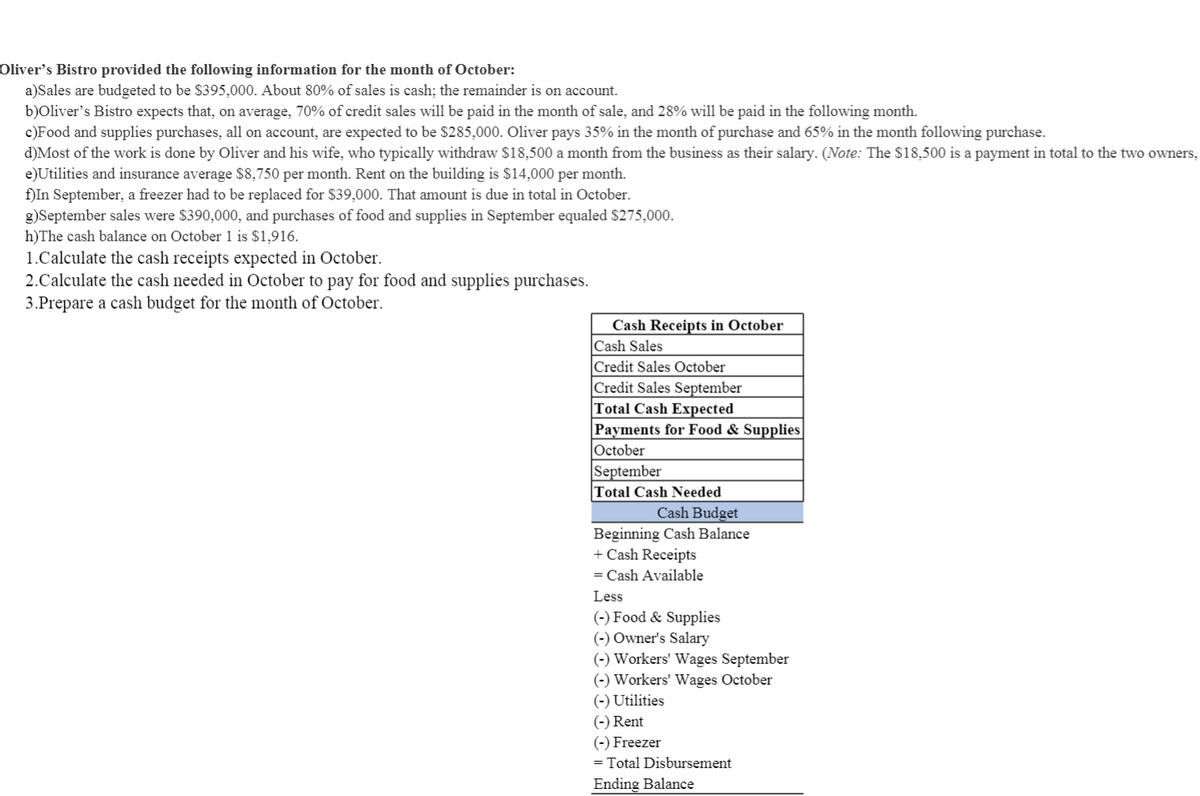

Oliver's Bistro provided the following information for the month of October: a)Sales are budgeted to be $395,000. About 80% of sales is cash; the remainder is on account. b)Oliver's Bistro expects that, on average, 70% of credit sales will be paid in the month of sale, and 28% will be paid in the following month. c)Food and supplies purchases, all on account, are expected to be $285,000. Oliver pays 35% in the month of purchase and 65% in the month following purchase. d)Most of the work is done by Oliver and his wife, who typically withdraw $18,500 a month from the business as their salary. (Note: The $18,500 is a payment in total to the two owners, e)Utilities and insurance average $8,750 per month. Rent on the building is $14,000 per month. f)In September, a freezer had to be replaced for $39,000. That amount is due in total in October. g)September sales were $390,000, and purchases of food and supplies in September equaled $275,000. h)The cash balance on October 1 is $1,916. 1.Calculate the cash receipts expected in October. 2.Calculate the cash needed in October to pay for food and supplies purchases. 3.Prepare a cash budget for the month of October. Cash Receipts in October Cash Sales Credit Sales October Credit Sales September Total Cash Expected Payments for Food & Supplies October September Total Cash Needed Cash Budget Beginning Cash Balance + Cash Receipts = Cash Available Less (-) Food & Supplies (-) Owner's Salary (-) Workers' Wages September (-) Workers' Wages October (-) Utilities (-) Rent (-) Freezer = Total Disbursement Ending Balance

Oliver's Bistro provided the following information for the month of October: a)Sales are budgeted to be $395,000. About 80% of sales is cash; the remainder is on account. b)Oliver's Bistro expects that, on average, 70% of credit sales will be paid in the month of sale, and 28% will be paid in the following month. c)Food and supplies purchases, all on account, are expected to be $285,000. Oliver pays 35% in the month of purchase and 65% in the month following purchase. d)Most of the work is done by Oliver and his wife, who typically withdraw $18,500 a month from the business as their salary. (Note: The $18,500 is a payment in total to the two owners, e)Utilities and insurance average $8,750 per month. Rent on the building is $14,000 per month. f)In September, a freezer had to be replaced for $39,000. That amount is due in total in October. g)September sales were $390,000, and purchases of food and supplies in September equaled $275,000. h)The cash balance on October 1 is $1,916. 1.Calculate the cash receipts expected in October. 2.Calculate the cash needed in October to pay for food and supplies purchases. 3.Prepare a cash budget for the month of October. Cash Receipts in October Cash Sales Credit Sales October Credit Sales September Total Cash Expected Payments for Food & Supplies October September Total Cash Needed Cash Budget Beginning Cash Balance + Cash Receipts = Cash Available Less (-) Food & Supplies (-) Owner's Salary (-) Workers' Wages September (-) Workers' Wages October (-) Utilities (-) Rent (-) Freezer = Total Disbursement Ending Balance

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 4P

Related questions

Question

1.

What is the cash receipts expected in October?

2.

What is the cash needed in October to pay for food and supplies purchases?

3.

What is the Ending Balance of October's

Transcribed Image Text:Oliver’s Bistro provided the following information for the month of October:

a)Sales are budgeted to be $395,000. About 80% of sales is cash; the remainder is on account.

b)Oliver's Bistro expects that, on average, 70% of credit sales will be paid in the month of sale, and 28% will be paid in the following month.

c)Food and supplies purchases, all on account, are expected to be $285,000. Oliver pays 35% in the month of purchase and 65% in the month following purchase.

d)Most of the work is done by Oliver and his wife, who typically withdraw $18,500 a month from the business as their salary. (Note: The $18,500 is a payment in total to the two owners,

e)Utilities and insurance average $8,750 per month. Rent on the building is $14,000 per month.

f)In September, a freezer had to be replaced for $39,000. That amount is due in total in October.

g)September sales were $390,000, and purchases of food and supplies in September equaled $275,000.

h)The cash balance on October 1 is $1,916.

1.Calculate the cash receipts expected in October.

2.Calculate the cash needed in October to pay for food and supplies purchases.

3.Prepare a cash budget for the month of October.

Cash Receipts in October

Cash Sales

Credit Sales October

Credit Sales September

Total Cash Expected

Payments for Food & Supplies

October

September

Total Cash Needed

Cash Budget

Beginning Cash Balance

+ Cash Receipts

= Cash Available

Less

(-) Food & Supplies

(-) Owner's Salary

(-) Workers' Wages September

(-) Workers' Wages October

(-) Utilities

(-) Rent

(-) Freezer

= Total Disbursement

Ending Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning