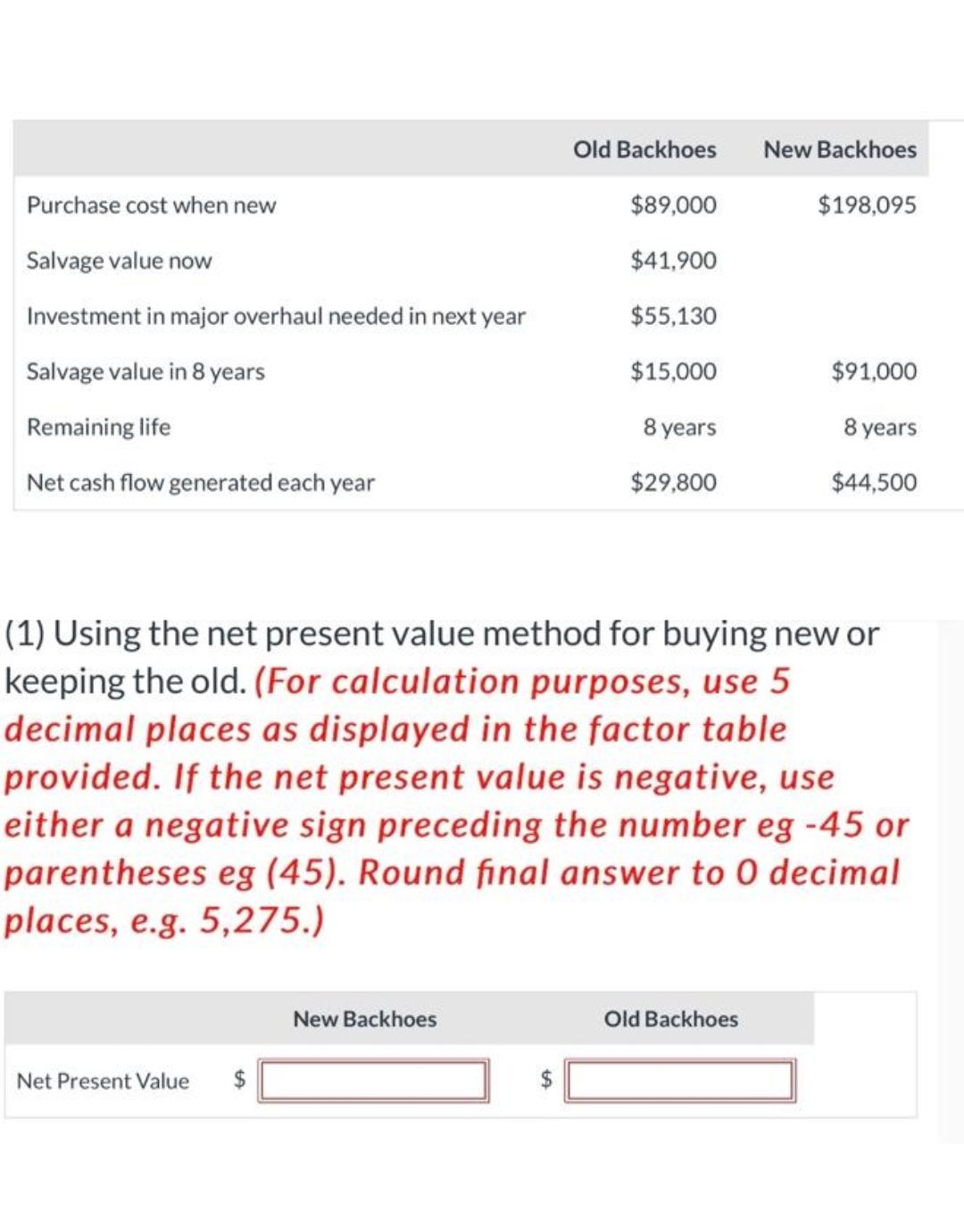

Old Backhoes New Backhoes Purchase cost when new $89,000 $198,095 Salvage value now $41,900 Investment in major overhaul needed in next year $5,130 Salvage value in 8 years $15,000 $91,000 Remaining life 8 years 8 years Net cash flow generated each year $29,800 $44,500 (1) Using the net present value method for buying new or keeping the old. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round final answer to 0 decimal places, e.g. 5,275.) New Backhoes Old Backhoes Net Present Value $

Old Backhoes New Backhoes Purchase cost when new $89,000 $198,095 Salvage value now $41,900 Investment in major overhaul needed in next year $5,130 Salvage value in 8 years $15,000 $91,000 Remaining life 8 years 8 years Net cash flow generated each year $29,800 $44,500 (1) Using the net present value method for buying new or keeping the old. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round final answer to 0 decimal places, e.g. 5,275.) New Backhoes Old Backhoes Net Present Value $

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 11P

Related questions

Question

Please help me to solve this problem

Thank you.

Transcribed Image Text:Old Backhoes

New Backhoes

Purchase cost when new

$89,000

$198,095

Salvage value now

$41,900

Investment in major overhaul needed in next year

$55,130

Salvage value in 8 years

$15,000

$91,000

Remaining life

8 years

8 years

Net cash flow generated each year

$29,800

$44,500

(1) Using the net present value method for buying new or

keeping the old. (For calculation purposes, use 5

decimal places as displayed in the factor table

provided. If the net present value is negative, use

either a negative sign preceding the number eg -45 or

parentheses eg (45). Round final answer to 0 decimal

places, e.g. 5,275.)

New Backhoes

Old Backhoes

Net Present Value

$

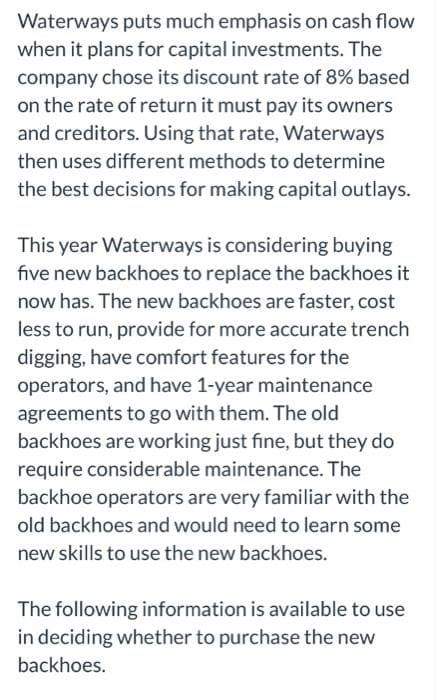

Transcribed Image Text:Waterways puts much emphasis on cash flow

when it plans for capital investments. The

company chose its discount rate of 8% based

on the rate of return it must pay its owners

and creditors. Using that rate, Waterways

then uses different methods to determine

the best decisions for making capital outlays.

This year Waterways is considering buying

five new backhoes to replace the backhoes it

now has. The new backhoes are faster, cost

less to run, provide for more accurate trench

digging, have comfort features for the

operators, and have 1-year maintenance

agreements to go with them. The old

backhoes are working just fine, but they do

require considerable maintenance. The

backhoe operators are very familiar with the

old backhoes and would need to learn some

new skills to use the new backhoes.

The following information is available to use

in deciding whether to purchase the new

backhoes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College