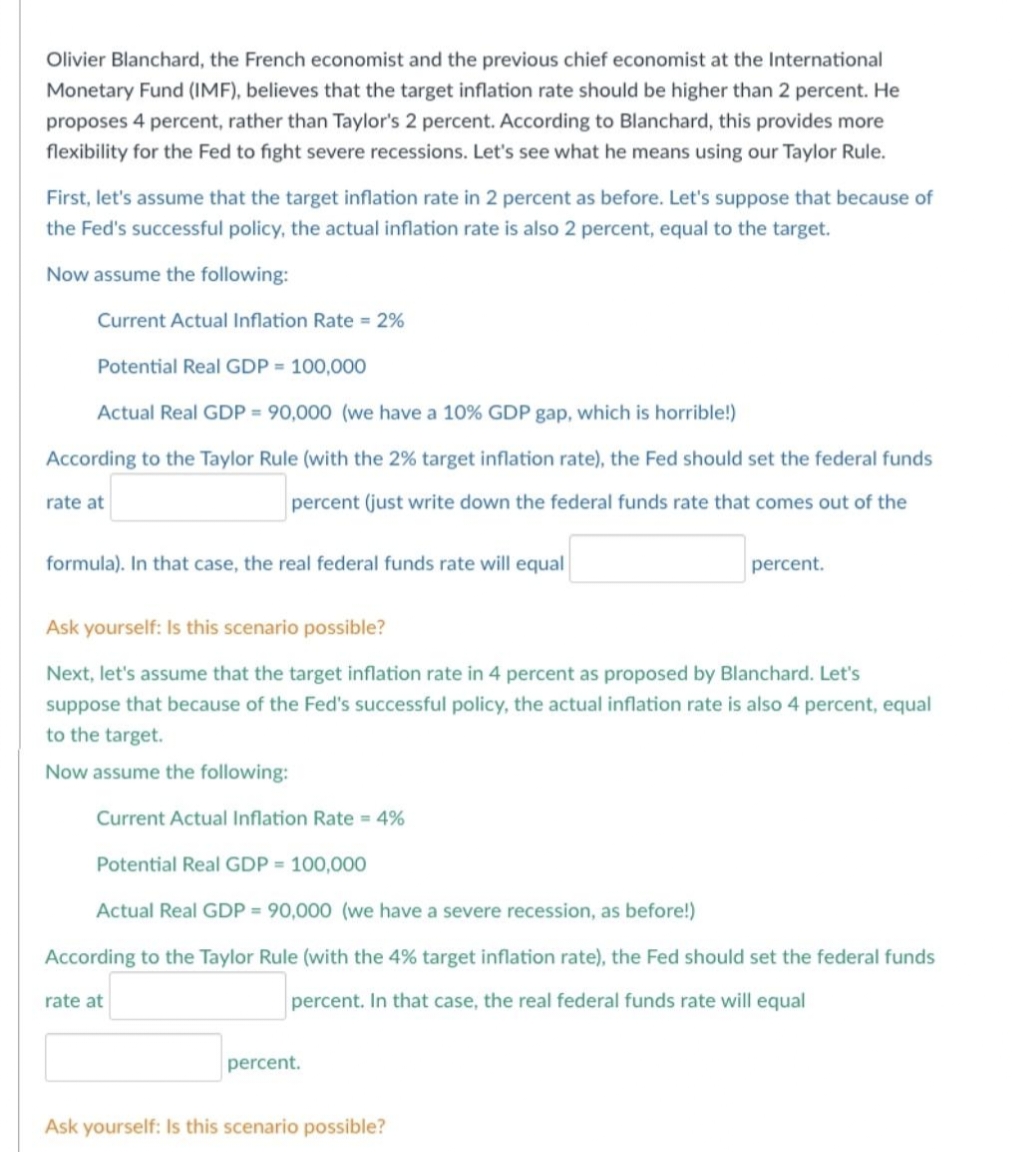

Olivier Blanchard, the French economist and the previous chief economist at the International Monetary Fund (IMF), believes that the target inflation rate should be higher than 2 percent. He proposes 4 percent, rather than Taylor's 2 percent. According to Blanchard, this provides more flexibility for the Fed to fight severe recessions. Let's see what he means using our Taylor Rule. First, let's assume that the target inflation rate in 2 percent as before. Let's suppose that because of the Fed's successful policy, the actual inflation rate is also 2 percent, equal to the target. Now assume the following: Current Actual Inflation Rate = 2% Potential Real GDP = 100,000 Actual Real GDP = 90,000 (we have a 10% GDP gap, which is horrible!) According to the Taylor Rule (with the 2% target inflation rate), the Fed should set the federal funds percent (just write down the federal funds rate that comes out of the rate at formula). In that case, the real federal funds rate will equal Ask yourself: Is this scenario possible? Next, let's assume that the target inflation rate in 4 percent as proposed by Blanchard. Let's suppose that because of the Fed's successful policy, the actual inflation rate is also 4 percent, equal to the target. Now assume the following: percent. Current Actual Inflation Rate = 4% Potential Real GDP = 100,000 Actual Real GDP = 90,000 (we have a severe recession, as before!) According to the Taylor Rule (with the 4% target inflation rate), the Fed should set the federal funds percent. In that case, the real federal funds rate will equal rate at percent. Ask yourself: Is this scenario possible?

Olivier Blanchard, the French economist and the previous chief economist at the International Monetary Fund (IMF), believes that the target inflation rate should be higher than 2 percent. He proposes 4 percent, rather than Taylor's 2 percent. According to Blanchard, this provides more flexibility for the Fed to fight severe recessions. Let's see what he means using our Taylor Rule. First, let's assume that the target inflation rate in 2 percent as before. Let's suppose that because of the Fed's successful policy, the actual inflation rate is also 2 percent, equal to the target. Now assume the following: Current Actual Inflation Rate = 2% Potential Real GDP = 100,000 Actual Real GDP = 90,000 (we have a 10% GDP gap, which is horrible!) According to the Taylor Rule (with the 2% target inflation rate), the Fed should set the federal funds percent (just write down the federal funds rate that comes out of the rate at formula). In that case, the real federal funds rate will equal Ask yourself: Is this scenario possible? Next, let's assume that the target inflation rate in 4 percent as proposed by Blanchard. Let's suppose that because of the Fed's successful policy, the actual inflation rate is also 4 percent, equal to the target. Now assume the following: percent. Current Actual Inflation Rate = 4% Potential Real GDP = 100,000 Actual Real GDP = 90,000 (we have a severe recession, as before!) According to the Taylor Rule (with the 4% target inflation rate), the Fed should set the federal funds percent. In that case, the real federal funds rate will equal rate at percent. Ask yourself: Is this scenario possible?

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter14: Modern Macroeconomics And Monetary Policy

Section: Chapter Questions

Problem 10CQ

Related questions

Question

V4

Transcribed Image Text:Olivier Blanchard, the French economist and the previous chief economist at the International

Monetary Fund (IMF), believes that the target inflation rate should be higher than 2 percent. He

proposes 4 percent, rather than Taylor's 2 percent. According to Blanchard, this provides more

flexibility for the Fed to fight severe recessions. Let's see what he means using our Taylor Rule.

First, let's assume that the target inflation rate in 2 percent as before. Let's suppose that because of

the Fed's successful policy, the actual inflation rate is also 2 percent, equal to the target.

Now assume the following:

Current Actual Inflation Rate = 2%

Potential Real GDP = 100,000

Actual Real GDP = 90,000 (we have a 10% GDP gap, which is horrible!)

According to the Taylor Rule (with the 2% target inflation rate), the Fed should set the federal funds

rate at

percent (just write down the federal funds rate that comes out of the

formula). In that case, the real federal funds rate will equal

Ask yourself: Is this scenario possible?

Next, let's assume that the target inflation rate in 4 percent as proposed by Blanchard. Let's

suppose that because of the Fed's successful policy, the actual inflation rate is also 4 percent, equal

to the target.

Now assume the following:

Current Actual Inflation Rate = 4%

Potential Real GDP = 100,000

Actual Real GDP = 90,000 (we have a severe recession, as before!)

According to the Taylor Rule (with the 4% target inflation rate), the Fed should set the federal funds

percent. In that case, the real federal funds rate will equal

rate at

percent.

percent.

Ask yourself: Is this scenario possible?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning