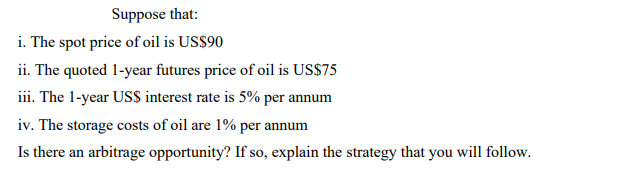

of oil is US$90 rear futures price of oil is US$75 ES interest rate is 5% per annum sts of oil are 1% per annum ge opportunity? If so, explain the strategy that you will fo

Q: month. (Green power is generated from solar, wind power, and methane sources.). a. If a certain…

A: The Average Cost is the per unit cost of production obtained by dividing the total cost (TC) by the…

Q: our construction company has built 50 houses so ar this year at a total cost to the company of $8…

A: Total cost is the total expenses incurred by a producer when he produces goods and services in the…

Q: A company plans to modernize its facilities in 9 years. They estimate saving $9,230 per month if…

A:

Q: If you stay in-state you can attend college for $6000 let year, but pay $950 per month in rent. Or…

A: Option A (in state)College fees=$6000Annual rent=$950*12=$11400Annual cost=$6000+$11400=$17400

Q: enumerate the 7 steps in engineering economy study. apply it on a situation you can encounter in…

A: The work that engineers undertake in doing analyses, summarizing, and reaching to a decision while…

Q: How much must be invested now at 8% interest to produce $5000 at the end of every year for 10 years.

A: The rate of interest is the indication of the fraction of the deposited money which the depositor…

Q: My friend’s aunt used to drive a Lincoln/Mercury Capri. It cost $2,999 in 1973. This sounds…

A: The consumer price index in the year 1973 was 44.4. The latest CPI that is CPI in year 2020…

Q: Calculate Economic Order Quantity (EOQ), number of orders, annual ordering costs, annual carrying…

A: Given information: Annual consumption (C) = 6,000 units Carrying (holding) cost per unit (H) = RO 2…

Q: If the seller manufacturing the books with costing $10 per book. the seller sells 500 books at a…

A: Total number of books (Q) = 500 Price of each books (P) = $100

Q: s AED 5300/- Direct labor cost per day is AED 8200.00 and factory over head is AED 4200.00 . If he…

A: Factory Costs are the expenses that are incurred by the business to manufacture goods that are…

Q: A company manufactures dog leashes that sell for $20.97, including shipping and handling. The…

A: Here, given information is: Selling price per unit: $20.97 Fixed cost: $23,202 Variable cost per…

Q: Which is more valuable, $20,000 received now or $5000 per year for 4 years? Why? Explain the term…

A: The TVM (time value of money) refers that the money in the current has more worth than the worth of…

Q: that $300 for a weekend getaway. uilding mural is a public good, both Nick and Tim will benefit from…

A: Given that, The public good is divided by non-rivalry and non excludability. No one can decrease the…

Q: Given that EOQ is 500 units annual demand is 10,000 units then number of orders be placed in year…

A: The order quantity that a firm should buy to minimize its costs of holding and ordering is said to…

Q: a. What is the unit rate price per ounce for each bag of popcorn? Mega Bag (32 oz) Giant Bag (24 oz)…

A: Mega Bag = 32 Oz , P = $10.24 Price per ounce = Price / total ounce

Q: Mac's credit card statement included $1297.00 in cash advances and $143.91 in interest charges. The…

A: This is question of interest rate .

Q: A certain firm has a capacity to produce 650,000 units of a certain product per year. At present, it…

A: The firm enters into the industry and continues to operate in order to make profits. It will assess…

Q: turer produces a pair of gloves at labor cost of 15 and a material cost of 40 a pair. The fixed…

A: Given fixed cost = 90000 Labor cost = 15 Material cost = 40 Other variable cost = 15 Total variable…

Q: a. A fleet repair facility has the capacity to repair 800 trucks per month. However, due to…

A: Given: Total Capacity to repair trucks=800 Maximum trucks that could be repaired=600 Actual Trucks…

Q: A school building requires repainting. The surface area to be repainted is 1, 744 sq. mtrs. Two…

A:

Q: Cost, revenuo, Ciq) profit (dollars por yar) Rig Output (units per year) Cost, revenue, profit…

A: Profit refers to total revenue after subtracting total cost from it Profit = total revenue- total…

Q: A buyer placed an initial order with a supplior named Ronco that makes brakn assenblies. The order…

A: Given the costs and the productivity improvement. Calculate the impact of productivity improvement…

Q: A The fixed costs at Mahi consulting company are $120,000 annually. The annual revenue is $3,000 per…

A: The meaning of annual revenue is the money your business receives during the course of a year. Here,…

Q: In the fall, Jay Thompson decided to live in a university dormitory. He signed a dorm contract under…

A: The universal existence of scarcity prevents an economic agent from carrying out an action…

Q: Use the table below to calculate the bid rent for manufacturing in Burgville in dollars per acre.…

A: so by using the formula we can calculate the Bid Rent as follow-

Q: A) A retailer wants to sell some DVDs to 4 consumers (A, B, C and D). Assume there are only 4 DVDs…

A: A optimal point for a seller is where the total profits are maximized given valuation schedules for…

Q: Every year, 260260 cars are damaged because of the potholes on Cherry Street, and each driver has to…

A: Given that: The total no of cars damaged every year = 260 Each driver has to pay for repairing the…

Q: The TopCar Industries manufactures and sells car components. The current annual sales volume is…

A:

Q: Tandra's grandparents would like to sell her their second home in 10 years for the present market…

A:

Q: Markus worked as an office manager in 2015 and earned per year, € In 2016 he opened a furniture…

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Use the values in the table below to answer the following questions. TC ATC MC 2 28.44 14.22 (A)-…

A: MC is the ratio of change in TC and change in Q TCn = TCn-1 + MCn TC at 41 units = 46750 + 3560=…

Q: Classifieds NURSES NO EXPERIENCE REQUIRED St. Bart's Hospital seek RN and LVN, with minimum two…

A: Eqm wage rate is determined by the intersection of dd(demand for labor) and ss(supply) of labor.…

Q: Price and cost (dollars per pair) 150 MC 125- 100 ATC 75- 50+ 25- MR 100 200 300 400 Quantity (pairs…

A: Equilibrium is at the point where MR = MC and MC will be upward rising.

Q: n engineer believes that by modifying the structure of a certain water treatment polymer, his/her…

A:

Q: Nancy is considering two career options, fashion design (A) or landscape architecture (B). She has…

A: Net present value: It refers to the cash flow that will come in the future. The cash flow can be…

Q: Gumez runs a small pottery firm he hires one helper at $12,000 per year, pays annual rent of $5,000…

A: a.Accounting profit can be calculated as follows:Accounting profit = revenue – explicit cost= 72000…

Q: Write the formula of Annual Effective Yields?

A: The Annual Effective Yield is one of the methods used to calculate coupon rate which is the interest…

Q: Farmer McDonald gives banjo lessons for $20 perhour. One day, he spends 10 hours planting $100worth…

A: Accounting cost or explicit cost refers to the monetary value of inputs or resources utilized in the…

Q: nly that the project has: r project life with an initial cost of $400.000.

A: The given values are cost= 400,000time= 8

Q: Engineering economic analysis can play a role in many types of situations: O a. Making a…

A: Engineering economics is a sub-part of economics that deals with little complex situation where an…

Q: Calculate Total revenue is per unit price is $10 and output is 320

A: According to the above mentioned question, we have:- Price per unit= $10 Output = 320 units Total…

Q: How much money must be invested now at 8% to purchase a machine in 5 years ?for $200,000

A: Given the interest rate = 8% Time = 5 years Future value = $200000

Q: If total revenue is $550 and price per unit is $55 What is the value of output sold?

A: The given information is as follows:- Total revenue = $550 Price per unit = $55 We have to…

Q: Huawei Company produces mobile phones. Selling Price = $350/unit. Total Fixed expenses = $250,000…

A: In the market, an organization uses various methods to understand the potential and actual output…

Q: Mr. Allahditta who runs a general store at Jodia Bazar, a customer namely Mr. Arif visited his shop…

A: A contract is a spoken or written arrangement between two or more than two people that is…

Q: 1. A furniture store sold picnic chair for $22.95 during a promotional sale. The store bought the…

A: Given: Cost of coffee maker = $36 less 40% and 15% Now the actual cost = 85% of (60% of 36) =…

Q: Heinrich is a manufacturing engineer with the Miller Company. He has determined the costs of…

A: Perfect Competition has many buyers and many sellers, the firm is a price-taker firm, and has free…

Q: Question 1 Cost of a stainless vessel in year 2002 was $33,000. Estimate its cost in year 2016 by…

A: The data presented in the question above is:- In 2022 cost of stainless steel vessel = $33,000 CEPCI…

Step by step

Solved in 2 steps

- 9-month long futures contract on an investment asset that provides $25 coupon payment in 3 months. Storage cost is $2 per unit payable at 9 mos. Spot price of asset is $275 per unit. Risk-free rate is 6.5% per annum. A. What is the no-arbitrage futures price? B. Suppose futures price is $320, how will the trader exploit the arbitrage opportunity? C. Suppose futures price is $220, how will the trader exploit the arbitrage opportunity?Assume you are a soybean producer wanting to establish a selling price range. You purchase a $10.00 put for 11 cents and sell a $11.00 call for 12 cents. The expected basis is 25 cents under Nov Soybean futures. What is your anticipated selling price range? Find the floor price and ceiling price.What are some examples of price indices that might be used to track commodityprices such as steel or copper, and how should they be included in the schedule tominimize risk to both parties?

- 19-An Indian trader approached you with two quotes to know if there is a change in their values after 30 days. Spot rate INR 195 = 1 OMR and 1 INR = 0.00500 OMR after 30 days. Which one of the following will be your answer to the Indian trader? a. None of the options b. INR is appreciated and OMR is appreciated c. INR is depreciated and OMR is depreciated d. OMR is appreciated and INR is depreciatedSuppose a company is considering buying a new copier. The new machine is less labor intensive, and would save somewhat on the wage bill. A clerical assistant, working 10 hours a week (for 50 weeks a year) would not be needed any longer. This assistant, including all benefits and other compensation costs, costs $20/hour. A.) What is the annual wage/savings? B.) Suppose that the machine would last for 5 years. It requires a maintenance agreement, which would cost $500 annually. Use a discount rate of 5%. What is the most the company should be willing to pay for it?Answer the two questions below with solutions. a. A certain sum of money amounts to 7/4 of itself in 3 years. The simple interest rate is? b. The tag price of a certain commodity is payable in 90 days but if payed in 15 days there will be a 10% discount. Find the annual rate of simple interest.

- Give typing answer with explanation and conclusion to all parts The common stock of Teledyne trades on NYSE. Teledyne has never paid a cash dividend. the stock is relatively risky. Assume that the beta for Teledyne is 1.3 and that Teledyne closed at a price of $162. Hypothetical question quotes on Teledyne are as follows: Use the Teledyne data, answer the following: a. What is the cost of 10 October 150 call contracts in total dollars. b. what is the cost of 20 October 160A share of stock currently costs $35. You can purchase either the shares, or options to buy the stock anytime this year at $38.50. These options cost $0.75 per. What price must the stock rise to this year to make the stock options equally profitable (meaning equal capital gain) to purchasing the stock? (Assume you exercise the options/sell the stock at this price.) What price must the stock rise to this year to make purchasing the stock options 6 times as profitable (meaning 6 times the capital gain) as purchasing the stock?a) Define operating leverageb) Firm A operating in a perfectly competitive market sells its product alpha at K10 per unit. Its variable costs are K5 per unit and it is currently selling 60 units. How much are its fixed cost if it’s degree of operating leverage is 1.5.c) What will be Firm A’s profit if its sales increased by 1% from 60 to 60.6?

- 3. At an estate auction attended by more than 1,957 people, a bidding war broke out over a highly coveted collection of 175 very rare gold coins, each minted and stamped on both sides with the following: A Roman Eagle adorned with a small crown and superimposed with a French fluer de lis on its breast, [x]:175, 1957, 1 troy oz., 0.9999 pure gold, HM Royal Mint. The auction company charges 9% commission on all sales. All 1,957 people in attendance had to agree to this fee prior to participating in the auction; that is to say, the fee is considered a given and is a separate pecuniary matter from the bidding action. The auctioneer began by calling $350,000, which was quickly agreed to by one of the bidders. After 27 more exchanges of bids and counterbids, each one met by willing buyer after willing buyer, the collection eventually sold for $402,500 to a lady named Sofia. After the bid was closed, Sofia used her mobile phone to check the current price of gold on the commodities market. She…A corporate treasurer tells you that he has just negotiated a five-year loan at a competitivefixed rate of interest of 5.2%. The treasurer explains that he achieved the 5.2% rate byborrowing at six-month LIBOR plus 150 basis points and swapping LIBOR for 3.7%. He goeson to say that this was possible because his company has a comparative advantage in thefloating-rate market. What has the treasurer overlooked? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.A university spent $2 million to install solar panels atop a parking garage. These panels will have a capacity of 700 kilowatts (kW) and have a life expectancy of 20 years. Suppose that the discount rate is 20%, that electricity can be purchased at $0.10 per kilowatt-hour (kWh), and that the marginal cost of electricity production using the solar panels is zero. Hint: It may be easier to think of the present value of operating the solar panels for 1 hour per year first. Approximately how many hours per year will the solar panels need to operate to enable this project to break even? 8,214.28 5,867.34 2,346.94 4,693.87 If the solar panels can operate only for 5,281 hours a year at maximum, the project break even. Continue to assume that the solar panels can operate only for 5,281 hours a year at maximum. In order for the project to be worthwhile (i.e., at least break even), the university would need a grant of at least blank