The Compressor Division and the Fabrication Division of Plash Company, which exclusively produces one type of washing machine, respectively, are its two divisions. For the Fabrication Division, which completes the washing machine and sells it to retailers, the Compressor Division makes compressors. The Fabrication Division buys compressors from the Compressor Division. The Fabrication Division will spend $40.00 on a compressor, which is the market price. (Skip updates to the inventory.) It is expected that the fixed costs for the Compressor Division remain constant for orders between 5,000 and 10,000 units. The Fabrication Division's fixed expenses are estimated to be $7.50 per unit at 10,000 units. Compressor's costs per compressor are: Direct materials Direct labor Variable overhead Division fixed costs Fabrication's costs per completed air conditioner are: Direct materials $15.00 $7.25 $3.00 $7.50 $150.00 $62.50 $20.00 $7.50 Assume that 1,000 compressors are built and transferred to the Fabrication Division at a transfer price that is equal to 150 percent of the Compressor Division's total expenses. The operational income of the Compressor Division comprises a $15 875 a b $18 250 c $16.375 d $17 375 Direct labor Variable overhead Division fixed costs

The Compressor Division and the Fabrication Division of Plash Company, which exclusively produces one type of washing machine, respectively, are its two divisions. For the Fabrication Division, which completes the washing machine and sells it to retailers, the Compressor Division makes compressors. The Fabrication Division buys compressors from the Compressor Division. The Fabrication Division will spend $40.00 on a compressor, which is the market price. (Skip updates to the inventory.) It is expected that the fixed costs for the Compressor Division remain constant for orders between 5,000 and 10,000 units. The Fabrication Division's fixed expenses are estimated to be $7.50 per unit at 10,000 units. Compressor's costs per compressor are: Direct materials Direct labor Variable overhead Division fixed costs Fabrication's costs per completed air conditioner are: Direct materials $15.00 $7.25 $3.00 $7.50 $150.00 $62.50 $20.00 $7.50 Assume that 1,000 compressors are built and transferred to the Fabrication Division at a transfer price that is equal to 150 percent of the Compressor Division's total expenses. The operational income of the Compressor Division comprises a $15 875 a b $18 250 c $16.375 d $17 375 Direct labor Variable overhead Division fixed costs

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter11: Performance Evaluation And Decentralization

Section: Chapter Questions

Problem 16BEA

Related questions

Question

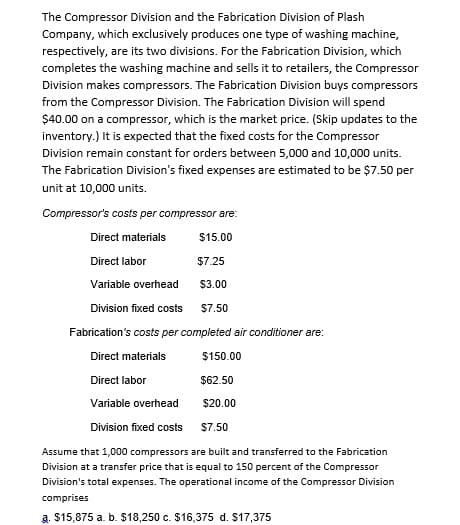

Transcribed Image Text:The Compressor Division and the Fabrication Division of Plash

Company, which exclusively produces one type of washing machine,

respectively, are its two divisions. For the Fabrication Division, which

completes the washing machine and sells it to retailers, the Compressor

Division makes compressors. The Fabrication Division buys compressors

from the Compressor Division. The Fabrication Division will spend

$40.00 on a compressor, which is the market price. (Skip updates to the

inventory.) It is expected that the fixed costs for the Compressor

Division remain constant for orders between 5,000 and 10,000 units.

The Fabrication Division's fixed expenses are estimated to be $7.50 per

unit at 10,000 units.

Compressor's costs per compressor are:

Direct materials

$15.00

Direct labor

$7.25

Variable overhead

$3.00

Division fixed costs

$7.50

Fabrication's costs per completed air conditioner are:

Direct materials

$150.00

Direct labor

$62.50

Variable overhead

$20.00

Division fixed costs

$7.50

Assume that 1,000 compressors are built and transferred to the Fabrication

Division at a transfer price that is equal to 150 percent of the Compressor

Division's total expenses. The operational income of the Compressor Division

comprises

a. $15,875 a. b. $18,250 c. $16,375 d. $17,375

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning