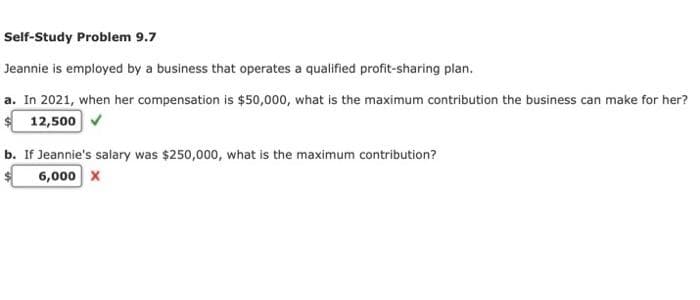

Self-Study Problem 9.7 Jeannie is employed by a business that operates a qualified profit-sharing plan. a. In 2021, when her compensation is $50,000, what is the maximum contribution the business can make for her? 12,500 b. If Jeannie's salary was $250,000, what is the maximum contribution? 6,000 x

Q: Please Solve In 20mins

A: These are the accounting transactions that are having a monetary impact on the financial statement…

Q: Using the weighted-average method, compute the equivalent units of production if the beginning…

A: The term equivalent units are defined as how much amount of work has been completed on certain or…

Q: A process for producing the mosquito repellant Deet has an initial investment of $200,000 with…

A: The following information is given: Initial investment (P) = $200,000 Annual costs = $43,000 Annual…

Q: Balance of Cleaning Supplies Expense The trial balance for Ariel Certified Cleaners appears as…

A: Trial balance is the summary of all general ledger account balances in the business. Total debits…

Q: An entity has made an error in the balance sheet. During the current year, a bond has been…

A: it is important that financial statement in order to make investment decisions by the investors. the…

Q: You are provided with the following information for Keon Company, You are asked to assist ln the…

A: Budget refers to the financial plan for the defined set of period, usually a year and it also…

Q: Treasury Stock Coastal Corporation issued 35,000 shares of $5 par value common stock at $34 per…

A: Equity = Paid in capital + retained earnings - treasury stock The issuance of shares, purchase or…

Q: Required: 1. Compute the company's average operating assets for last year. 2. Compute the company's…

A: Accounting Ratios: Accounting Ratios are the financial ratios through which a company can analyze…

Q: rane Corporation incurred the following transactions. 1. Purchased raw materials on account…

A: A Journal entry is a primary entry that records the financial transactions initially. The…

Q: Please refer to the following information to answer question 12 and 13: Misra Company compiled the…

A: Lets understand the basics. There are three heads are there in the balance sheet which are explained…

Q: Schedule of Cash Collections of Accounts Receivable Pet Supplies Inc., a pet wholesale supplier, was…

A: In the context of the given question, we are required to compute the total cash collection of Pet…

Q: ach of the cases below, assume Division X has a product that can be sold either to outside customers…

A: The total cost of production of a good comprises the total fixed cost of production and the total…

Q: On January 1, 2018, Kefauver Company purchased a piece of equipment for $375,000. The equipment had…

A: 1. Depreciation Expenses - Depreciation Expenses are the expense incurred on the wear and tear of…

Q: Prepare Closing Entries

A: The questions is related to Journal Entries. Journal entries are the first step of accounting. All…

Q: which of the following is necessary to solve a discount problem? a.future amount b.interest…

A: In a discounting problem, the present value of future cash flow is calculated. In order to…

Q: T surreptitiously stole the specific necklace of S. Afterwards, T conducted a public auction then…

A: Title is the legal way of saying you own a right to something.

Q: Question Content Area

A: Cash flow is categorized in three parts Operating Investing Financing

Q: The following balance sheet is for X Company: Balance Sheet January 1, 2021 Assets Equities Cash…

A: Solution: Ending Total assets = Beginning Total assets + Increase in assets during the year -…

Q: Blue Circle Corporation's comparative balance sheet for current assets and liabilities was as…

A: Cash flows from operating activities: It is a section of the Statement of cash flow that explains…

Q: chased vears, with an $24,000 residual value. Tiltor Year 7, Tilton Products sells this machinery…

A: The Answer to the above given case will be option a) A $ 6000 loss in both the company financial…

Q: ABC Inc purchased $9,000 inventory during the month of November from CDE Co. CDE applied a credit…

A: Formula used: Net purchases = Purchases - Purchase returns. Deduction of purchase returns value from…

Q: Fugazi City College sold season tickets for the 2015 football season for $240,000. A total of 8…

A: Introduction: Journals: Each and every business transactions are to be recorded in journals. Another…

Q: What is the reason for renewed interest in not-for-profits corporations?

A: Non-profit corporation owners do not make a profit. The money of a not-for-profit organisation is…

Q: Balance of Salaries Expense The trial balance for Ariel Certified Cleaners appears as follows: Ariel…

A: Financial statements are those statements which are prepared by business at the end of financial…

Q: Does Ronald satisfy the physical presence text for 2022 if he established a home in a foreign…

A: The physical presence test is the test that is done to check the presence of the taxpayer. This test…

Q: Swifty Corporation’s comparative balance sheets are presented below. SWIFTY CORPORATION Balance…

A: The ratio analysis helps to analyse the financial statements of the business on basis of various…

Q: What are the limitations of a manual accounting information system in business? How simple is the…

A: Limitations of manual accounting information system Manual accounting system is the system where…

Q: Municipal bond interest Ordinary dividends Qualified dividends Taxable interest $20,000 $3,000…

A: The deduction of interest on investment that is paid to broker depends on the income from the…

Q: If a new full-time employee is paid $40,000 a year, and taxes and insurance add 20% of wages to the…

A: Wages = $40,000 Taxes and insurance = $40,000 x 20%

Q: Abbott Company uses the allowance method of accounting for uncollectible accounts. Abbott estimates…

A: Bad debt expense = Estimated credit sales × estimated uncollectible percent

Q: A: Choose the right answer: 1. DRP Limited has recently introduced manufactures three products,…

A: Under Activity Based costing, Activity rates are calculated for each cost pools and then costs are…

Q: Required: Prepare an Income Statement of Company Alfex as at 31 Dec. 2020. a) Loss on sale of…

A: Income statement shows revenues and expenses incurred by the company during a particular period. It…

Q: In 2014,Craig and Kathy Koehler owned a small business which was held as a proprietorship in Kathy's…

A: Tax liability: Tax liability is an amount levied on the taxpayer's income on the basis of applicable…

Q: Standard costs are preset costs for delivering a product or service under normal conditlons. True or…

A: Lets understand the basics. Management prepares the standard cost sheet which contain details about…

Q: The income statement disclosed the following items for the year: Depreciation expense $40,700 Gain…

A: Solution a: Statement of Cash Flows (Partial) Particulars Amount Cash flows from operating…

Q: The cost of units sold is recorded by debiting Cost of Goods Sold and crediting

A: Cost of goods sold = beginning finished goods inventory + transfers in from work in process -…

Q: The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as…

A: Cash flows from operating activities: It is a section of the Statement of cash flow that explains…

Q: Cash balance per books, September 30 $5,300 eposits in transit 510 lotes receivable with interest…

A: Introduction:- Bank reconciliation is the process of comparing accounting records to a bank…

Q: Prepare the journal entry to record the sale of 1,800 units that cost $9 per unit and sold for $15…

A: Journal entries recording is the first step of accounting cycle process, under which one account is…

Q: Swifty Corporation recently performed repair services for acustomer that totaled $600. Somehow the…

A: Direct Labor - Labor directly involved in the manufacturing process and identifiable with relevant…

Q: s the principle of caveat emptor (let the buyer beware) be applied to

A: The principle of caveat emptor is very old concept that favor more to the seller of product and…

Q: You have just been hired into a management position which requires the application of your budgeting…

A:

Q: When would the terms of a union agreement take precedence over employment standards: O The union…

A: The union agreement must be followed when collectively taking a decision and following on all the…

Q: Which of the following is an example of an adjusting entry? Recording the billing of customers for…

A: Hi student Since there are multiple questions, we will answer only first question.

Q: Prepare the T-Account

A:

Q: pales Jariable expenses

A: In this question, we have to find out the return on assets. ROA is a financial ratio that tells us…

Q: Required: (a) How many rights are required to purchase one new share? (b) What is the price of one…

A: Number of shares = Desired funds /Subscription price= 22,500,000/ 75= 300,000 shares

Q: Historically, Ragman Company has had no significant bad debt experience with its customers.Cash…

A: Cash flow forecasting, often known as capital forecasting, is a means of predicting the flow of…

Q: 16) The account "Cash" began with a zero balance and then had the following changes: increase of…

A: Introduction: Cash: Cash is the most liquid asset. Cash is a current Asset to be shown in Balance…

Q: Annual depreciation on equipment at Charmed, Inc.is $2,100. The adjusting entry to record one…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

1

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- LO.2 Oak Corporation has the following general business credit carryovers. If the general business credit generated by activities during 2019 equals 36,000 and the total credit allowed during the current year is 60,000 (based on tax liability), what amounts of the current general business credit and carryovers are utilized against the 2019 income tax liability? What is the amount of unused credit carried forward to 2020?Use Figure 12.15 as a reference to answer the following questions. A. If an employee makes $1,400 per month and files as single with no withholding allowances, what would be his monthly income tax withholding? B. What would it be if an employee makes $2,500 per month and files as single with two withholding allowances?LO2 Joyce Lee earns 30,000 a year. Her employer pays a matching Social Security tax of 6.2% on the first 118,500 in earnings, a Medicare tax of 1.45% on gross earnings, and a FUTA tax of 0.6% and a SUTA tax of 5.4%, both on the first 7,000 in earnings. What is the total cost of Joyce Lee to her employer? (a) 32,295 (b) 30,000 (c) 30,420 (d) 32,715

- Use Exhibit 14.2 to estimate the average Social Security benefits for a retired couple. Assume that one spouse has a part-time job that pays $28,000 a year, and that this person also receives another $47,000 a year from a company pension. Assume, that the earnings limit was $17,040 per year. Also assume for Social Security benefits the recipients are aged below 67 and will lose $1 in benefits for every $2 they earn above the earnings test amount. Also assume that they would have to pay taxes of 50% on a combined income between $32,000 and $44,000, of their Social Security benefits. If their combined income is more than $44,000, up to 85% of their Social Security benefits is subject to income tax. Round your answer to the nearest dollar.$ __________ Based on current policies, would this couple be liable for any tax on their Social Security income?-Select: YES or NOQuestion 2 – During 2020, you receive from your employer: • a $400 gift certificate. • a $600 chair for outstanding customer service. • 4 coffee mugs that cost the employer $20. • an Easter basket of gourmet treats valued at $245. • a cash award of $300 in recognition of 10 years of service with the employer. What is the amount that will be included in your 2020 Net Income (Division B)? A) $800. B) $1,000. C) $1,300. D) $700.1. The home improvement center (HIC) has an employment contract with the newly hired CEO. The contract requires a lump-sum payment of 32.4 million dollars to be paid to the CEP upon the successful completion of her first five years of service. HIC, wants to set aside an equal amount of money at the end of each year to cover this anticipated cash outflow and will earn 7,25% on the funds. How much must HIC is set aside each year for this purpose? a) 7 270 433 b)5 227 064 c)5 668 987 d) 5 606 026 e) 6 778 958

- Problem Solving. 1. Ms. Beta earned an annual compensation income of P1,140,000, net of statutory payments. Tax exempt 13th month pay and other bonuses – P95,000. How much is the taxable compensation income? 2. Assuming that Ms. Beta's employer already withheld half of her income tax due, how much is the remaining income tax due and payable? 3. How much is Ms. Beta's income tax due?KA. QUESTION 10 Maria is employed by a major defense contractor and earns $156,000 in 2016. She Calculates: a. The amount of Social Security taxes withheld from your income b. The amount of Medicare tax withheld from your income c. The amount of FUTA withheld from your incomeModule 5 - Practice QuestionMr. Jay Brown is 66 years of age and his 2020 income is made up of employmentincome of $75,800, contributed $6,500 to his RRSP. He also earned interestincome from Guaranteed Investment Certificate (GIC) of $3,700 during 2020 andreceived Old Age Security benefits of $7,400 (because of large business lossesduring the previous two years, no amount was withheld from the OAS payments).Mr. Brown and his family live in Toronto, Ontario. For 2020, Mr. Brown’semployer withheld maximum CPP ($2,898) and EI ($856) contributions. Otherinformation pertaining to 2020 is as follows:1. Mr. Brown’s spouse is 59 years old and qualifies for the disability tax credit.Her income for the year totaled $4,500.2. Mr. and Mrs. Brown have two daughters, Keith, aged 15 and Laura, aged17. Keith had income of $2,700 for the year while Laura had net income of$3,000. In September 2020, Laura began full time attendance at a Canadianuniversity. Mr. Brown paid her tuition fees of $6,000, of…

- 6. Boilermaker Design, Inc. (BD) has an employment contract with its newly hired CEO. The contract requires a lump sum payment of $5 million be paid to the CEO upon the successful completion of her first three years of service. BD wants to set aside an equal amount of money at the end of each year to cover this anticipated payment and will earn 8% on the funds. How much must BD set aside each year for this purpose?1. Currently, Jan receives a salary of $48,000 and pays premiums of $2,000 toward the group insurance packages that the employer provides as a fringe benefit. Jan's income tax rate is 24%. The employer is considering reducing Jan's salary by $2,000 to $46,000 and paying the $2,000 insurance premiums. How much money will Jan save if the employer makes the change? a.$46,000 b.$2,000 c.$480 d.$48,000 e.$11,520Ma1 Matthew (48 at year-end) develops cutting-edge technology for SV Inc., located in Silicon Valley. In 2020, Matthew participates in SV’s money purchase pension plan (a defined contribution plan) and in his company’s 401(k) plan. Under the money purchase pension plan, SV contributes 15 percent of an employee’s salary to a retirement account for the employee up to the amount limited by the tax code. Because it provides the money purchase pension plan, SV does not contribute to the employee’s 401(k) plan. Matthew would like to maximize his contribution to his 401(k) account after SV’s contribution to the money purchase plan. (Leave no answers blank. Enter zero if applicable.) d. Assume Matthew's annual salary is $72,500 and that he is 54 years old at the end of 2020. What amount can Matthew contribute to his 401(k) account in 2020?