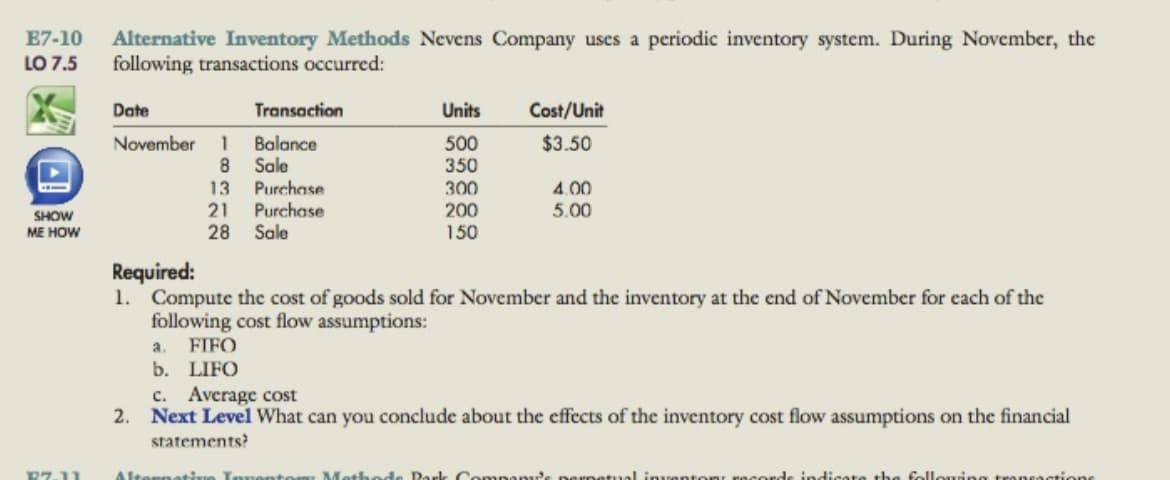

OAlternative Inventory Methods Nevens Company uses a periodic inventory system. During November, the following transactions occurred: Date Transaction Units Cost/Unit November 1 Balance 8 Sale Purchase 500 350 300 $3.50 13 4.00 21 Purchase 28 Sale 200 5.00 150 Required: 1. Compute the cost of goods sold for November and the inventory at the end of November for cach of the following cost flow assumptions: a. FIFO b. LIFO c. Average cost 2. Next Level What can you conclude about the effects of the inventory cost flow assumptions on the financial statemente?

OAlternative Inventory Methods Nevens Company uses a periodic inventory system. During November, the following transactions occurred: Date Transaction Units Cost/Unit November 1 Balance 8 Sale Purchase 500 350 300 $3.50 13 4.00 21 Purchase 28 Sale 200 5.00 150 Required: 1. Compute the cost of goods sold for November and the inventory at the end of November for cach of the following cost flow assumptions: a. FIFO b. LIFO c. Average cost 2. Next Level What can you conclude about the effects of the inventory cost flow assumptions on the financial statemente?

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter6: Inventories

Section: Chapter Questions

Problem 2PB: LIFO perpetual inventory The beginning inventory for Dunne Co. and data on purchases and sales for a...

Related questions

Question

Attached is the numbers that’s needed for the attached spreadsheet sheet .

Please help!

Transcribed Image Text:E7-10

Alternative Inventory Methods Nevens Company uses a periodic inventory system. During November, the

following transactions occurred:

LO 7.5

Date

Transaction

Units

Cost/Unit

November

$3.50

Balance

8.

1

Sale

Purchase

Purchase

500

350

300

13

4.00

200

150

21

5.00

SHOW

ME HOW

28

Sale

Required:

1. Compute the cost of goods sold for November and the inventory at the end of November for each of the

following cost flow assumptions:

a.

FIFO

b. LIFO

c.

Average cost

2. Next Level What can you conclude about the effects of the inventory cost flow assumptions on the financial

statements?

マワ11

Altorn

Methode Pork

the follouing transas

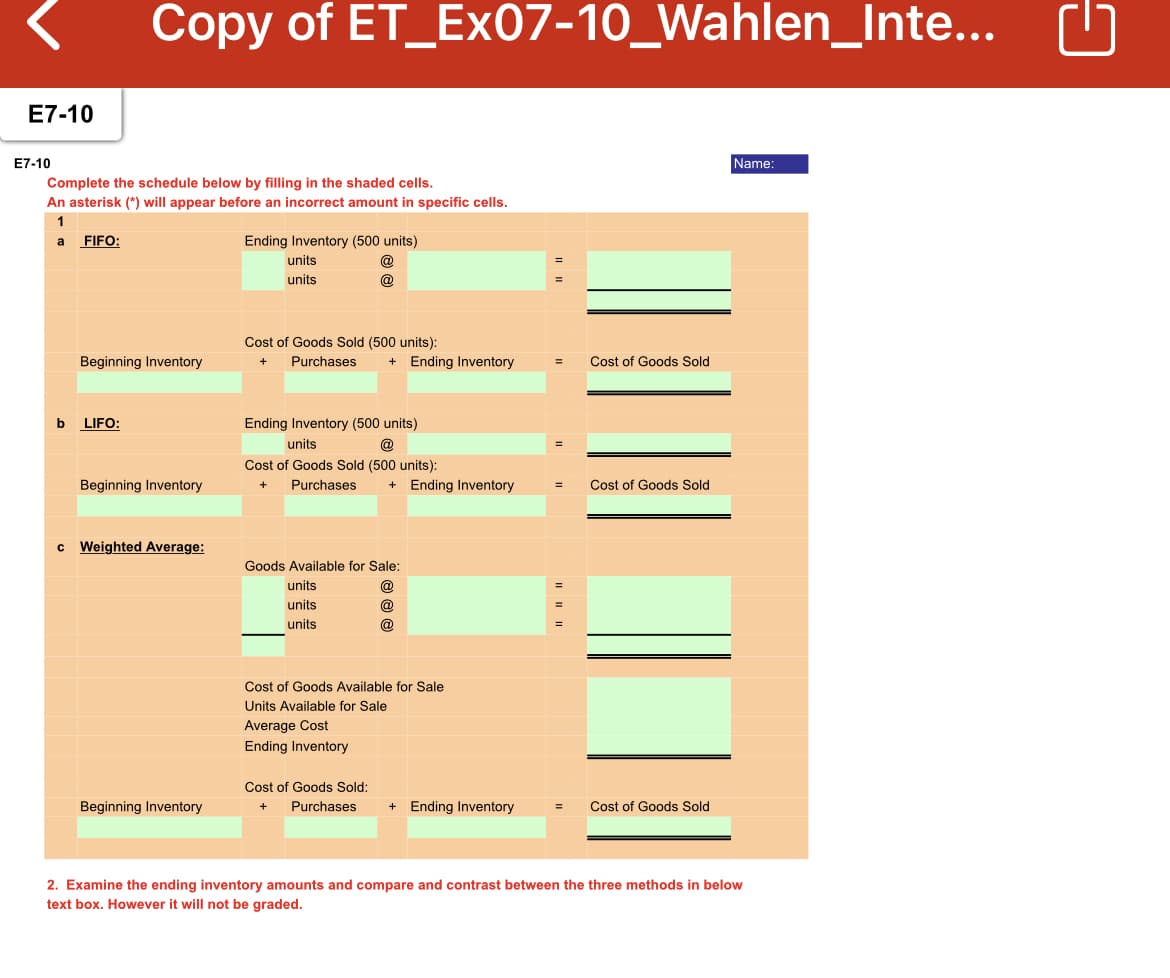

Transcribed Image Text:Copy of ET_Ex07-10_Wahlen_Inte...

E7-10

E7-10

Name:

Complete the schedule below by filling in the shaded cells.

An asterisk (*) will appear before an incorrect amount in specific cells.

1

a

FIFO:

Ending Inventory (500 units)

units

units

@

Cost of Goods Sold (500 units):

Beginning Inventory

Purchases

+ Ending Inventory

Cost of Goods Sold

Ending Inventory (500 units)

@

b

LIFO:

units

Cost of Goods Sold (500 units):

Beginning Inventory

Purchases

Ending Inventory

Cost of Goods Sold

Weighted Average:

Goods Available for Sale:

units

@

units

@

units

@

Cost of Goods Available for Sale

Units Available for Sale

Average Cost

Ending Inventory

Cost of Goods Sold:

Beginning Inventory

Purchases

+ Ending Inventory

Cost of Goods Sold

+

%3D

2. Examine the ending inventory amounts and compare and contrast between the three methods in below

text box. However it will not be graded.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning