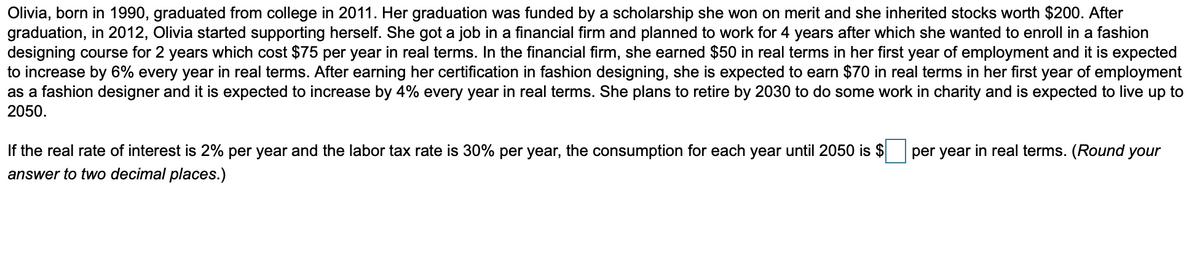

Olivia, born in 1990, graduated from college in 2011. Her graduation was funded by a scholarship she won on merit and she inherited stocks worth $200. After graduation, in 2012, Olivia started supporting herself. She got a job in a financial firm and planned to work for 4 years after which she wanted to enroll in a fashion designing course for 2 years which cost $75 per year in real terms. In the financial firm, she earned $50 in real terms in her first year of employment and it is expected to increase by 6% every year in real terms. After earning her certification in fashion designing, she is expected to earn $70 in real terms in her first year of employment as a fashion designer and it is expected to increase by 4% every year in real terms. She plans to retire by 2030 to do some work in charity and is expected to live up to 2050. If the real rate of interest is 2% per year and the labor tax rate is 30% per year, the consumption for each year until 2050 is $ per year in real terms. (Round your answer to two decimal places.)

Olivia, born in 1990, graduated from college in 2011. Her graduation was funded by a scholarship she won on merit and she inherited stocks worth $200. After graduation, in 2012, Olivia started supporting herself. She got a job in a financial firm and planned to work for 4 years after which she wanted to enroll in a fashion designing course for 2 years which cost $75 per year in real terms. In the financial firm, she earned $50 in real terms in her first year of employment and it is expected to increase by 6% every year in real terms. After earning her certification in fashion designing, she is expected to earn $70 in real terms in her first year of employment as a fashion designer and it is expected to increase by 4% every year in real terms. She plans to retire by 2030 to do some work in charity and is expected to live up to 2050. If the real rate of interest is 2% per year and the labor tax rate is 30% per year, the consumption for each year until 2050 is $ per year in real terms. (Round your answer to two decimal places.)

Chapter15: Taxing Business Income

Section: Chapter Questions

Problem 3DQ

Related questions

Question

Transcribed Image Text:Olivia, born in 1990, graduated from college in 2011. Her graduation was funded by a scholarship she won on merit and she inherited stocks worth $200. After

graduation, in 2012, Olivia started supporting herself. She got a job in a financial firm and planned to work for 4 years after which she wanted to enroll in a fashion

designing course for 2 years which cost $75 per year in real terms. In the financial firm, she earned $50 in real terms in her first year of employment and it is expected

to increase by 6% every year in real terms. After earning her certification in fashion designing, she is expected to earn $70 in real terms in her first year of employment

as a fashion designer and it is expected to increase by 4% every year in real terms. She plans to retire by 2030 to do some work in charity and is expected to live up to

2050.

If the real rate of interest is 2% per year and the labor tax rate is 30% per year, the consumption for each year until 2050 is $

per year in real terms. (Round your

answer to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT