OLA #11.2 Due to a restricted budget, a company can only undertake one of the following projects: Project X: This project has an initial investment of $850,000 and annual profits of $400,000 in year 1, $400,000 in year 2 and $325,000 in year 3. Project Y: This project has an initial investment of $850,000 and a profit of $1,050,000 in year 3. a. Calculate the IRR for Project X. b. Calculate the IRR for Project Y. c. Which project should the company undertake? Kindly add all the decimals DO NOT ROUND

OLA #11.2 Due to a restricted budget, a company can only undertake one of the following projects: Project X: This project has an initial investment of $850,000 and annual profits of $400,000 in year 1, $400,000 in year 2 and $325,000 in year 3. Project Y: This project has an initial investment of $850,000 and a profit of $1,050,000 in year 3. a. Calculate the IRR for Project X. b. Calculate the IRR for Project Y. c. Which project should the company undertake? Kindly add all the decimals DO NOT ROUND

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter10: The Cost Of Capital

Section: Chapter Questions

Problem 18P: WACC AND OPTIMAL CAPITAL BUDGET Adams Corporation is considering four average-risk protects with the...

Related questions

Question

OLA #11.2

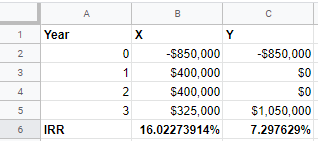

Due to a restricted budget, a company can only undertake one of the following projects:

Project X: This project has an initial investment of $850,000 and annual profits of $400,000 in year 1, $400,000 in year 2 and $325,000 in year 3.

Project Y: This project has an initial investment of $850,000 and a profit of $1,050,000 in year 3.

a. Calculate the

b. Calculate the IRR for Project Y.

c. Which project should the company undertake?

Kindly add all the decimals DO NOT ROUND

Expert Solution

Step 1

The IRR is an annualized measure of return the investment is expected to generate every year. At this rate, the NPV is 0.

Step 2

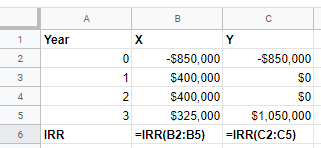

The IRR is calculated as:

Workings:

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College