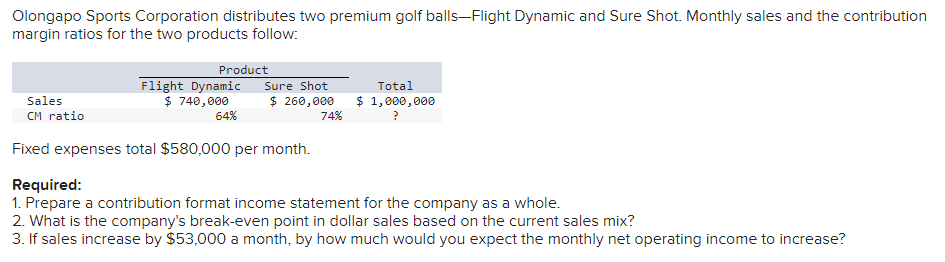

Olongapo Sports Corporation distributes two premium golf balls-Flight Dynamic and Sure Shot. Monthly sales and the contributio margin ratios for the two products follow: Product Flight Dynamic $ 740,000 64% Sure Shot $ 260,000 74% Sales CM ratio Fixed expenses total $580,000 per month. Total $ 1,000,000 ? Required: 1. Prepare a contribution format income statement for the company as a whole. 2. What is the company's break-even point in dollar sales based on the current sales mix? 2. If sales increase by $53.000 a month by how much would you expect the monthly net operating income to increase?

Olongapo Sports Corporation distributes two premium golf balls-Flight Dynamic and Sure Shot. Monthly sales and the contributio margin ratios for the two products follow: Product Flight Dynamic $ 740,000 64% Sure Shot $ 260,000 74% Sales CM ratio Fixed expenses total $580,000 per month. Total $ 1,000,000 ? Required: 1. Prepare a contribution format income statement for the company as a whole. 2. What is the company's break-even point in dollar sales based on the current sales mix? 2. If sales increase by $53.000 a month by how much would you expect the monthly net operating income to increase?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 1CE

Related questions

Question

solve all the requirements

Transcribed Image Text:Olongapo Sports Corporation distributes two premium golf balls-Flight Dynamic and Sure Shot. Monthly sales and the contribution

margin ratios for the two products follow:

Product

Flight Dynamic

$ 740,000

64%

Sure Shot

$ 260,000

74%

Sales

CM ratio

Fixed expenses total $580,000 per month.

Total

$ 1,000,000

?

Required:

1. Prepare a contribution format income statement for the company as a whole.

2. What is the company's break-even point in dollar sales based on the current sales mix?

3. If sales increase by $53,000 a month, by how much would you expect the monthly net operating income to increase?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College