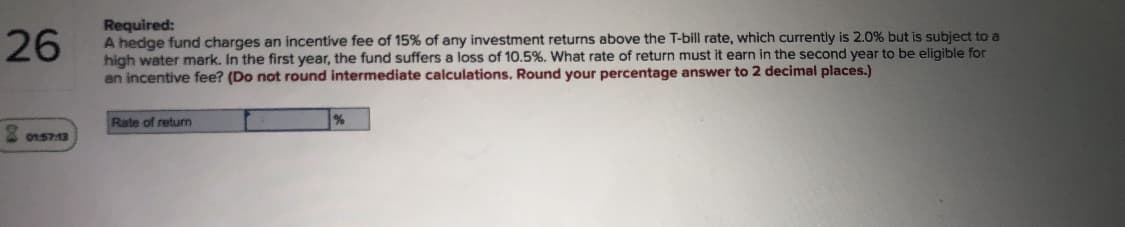

of 15% of ay investment returns above the l-bill răte, d suffers a loss of 10.5%. What rate of return must it earn in the s ediate calculations. Round your percentage answer to 2 decima

Q: Which of the following investments a return-maximizing investor would select? Select one: O a. An…

A: Please refer to the image below.

Q: n entrepreneur has $200.000 is available for investment and Minimum Acceptable Rate of Return…

A: Weighted average return of rate applies various weights upon the investment depending upon the share…

Q: Para Co. is reviewing the following data relating to an energy saving investment proposal: • Cost…

A: Annual Savings refers to the quantifiable savings that occurred during any one annual savings cycle…

Q: Suppose an initial investment of $100 returns $40 at the end of the first year and $80 at the end of…

A:

Q: ear-to-date, Oracle had earned a 15.0 percent return. During the same time period, Valero Energy…

A: Portfolio return =Security 1 return * Weight + Security n return * Weight

Q: A proposed new investment has projected sales of $720,000. Variable costs are 40 percent of sales,…

A: The income statement is an essential part of the financial statements of the company. It is prepared…

Q: An investment of $20,000 will create a perpetual after-tax cash flow of $2,000. The required rate of…

A: We have the following information: Investment: $20,000 Perpetual After-tax cash flow of: $2,000…

Q: A proposed new investment has projected sales of $710,000. Variable costs are 38 percent of sales,…

A: Projected net income can be calculated as: = Sales revenue - sum of all costs

Q: The five alternatives shown here are being evaluated by the rate of return method: If the…

A: Companies have different alternatives to invest their money in, but they should always compare the…

Q: An investment product promises to pay $25,458 at the end of nine years. If an investor feels this…

A: Annuity: The fixed amount paid or received in equal time periods is referred to as annuity.Present…

Q: a. Calculate the following Periodic Total Returns on a 5-year investment. To your calculations,…

A: a. Calculate the total return on invest as follows: Selling Cost = 5% Total Return = NCF + Increase…

Q: ear-to-date, Oracle had earned a −1.34 percent return. During the same time period, Valero Energy…

A: Given that Oracle return=-1.34% Oracle Weight=30%=0.3 Valero Energy return= 7.96% Valero Energy…

Q: If the actual benefits turned out to be $590 million in year 1 (8,) and then no further benefits.…

A: The bid amount: The maximum amount that the City of Nairobi can bid is the present value of the…

Q: Management of a firm with a cost of capital of 12 percent is considering a $100,000 investment with…

A: given, r = 12% Initial investment = $100,000 Annual cashflow = $44,524 n = 3 years

Q: If the quarterly Income Return is 2.2% and the Quarterly Capital Return is 0.4%, calculate the…

A: Return on investment involves two elements which are, income return and capital return. The total of…

Q: Price is ten times PGI, there are 5% vacancies, operating expenses are 40% of EGI. You are financing…

A: EDR stands for Equity dividend rate which is defined as the ratio of the single period before the…

Q: With a margin of 120 million of a base year that grows at 10%, some commissions collected of 205…

A: Calculate the margin in the following year (Margin T+1) by multiplying the margin in the base year…

Q: Assume $100,000 is available for investment and MARR =10% per year. If alternative A would earn 25%…

A: Assuming, Investment available = $100000 MARR = 10% Investment = $60000 Return = 25% Return on…

Q: An investment of P3M can be made in a business that will produce uniform annual revenue of P1.2M for…

A: Given data, Initial investment = P3M Annual income =P1.2M Salvage value =10% of the investment…

Q: Assuming monetary benefits of an IS at $85,000 per year (5% inflation), one-time sunk developmental…

A: ROI means return on Investments. It is calculated by dividing the net cash inflows by the…

Q: residual income

A: Residual income = Average operating assets * (Return on investment - Required rate of minimum return…

Q: Park Company is considering an investment that requires immediate payment of $27,215 and provides…

A: The net present value method is used to evaluate investment projects. We can evaluate the project by…

Q: I need help woring this problem and how to set up on excel too.

A: Calculate the Net present value as follows:At 5% discount rate:

Q: The prices of its products average $20 per unit, and variable costs average $18 per unit. If the…

A: Credit sale can be defined as the business transaction where the goods are sold on credit to the…

Q: Compute the payback statistic for Project B if the approprlate cost of capital is 11 percent and the…

A: Initial investment (I) = $11700 CF1 = $3420 CF2 = $4320 CF3 = $1660 CF4 = 0 CF5 = $1140

Q: ) The initial outlay of the investment is €125,000. The income stream is €30,000 in vear 1, €55,000…

A: Net present value(NPV) is the difference between present value of all cash inflows and initial…

Q: Year-to-date, Oracle had earned a -1.44 percent return. During the same time period, Valero Energy…

A: Portfolio return = ( Weight 1 * Return 1) + ( weight 2 * Return 2) +...(weight n * Return n)

Q: Para Co. is reviewing the following data relating to an energy saving investment proposal: Cost…

A: The projected worth of a fixed asset after the end of its lease term or usable life is known as the…

Q: your required return is 7.32% how would adding ETFS with average annual returns that are expected to…

A: ETFs or exchange traded fund is a pool of securities like bonds, stocks, commodities, etc. ETF or…

Q: Suppose you makes a $1,000 initial investment today, a $4,000 additional investment at the end of…

A: Money-weighted index is the internal rate of return of the investment made. The IRR is the rate at…

Q: A company has a policy of requiring a tate of return on investment of 13%. Two investment…

A: Required Rate of return =13% Alternative 1 Amount at the end of 5 year = $15,000 Amount at the end…

Q: The capital investment in the system is $72,000, and the projected annual savings are tabled below.…

A: Future Worth: Using an expected rate of growth, future value (FV) is defined as the worth of a…

Q: a. Calculate the following Periodic Total Returns on a 5-year investment. To your calculations,…

A: You have posted multiple questions. We will solve the first question for you. The return on…

Q: you brought 10,000 $ from city group, your initial margin was 55% if price went up 15% or down 20%…

A: Maintenance margin: It is the minimum amount that must be maintained by an investor in the margin…

Q: For the following table, assume a MARR of 15% per year and a useful life for each alternative of…

A: PW is the current worth of cash flows that are expected to occur in the future.

Q: An investment under consideration has a payback of seven years and a cost of $685,000. Assume the…

A: In this we have to calculate annual cash flow and than calculate the net present value.

Q: If Quail Company invests $43,000 today, it can expect to receive $12,600 at the end of each year for…

A: The question is based on the concept of Financial Management.

Q: An investment of s80.000 is expected to generate a net annuol income of $27,000 for 5 years f the…

A: Investment = 80,000 Net Annual Income = 27,000 for 5 years MARR = 13% Total Time Period = 20 years…

Q: Net Income for Company A is $200,000 in 2014, $300,000 in 2015, $400,000 in 2016, $500,000 in 2017,…

A: The expected return is the minimum required rate of return which an investor required from the…

Q: The following three investment opportunities are available. The returns for each investment for each…

A: The value of the cash flow after a particular time period with the addition of the interest amount…

Q: An investment costs $17,944 and will generate cash flow of $4,000 annually for six years. The firm's…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: An investment under consideration has a payback of seven years and a cost of €724,000. Assume the…

A: given information payback period = 7 years cost = €724,000. required rate of return = 12%

Q: A project has a NPV of 15,000 when the cutoff rate is 10%. The annual cash flows are 20,505 on an…

A: Profitability index is used to see the attractiveness of investment or a project. It is also written…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- ASAP 65.You invest in a mutual fund that charges a 3% front-end load, 1% total annual fees and a 2% back-end load, which decreases .5% per year. How much will you pay in fees on a $10,000 investment that does not grow if you cash out after 3 years of no gain? $635 $219 $553 $103 66.The five-star Morningstar rating implies superior returns compared to risk. lowest turnover compared to peers. superior risk compared to return. lowest fees compared to peers.1. A mutual fund with K100 million in assets at the start of the year and with 10 million shares outstanding invests in a portfolio of stocks that provides no income but increases in value by 10 %. Required: What is the rate of return in the fund? If a fund has an initial NAV of K20 at the start of the month makes income distributions K0.15 and capital gain distributions of K0. 05 and ends the month with NAV of K20.10. Calculate the monthly rate of return. 2. An equity fund has a front end load of 4 % and special fees of 0.5% annually as well as back-end fees that start at 5 % and fall by 1 % for each full year the investor holds the portfolio until the fifth year. Assuming the rate of return on the fund net of operating expenses is 10 % annually, what will be the value of a K10 000 investment in the equity fund shares if the shares are sold after 1 year, 4 years and 10 years?You have made a $400,000 investment in a hedge fund that has a 2/20 fee structure. The fund has a total of $25 million of assets under management and provides a return of 10% in the first year. Assume that management fees are paid at the beginning of each year and performance fees are paid at the end of each year in which they are applicable. How much will you pay in management and performance fees for the year? Multiple Choice A)$1,000; $10,250 B)$1,000; $10,700 C)$8,000; $10,250 D)$8,000; $6,240 E)$6,240; $9,000

- Y2 .You invest $100,000 in a hedge fund with a 2/20 fee structure. For the next 3 years, the hedge fund earns annual returns of 25.93%, -13.03%, and 75.34%. You make no withdrawals from the fund. Whenever fees are due, you write a check for that amount to the fund (such that the fund doesn't deduct the fees from your portfolio value). The fund's fee structure has a high watermark feature. What are the total fees you pay over the course of the three years? Enter a number with two decimal points. Answer the question in dollar amount, i.e., if the answer is $20, enter 20.00.A hedge fund adopts the 2/20 regime for managers' compensation. It also adopts the T-bill return as benchmark. T-bill returned 5% per year in the past 2 years. The hedge fund had 0% return in first year. What 2nd year's return must it deliver for the manager to realize any incentive fees?A hedge fund with $25 million of assets under management has a standard 2/20 fee structure and earns 14 percent this year. Assume that management fees are paid at the beginning of each year and performance fees are paid at the end of each year. Assume that the fund’s fee structure also contains a high-water mark provision. What is the management fee collected by the fund managers? What is the performance fee collected by the fund managers? What is the investor’s net return?

- A mutual fund with K100 million in assets at the start of the year and with 10 million shares outstanding invests in a portfolio of stocks that provides no income but increases in value by 10 %. Required: a. What is the rate of return in the fund? b. If a fund has an initial NAV of K20 at the start of the month makes income distributions K0.15 and capital gain distributions of K0. 05 and ends the month with NAV of K20.10. Calculate the monthly rate of return. c. An equity fund has a front end load of 4 % and special fees of 0.5% annually as well as back-end fees that start at 5 % and fall by 1 % for each full year the investor holds the portfolio until the fifth year. Assuming the rate of return on the fund net of operating expenses is 10 % annually, what will be the value of a K10 000 investment in the equity fund shares if the shares are sold after 1 year, 4 years and 10 years?7. Impacts of Costs on Returns. A mutual fund has a 1.69% expense ratio and begins with a $124.655 NAV. It experiences the annual returns shown below. What are the end-of-year NAVs after fees for each year? What are the after-fee returns each year?A high-water mark of $115.25 million was established two years ago for Korean Fried Chicken (KFC) hedge fund. The end-of-year value before fees for last year was $124.58 million. This year’s end-of-year value before fees is $145.50 million. The fund charges “2 and 20.” Management fees are paid independently of incentive fees and are calculated on end-of-year values. What is the total fee paid this year? A. $9.91 million B. $8.96 million C. $7.78 million D. $6.87 million

- Finance ***don’t use excel to solve*** PIMCO Equity Fund has a 3% load. Annual fees are 0.35%, and the expected average annual return for the next 7 years is 11% annually. Vanguard Equity Fund is a no-load fund. Its expected average return for the next 7 years is 10% with annual fees of 1.1%. If you hold both investments for 2 years, which one is the better investment? You believe PIMCO is a better long-term investment. How long must you hold the PIMCO Fund to achieve higher average annual returns than an investment in Vanguard?A hedge fund following the 2 & 20 approach has $150 Billion under management. Assuming the fund has not earned any profits over the past year how much will it earn in fees? $30,000,000,000 $20,000,000 $3,000,000,000 $117,000,000,000You are considering an investment in a mutual fund with a 4% load and expense ratio of 0.5%. You can invest instead in a bank CD paying 6% interest.a. If you plan to invest for 2 years, what annual rate of return must the fund portfolio earn for you to be better off in the fund than in the CD? Assume annual compounding of returns. (Do not round intermediate calculations. Round your answer to 2 decimal places.)