cost or Market Adjustment

Marathon Petroleum Corporation disclosed the following in its 2015 annual report. The company reported revenues and cost of revenues of $72,051 million and $55,583 million respectively in 2015.

Inventories are stated at the lower of cost or market. Costs of crude oil, refinery feedstocks and refined products are aggregated on a consolidated basis for purposes of assessing if the LIFO cost basis of these

inventories may have to be written down to market values. At December 31, 2015, market values for these inventories, which totaled approximately 4.0 billion gallons, were lower than their LIFO cost basis and, as a

result, we recorded an inventory valuation charge of $345 million to cost of revenues to value these inventories at the lower of cost or market.

a. Compute gross profit margin for 2015.

Round answer to one decimal place (ex: 0.2345 = 23.5%)

22.9

%

b. What would gross profit margin and the gross profit margin percentage have been if the company had not had to record the lower of cost or market adjustment?

Round answer to one decimal place (ex: 0.2345 23.5%)

23.3

c. At the end of the year, Marathon's LIFO reserve was $684 million. If the company had used FlFO, what would the inventory valuation charge have been?

x million

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning