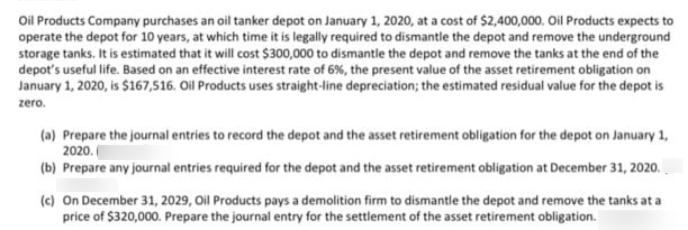

Oil Products Company purchases an oil tanker depot on January 1, 2020, at a cost of $2,400,000. Oil Products expects to operate the depot for 10 years, at which time it is legally required to dismantle the depot and remove the underground storage tanks. It is estimated that it will cost $300,000 to dismantle the depot and remove the tanks at the end of the depot's useful life. Based on an effective interest rate of 6%, the present value of the asset retirement obligation on January 1, 2020, is $167,516. Oil Products uses straight-line depreciation; the estimated residual value for the depot is zero. (a) Prepare the journal entries to record the depot and the asset retirement obligation for the depot on January 1, 2020. (b) Prepare any journal entries required for the depot and the asset retirement obligation at December 31, 2020. (c) On December 31, 2029, Oil Products pays a demolition firm to dismantle the depot and remove the tanks at a price of $320,000. Prepare the journal entry for the settlement of the asset retirement obligation.

Oil Products Company purchases an oil tanker depot on January 1, 2020, at a cost of $2,400,000. Oil Products expects to operate the depot for 10 years, at which time it is legally required to dismantle the depot and remove the underground storage tanks. It is estimated that it will cost $300,000 to dismantle the depot and remove the tanks at the end of the depot's useful life. Based on an effective interest rate of 6%, the present value of the asset retirement obligation on January 1, 2020, is $167,516. Oil Products uses straight-line depreciation; the estimated residual value for the depot is zero. (a) Prepare the journal entries to record the depot and the asset retirement obligation for the depot on January 1, 2020. (b) Prepare any journal entries required for the depot and the asset retirement obligation at December 31, 2020. (c) On December 31, 2029, Oil Products pays a demolition firm to dismantle the depot and remove the tanks at a price of $320,000. Prepare the journal entry for the settlement of the asset retirement obligation.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 10P: Petes Petroleum, Inc., an SEC registrant with a calendar year-end, is in the business of...

Related questions

Question

Transcribed Image Text:Oil Products Company purchases an oil tanker depot on January 1, 2020, at a cost of $2,400,000. Oil Products expects to

operate the depot for 10 years, at which time it is legally required to dismantle the depot and remove the underground

storage tanks. It is estimated that it will cost $300,000 to dismantle the depot and remove the tanks at the end of the

depot's useful life. Based on an effective interest rate of 6%, the present value of the asset retirement obligation on

January 1, 2020, is $167,516. Oil Products uses straight-line depreciation; the estimated residual value for the depot is

zero.

(a) Prepare the journal entries to record the depot and the asset retirement obligation for the depot on January 1,

2020.

(b) Prepare any journal entries required for the depot and the asset retirement obligation at December 31, 2020.

(c) On December 31, 2029, Oil Products pays a demolition firm to dismantle the depot and remove the tanks at a

price of $320,000. Prepare the journal entry for the settlement of the asset retirement obligation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT