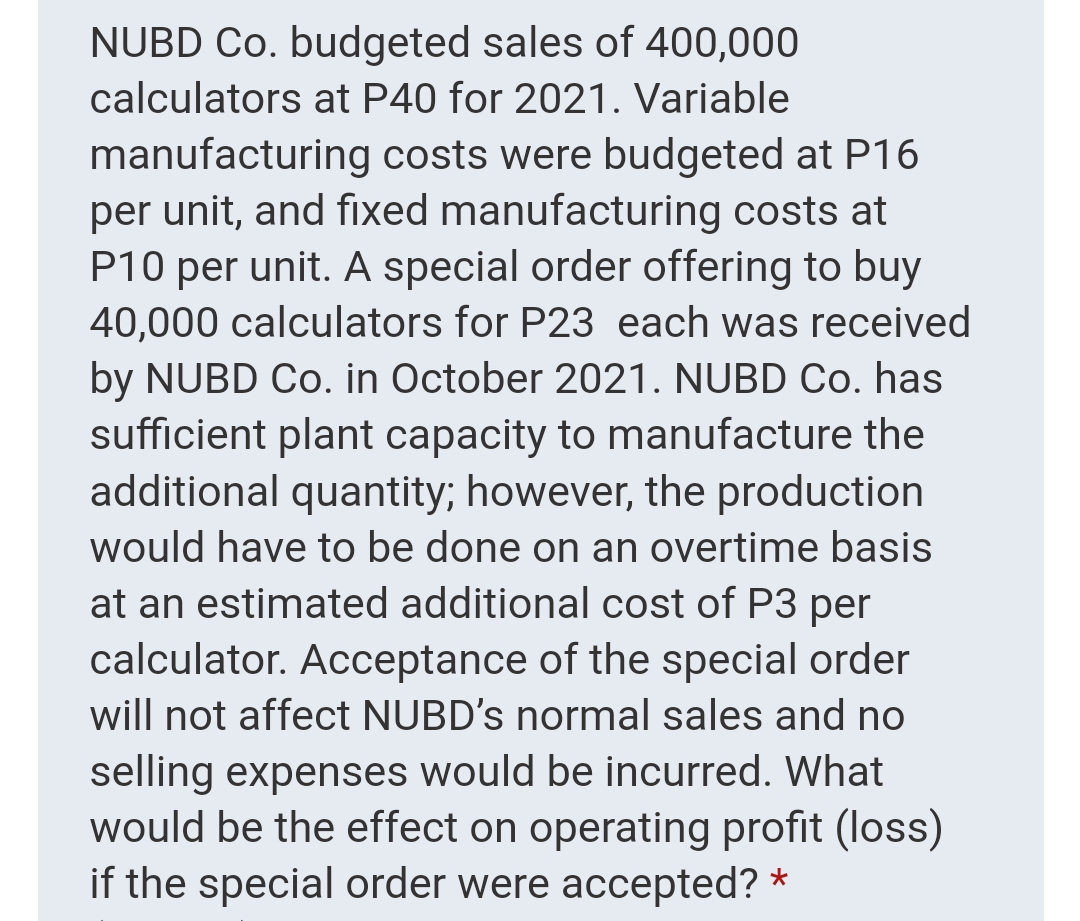

NUBD Co. budgeted sales of 400,000 calculators at P40 for 2021. Variable manufacturing costs were budgeted at P16 per unit, and fixed manufacturing costs at P10 per unit. A special order offering to buy 40,000 calculators for P23 each was received by NUBD Co. in October 2021. NUBD Co. has sufficient plant capacity to manufacture the additional quantity; however, the production would have to be done on an overtime basis at an estimated additional cost of P3 per calculator. Acceptance of the special order will not affect NUBD's normal sales and no selling expenses would be incurred. What would be the effect on operating profit (loss) if the special order were accepted? *

NUBD Co. budgeted sales of 400,000 calculators at P40 for 2021. Variable manufacturing costs were budgeted at P16 per unit, and fixed manufacturing costs at P10 per unit. A special order offering to buy 40,000 calculators for P23 each was received by NUBD Co. in October 2021. NUBD Co. has sufficient plant capacity to manufacture the additional quantity; however, the production would have to be done on an overtime basis at an estimated additional cost of P3 per calculator. Acceptance of the special order will not affect NUBD's normal sales and no selling expenses would be incurred. What would be the effect on operating profit (loss) if the special order were accepted? *

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 13CE: Nashler Company has the following budgeted variable costs per unit produced: Budgeted fixed overhead...

Related questions

Question

Transcribed Image Text:NUBD Co. budgeted sales of 400,000

calculators at P40 for 2021. Variable

manufacturing costs were budgeted at P16

per unit, and fixed manufacturing costs at

P10 per unit. A special order offering to buy

40,000 calculators for P23 each was received

by NUBD Co. in October 2021. NUBD Co. has

sufficient plant capacity to manufacture the

additional quantity; however, the production

would have to be done on an overtime basis

at an estimated additional cost of P3 per

calculator. Acceptance of the special order

will not affect NUBD's normal sales and no

selling expenses would be incurred. What

would be the effect on operating profit (loss)

if the special order were accepted? *

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub