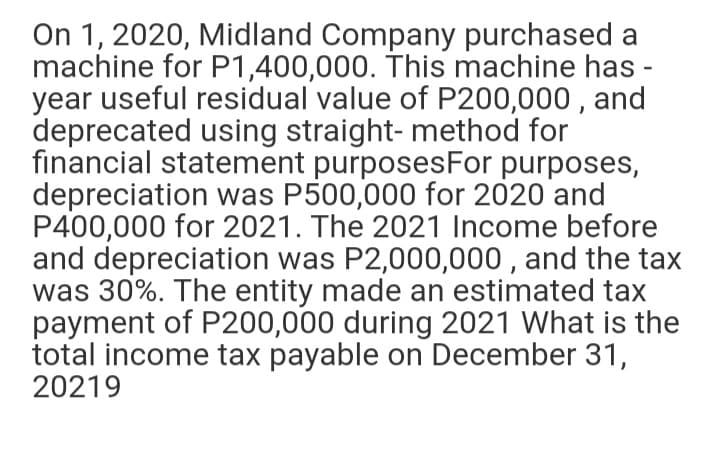

On 1, 2020, Midland Company purchased a machine for P1,400,000. This machine has - year useful residual value of P200,000 , and deprecated using straight- method for financial statement purposesFor purposes, depreciation was P500,000 for 2020 and P400,000 for 2021. The 2021 Income before and depreciation was P2,000,000 , and the tax was 30%. The entity made an estimated tax payment of P200,000 during 2021 What is the total income tax payable on December 31, 20219

On 1, 2020, Midland Company purchased a machine for P1,400,000. This machine has - year useful residual value of P200,000 , and deprecated using straight- method for financial statement purposesFor purposes, depreciation was P500,000 for 2020 and P400,000 for 2021. The 2021 Income before and depreciation was P2,000,000 , and the tax was 30%. The entity made an estimated tax payment of P200,000 during 2021 What is the total income tax payable on December 31, 20219

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 5MC: At the beginning of 2019, Conley Company purchased an asset at a cost of 10,000. For financial...

Related questions

Question

Transcribed Image Text:On 1, 2020, Midland Company purchased a

machine for P1,400,000. This machine has -

year useful residual value of P200,000 , and

deprecated using straight- method for

financial statement purposesFor purposes,

depreciation was P500,000 for 2020 and

P400,000 for 2021. The 2021 Income before

and depreciation was P2,000,000 , and the tax

was 30%. The entity made an estimated tax

payment of P200,000 during 2021 What is the

total income tax payable on December 31,

20219

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning