ollins Corporation is a major manufacturer of food processors. It purchases motors from Campbell Corporation. Annual demand is 104,000 motors per year or 2,000 motors per week. The ordering cost is $100 per order. The annual carrying cost is $20.80 per motor. It currently takes 3 eeks to supply an order to the assembly plant. ead the requirements. equirement 1. What is the optimal number of motors that Collins's managers should order according to the EOQ model? egin selecting the formula used to calculate EOQ. (D= Demand in units for one year, P= Ordering cost per purchase order, C= Carrying cost of one unit in stock, Q= Any order quantity) 2DP The optimal number of motors per order is 1,000 motors. equirement 2. At what point should managers reorder the motors, assuming that both demand and purchase-order lead time are known with certainty? etermine the formula used to calculate the reorder point for reordering motors, then calculate the reorder point. Demand per week Purchasing lead time (wks) Reorder point 2,000 3 6,000 motors equirement 3. Now assume that demand can vary during the 3-week purchase-order lead time. The table shows the probability distribution of various demand levels. If Collins runs out of stock, it would have to rush order the motors at an additional cost of $1 per motor. How much safety ock should the assembly plant hold? How will this affect the reorder point and reorder quantity? he assembly plant should hold motors as safety stock because when this number of motors are held, Demand ne total stockout and carrying costs are the Total Demand for Motors for 3 Weeks Probability of Demand (sums to 1) 3,000 0.05 4,000 0.30 6,000 0.10 6,140 0.50

ollins Corporation is a major manufacturer of food processors. It purchases motors from Campbell Corporation. Annual demand is 104,000 motors per year or 2,000 motors per week. The ordering cost is $100 per order. The annual carrying cost is $20.80 per motor. It currently takes 3 eeks to supply an order to the assembly plant. ead the requirements. equirement 1. What is the optimal number of motors that Collins's managers should order according to the EOQ model? egin selecting the formula used to calculate EOQ. (D= Demand in units for one year, P= Ordering cost per purchase order, C= Carrying cost of one unit in stock, Q= Any order quantity) 2DP The optimal number of motors per order is 1,000 motors. equirement 2. At what point should managers reorder the motors, assuming that both demand and purchase-order lead time are known with certainty? etermine the formula used to calculate the reorder point for reordering motors, then calculate the reorder point. Demand per week Purchasing lead time (wks) Reorder point 2,000 3 6,000 motors equirement 3. Now assume that demand can vary during the 3-week purchase-order lead time. The table shows the probability distribution of various demand levels. If Collins runs out of stock, it would have to rush order the motors at an additional cost of $1 per motor. How much safety ock should the assembly plant hold? How will this affect the reorder point and reorder quantity? he assembly plant should hold motors as safety stock because when this number of motors are held, Demand ne total stockout and carrying costs are the Total Demand for Motors for 3 Weeks Probability of Demand (sums to 1) 3,000 0.05 4,000 0.30 6,000 0.10 6,140 0.50

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter13: The Balanced Scorecard: Strategic-based Control

Section: Chapter Questions

Problem 9E: Computador has a manufacturing plant in Des Moines that has the theoretical capability to produce...

Related questions

Question

Hi, can someone answer this please?

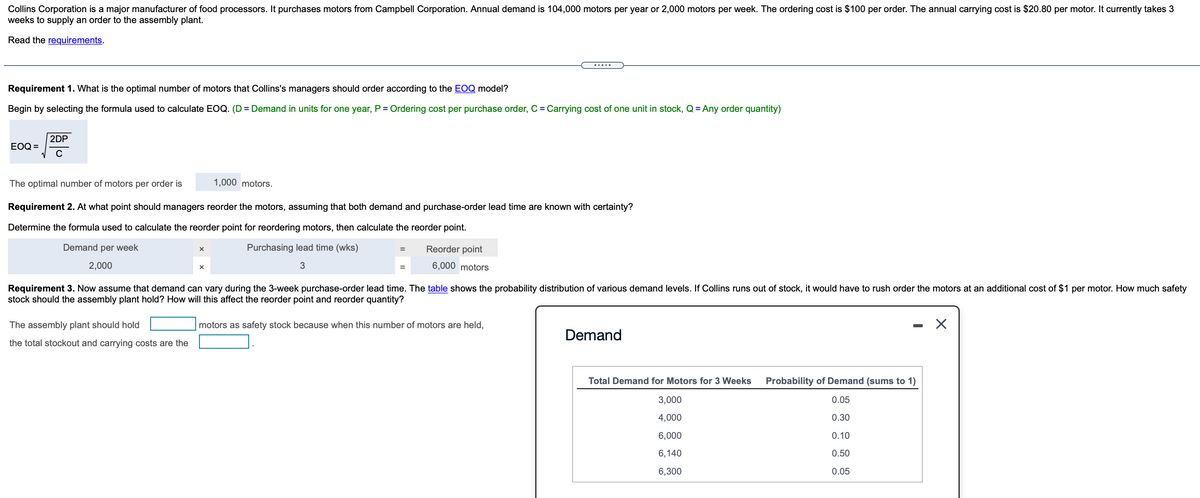

Transcribed Image Text:Collins Corporation is a major manufacturer of food processors. It purchases motors from Campbell Corporation. Annual demand is 104,000 motors per year or 2,000 motors per week. The ordering cost is $100 per order. The annual carrying cost is $20.80 per motor. It currently takes 3

weeks to supply an order to the assembly plant.

Read the requirements.

.....

Requirement 1. What is the optimal number of motors that Collins's managers should order according to the EOQ model?

Begin by selecting the formula used to calculate EOQ. (D = Demand in units for one year, P = Ordering cost per purchase order, C = Carrying cost of one unit in stock, Q = Any order quantity)

2DP

EOQ =

The optimal number of motors per order is

1,000 motors.

Requirement 2. At what point should managers reorder the motors, assuming that both demand and purchase-order lead time are known with certainty?

Determine the formula used to calculate the reorder point for reordering motors, then calculate the reorder point.

Demand per week

Purchasing lead time (wks)

Reorder point

%3D

2,000

6,000 motors

%3D

Requirement 3. Now assume that demand can vary during the 3-week purchase-order lead time. The table shows the probability distribution of various demand levels. If Collins runs out of stock, it would have to rush order the motors at an additional cost of $1 per motor. How much safety

stock should the assembly plant hold? How will this affect the reorder point and reorder quantity?

The assembly plant should hold

motors as safety stock because when this number of motors are held,

Demand

the total stockout and carrying costs are the

Total Demand for Motors for 3 Weeks

Probability of Demand (sums to 1)

3,000

0.05

4,000

0.30

6,000

0.10

6,140

0.50

6,300

0.05

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub