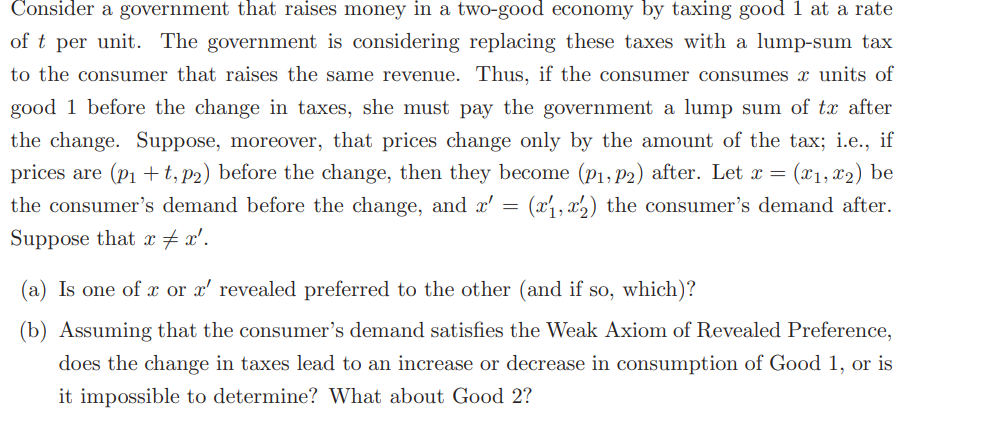

Consider a government that raises money in a two-good economy by taxing good 1 at a rate of t per unit. The government is considering replacing these taxes with a lump-sum tax to the consumer that raises the same revenue. Thus, if the consumer consumes x units of good 1 before the change in taxes, she must pay the government a lump sum of tx after the change. Suppose, moreover, that prices change only by the amount of the tax; i.e., if prices are (p₁+t, p2) before the change, then they become (P1, P2) after. Let x = = (x1, x2) be the consumer's demand before the change, and x' = (x₁, x2) the consumer's demand after. Suppose that x‡ x'.

Consider a government that raises money in a two-good economy by taxing good 1 at a rate of t per unit. The government is considering replacing these taxes with a lump-sum tax to the consumer that raises the same revenue. Thus, if the consumer consumes x units of good 1 before the change in taxes, she must pay the government a lump sum of tx after the change. Suppose, moreover, that prices change only by the amount of the tax; i.e., if prices are (p₁+t, p2) before the change, then they become (P1, P2) after. Let x = = (x1, x2) be the consumer's demand before the change, and x' = (x₁, x2) the consumer's demand after. Suppose that x‡ x'.

Chapter12: The Partial Equilibrium Competitive Model

Section: Chapter Questions

Problem 12.10P

Related questions

Question

please teach explain step by step, how is it like to graph?

Transcribed Image Text:Consider a government that raises money in a two-good economy by taxing good 1 at a rate

of t per unit. The government is considering replacing these taxes with a lump-sum tax

to the consumer that raises the same revenue. Thus, if the consumer consumes x units of

good 1 before the change in taxes, she must pay the government a lump sum of tx after

the change. Suppose, moreover, that prices change only by the amount of the tax; i.e., if

prices are (p₁+t, p2) before the change, then they become (P₁, P2) after. Let x = (x1, x₂) be

the consumer's demand before the change, and x' (x1,x2) the consumer's demand after.

Suppose that x = x'.

=

(a) Is one of x or x' revealed preferred to the other (and if so, which)?

(b) Assuming that the consumer's demand satisfies the Weak Axiom of Revealed Preference,

does the change in taxes lead to an increase or decrease in consumption of Good 1, or is

it impossible to determine? What about Good 2?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you