During 2021, Beal Company became involved in a tax dispute with the BIR. On December 31, 2021, the entity's tax advisor believed that an unfavorable outcome was probable and the best estimate of additional tax was P500,000 but could be as much as P650,000. After the 2021 financial statements were issued, the entity received and accepted a BIR settlement offer of P550,000. What amount of accrued liability should be reported December 31, 2021? on a. 650,000 b. 550,000 c. 500,000 d. 0.

During 2021, Beal Company became involved in a tax dispute with the BIR. On December 31, 2021, the entity's tax advisor believed that an unfavorable outcome was probable and the best estimate of additional tax was P500,000 but could be as much as P650,000. After the 2021 financial statements were issued, the entity received and accepted a BIR settlement offer of P550,000. What amount of accrued liability should be reported December 31, 2021? on a. 650,000 b. 550,000 c. 500,000 d. 0.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 10E: Multiple Temporary Differences Vickers Company reports taxable income of 4,500 for 2019. Vickers has...

Related questions

Question

Problem 4-21 (with solution)

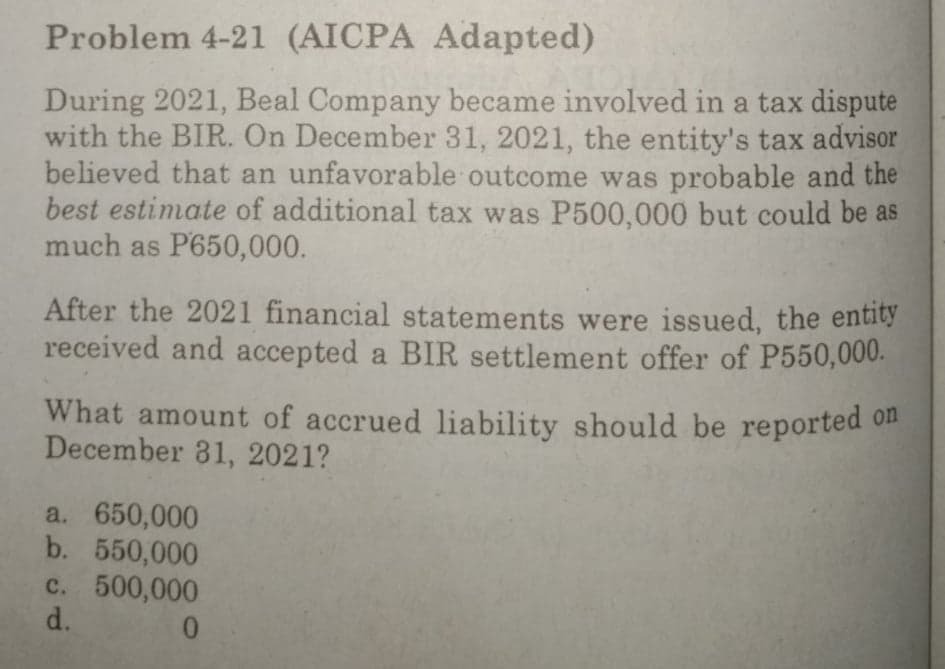

Transcribed Image Text:Problem 4-21 (AICPA Adapted)

During 2021, Beal Company became involved in a tax dispute

with the BIR. On December 31, 2021, the entity's tax advisor

believed that an unfavorable outcome was probable and the

best estimate of additional tax was P500,000 but could be as

much as P650,000.

After the 2021 financial statements were issued, the entity

received and accepted a BIR settlement offer of P550,000.

What amount of accrued liability should be reported on

December 31, 2021?

a. 650,000

b. 550,000

c. 500,000

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

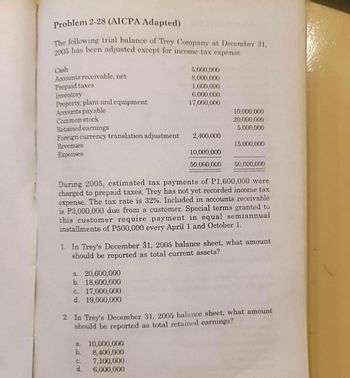

Transcribed Image Text:Problem 2-28 (AICPA Adapted)

The following trial balance of Trey Company at December 31,

2005 has been adjusted except for income tax expense.

Cash

Accounts receivable, net

Prepaid taxes

Inventory

Property, plant and equipment

Accounts payable

Common stock

Retained earnings

Foreign currency translation adjustment

Revenues

Expenses

a. 20,600,000

b. 18,600,000

c. 17,000,000

d. 19,000,000

5,000,000

8,000,000

1,600,000

6,000,000

17,000,000

a. 10,000,000

b. 8,400,000

2,400,000

d.

10,000,000

50,000,000

During 2005, estimated tax payments of P1,600,000 were

charged to prepaid taxes. Trey has not yet recorded income tax

expense. The tax rate is 32%. Included in accounts receivable

is P3,000,000 due from a customer. Special terms granted to

this customer require payment in equal semiannual

installments of P500,000 every April 1 and October 1.

7,100,000

6,000,000

10,000,000

20,000,000

5,000,000

1. In Trey's December 31, 2005 balance sheet, what amount

should be reported as total current assets?

15,000,000

50,000,000

2. In Trey's December 31, 2005 balance sheet, what amount

should be reported as total retained earnings?

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT