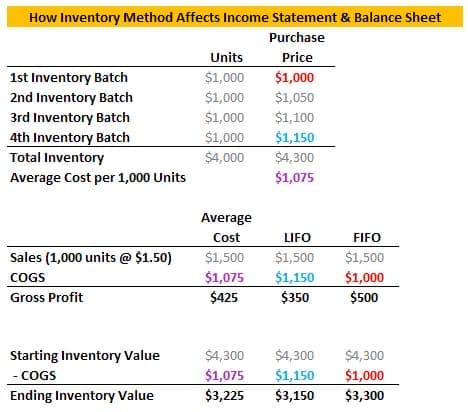

nventory valuation is used to calculate the cost of goods sold and cost of ending inventory. The most widely used methods are LIFO, FIFO and average cost method. You are required to find out the inventory system applied, the method of inventory valuation used, and what does inventory consists of with their respective amount?

nventory valuation is used to calculate the cost of goods sold and cost of ending inventory. The most widely used methods are LIFO, FIFO and average cost method. You are required to find out the inventory system applied, the method of inventory valuation used, and what does inventory consists of with their respective amount?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 6MCQ: Refer to the information for Morgan Inc. above. If Morgan uses a perpetual inventory system, what is...

Related questions

Topic Video

Question

Transcribed Image Text:How Inventory Method Affects Income Statement & Balance Sheet

Purchase

Units

Price

$1,000

1st Inventory Batch

2nd Inventory Batch

3rd Inventory Batch

$1,000

$1,000

$1,050

$1,100

$1,150

$4,300

$1,000

4th Inventory Batch

Total Inventory

$1,000

$4,000

Average Cost per 1,000 Units

$1,075

Average

Cost

$1,500

LIFO

FIFO

Sales (1,000 units @ $1.50)

$1,500

$1,150

$350

$1,500

$1,075

$425

$1,000

$500

COGS

Gross Profit

Starting Inventory Value

$4,300

$4,300

$4,300

- COGS

$1,075

$3,225

$1,150

$1,000

$3,300

Ending Inventory Value

$3,150

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,