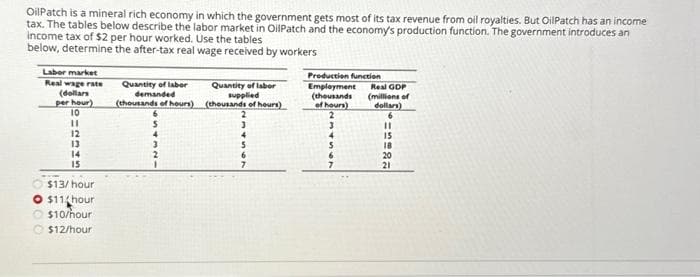

OilPatch is a mineral rich economy in which the government gets most of its tax revenue from oil royalties. But OilPatch has an income tax. The tables below describe the labor market in OilPatch and the economy's production function. The government introduces an income tax of $2 per hour worked. Use the tables below, determine the after-tax real wage received by workers Labor market Real wage rate (dollars per hour) 10 11 12 13 14 15 $13/hour O $11 hour $10/hour $12/hour Quantity of labor demanded (thousands of hours) 4 2 Quantity of labor supplied (thousands of hours) 3 4 6 Production function Employment (thousands of hours) 2 3 6 7 Real GDP (millions of dollars) 11 15 18 20 21

OilPatch is a mineral rich economy in which the government gets most of its tax revenue from oil royalties. But OilPatch has an income tax. The tables below describe the labor market in OilPatch and the economy's production function. The government introduces an income tax of $2 per hour worked. Use the tables below, determine the after-tax real wage received by workers Labor market Real wage rate (dollars per hour) 10 11 12 13 14 15 $13/hour O $11 hour $10/hour $12/hour Quantity of labor demanded (thousands of hours) 4 2 Quantity of labor supplied (thousands of hours) 3 4 6 Production function Employment (thousands of hours) 2 3 6 7 Real GDP (millions of dollars) 11 15 18 20 21

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter22: Inflation

Section: Chapter Questions

Problem 25CTQ: Imagine that the government statisticians who calculate the inflation rate have been updating the...

Related questions

Question

Transcribed Image Text:OilPatch is a mineral rich economy in which the government gets most of its tax revenue from oil royalties. But OilPatch has an income

tax. The tables below describe the labor market in OilPatch and the economy's production function. The government introduces an

income tax of $2 per hour worked. Use the tables

below, determine the after-tax real wage received by workers

Labor market

Real wage rate

(dollars

per hour)

10

11

12

13

14

15

$13/hour

O $11 hour

$10/hour

$12/hour

Quantity of labor

demanded

(thousands of hours)

5

4

2

Quantity of labor

supplied

(thousands of hours)

3

6

7

Production function

Employment

(thousands

of hours)

2

3

6

7

Real GDP

(millions of

dollars)

6

11

15

18

20

21

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning