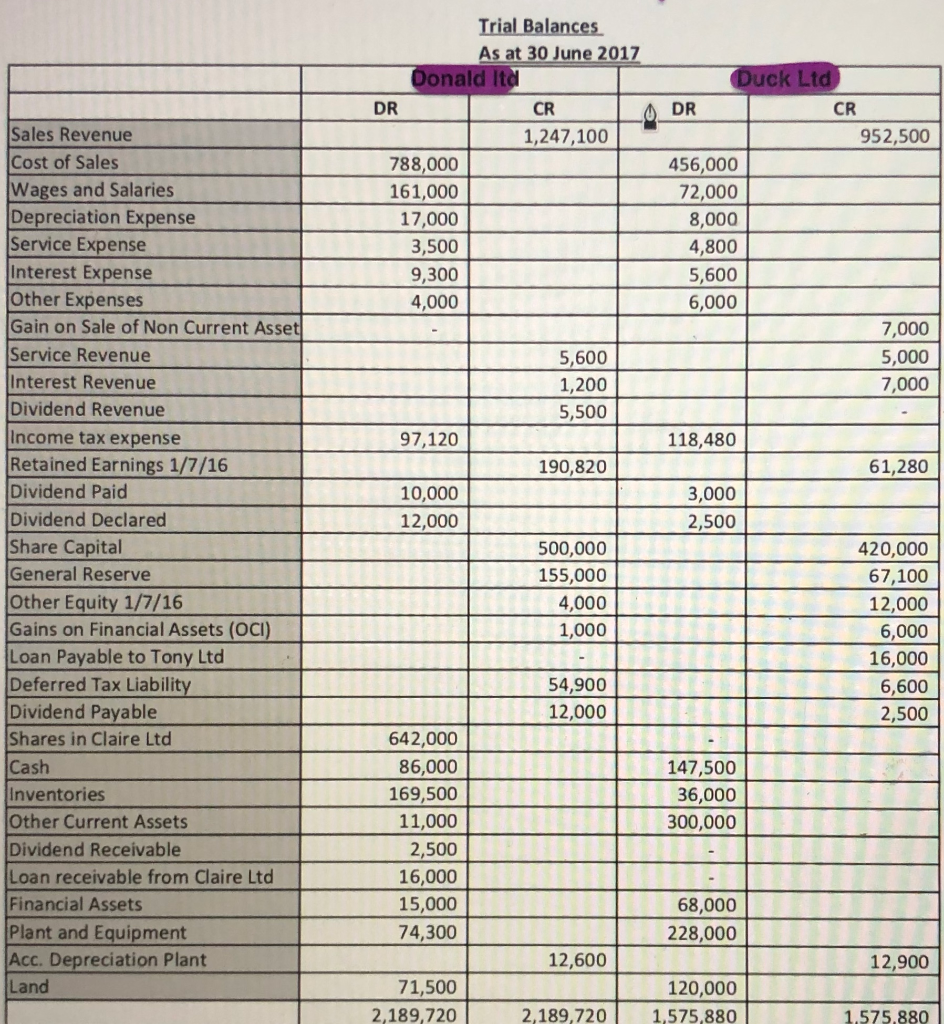

On 1 July 2013 Donald Ltd acquired all of the share capital (cum div) of Duck Limited for a consideration of $600,000 cash and a brand that was held in their accounts at a fair value of $50,000. Duck Ltd reported a dividend payable of $8,000 at 1 July 2013. At that date all the identifiable assets and liabilities were recorded at fair value with the exception of: The inventory was all sold by 30/6/14. The remaining useful life of the plant is 5 years. The accounts receivable were collected by 30/6/14 for $18,000. The land was sold on 30/12/16 for $90,000. The plant was on hand still at 30/6/17. At the date of acquisition the equity of Duck Ltd consisted of: Share capital 420000 General reserve 90000 Retained earnings 70000 Assume a tax rate of 30%. Required A. Prepare the acquisition analysis at 1 July 2013. B. Prepare the BCVR and pre-acquisition journal entries at 1 July 2013. C. Prepare the BCVR and pre-acquisition journal entries at 30 June 2017.

On 1 July 2013 Donald Ltd acquired all of the share capital (cum div) of Duck Limited for a consideration of $600,000 cash and a brand that was held in their accounts at a fair value of $50,000. Duck Ltd reported a dividend payable of $8,000 at 1 July 2013.

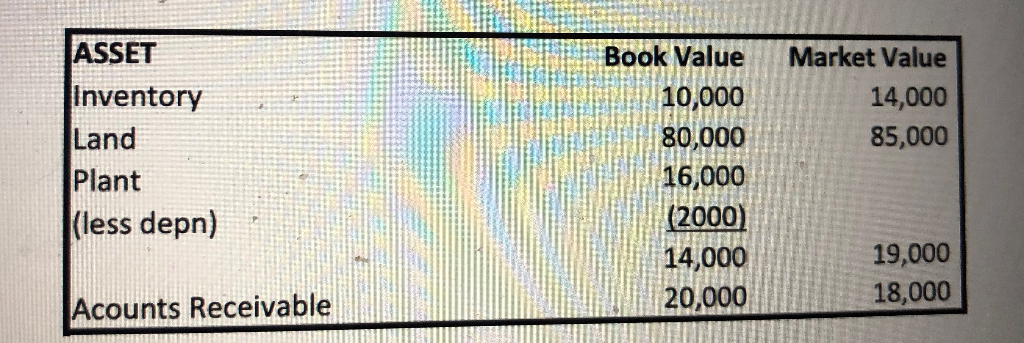

At that date all the identifiable assets and liabilities were recorded at fair value with the exception of:

The inventory was all sold by 30/6/14. The remaining useful life of the plant is 5 years. The

The land was sold on 30/12/16 for $90,000. The plant was on hand still at 30/6/17.

At the date of acquisition the equity of Duck Ltd consisted of:

Share capital 420000

General reserve 90000

Assume a tax rate of 30%.

Required

A. Prepare the acquisition analysis at 1 July 2013.

B. Prepare the BCVR and pre-acquisition

C. Prepare the BCVR and pre-acquisition journal entries at 30 June 2017.

Answer all the subparts A,B,C .if answered within 45 mins,it would be helpful!!I will upvote

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images