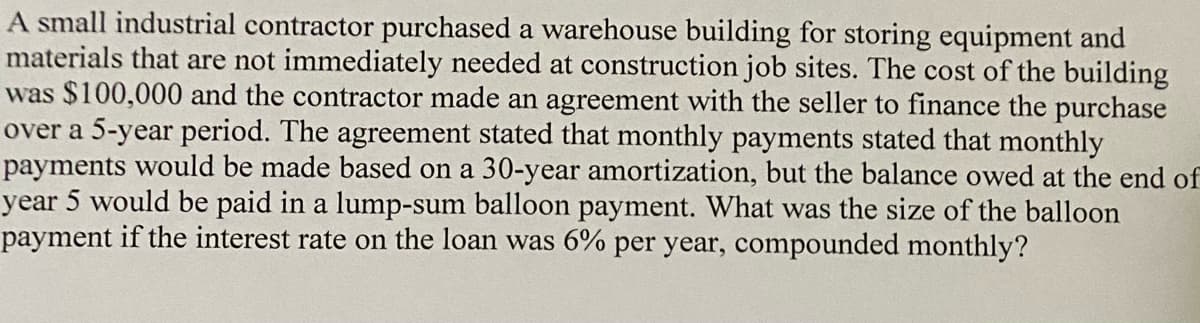

A small industrial contractor purchased a warehouse building for storing equipment and materials that are not immediately needed at construction job sites. The cost of the building was $100,000 and the contractor made an agreement with the seller to finance the purchase over a 5-year period. The agreement stated that monthly payments stated that monthly payments would be made based on a 30-year amortization, but the balance owed at the end of year 5 would be paid in a lump-sum balloon payment. What was the size of the balloon payment if the interest rate on the loan was 6% per year, compounded monthly?

A small industrial contractor purchased a warehouse building for storing equipment and materials that are not immediately needed at construction job sites. The cost of the building was $100,000 and the contractor made an agreement with the seller to finance the purchase over a 5-year period. The agreement stated that monthly payments stated that monthly payments would be made based on a 30-year amortization, but the balance owed at the end of year 5 would be paid in a lump-sum balloon payment. What was the size of the balloon payment if the interest rate on the loan was 6% per year, compounded monthly?

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 45P

Related questions

Question

Transcribed Image Text:A small industrial contractor purchased a warehouse building for storing equipment and

materials that are not immediately needed at construction job sites. The cost of the building

was $100,000 and the contractor made an agreement with the seller to finance the purchase

over a 5-year period. The agreement stated that monthly payments stated that monthly

payments would be made based on a 30-year amortization, but the balance owed at the end of

year 5 would be paid in a lump-sum balloon payment. What was the size of the balloon

payment if the interest rate on the loan was 6% per year, compounded monthly?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning