Please do show all your workings as well as the consolidated statement of financial position on the paper provided On 1 January 2014 Parent plc acquired 100% of the equity shares in Subsid plc for £72,000 to gain control. The retained earnings of the Subsid plc at 1 January 2014 were £9,600. The fair value of the land in Subsid plc was £3,000 above book value. During the year Parent plc sold some of its inventory to Subsid plc for £8,400, which represented cost plus a mark-up of 40%. Some of these goods, 80%, are still in the inventory of Subsid plc at 31 December 2014. The statements of financial position of the two companies as at 31 December 2014 are shown below. Parent plc Subsid plc 63,000 Non-Current Assets 50,000 Investment in Subsid plc 72,000 Current Assets Inventories 3,800 9,600 Parent Current Account 19,200 Other Current Assets 9,600 32,400 Current Liabilities Subsid. Current Account 19,200 15.000 7,800 Other Current Liabilities 25.000 7,600 Net Current Assets Net Assets 129.600 70,800 Equity Share Capital Retained Earnings 57,600 50,400 72,000 20,400 129.600 70.800 Required: Prepare a consolidated statement of financial position for Parent plc as at 31 December 2014.

Please do show all your workings as well as the consolidated statement of financial position on the paper provided On 1 January 2014 Parent plc acquired 100% of the equity shares in Subsid plc for £72,000 to gain control. The retained earnings of the Subsid plc at 1 January 2014 were £9,600. The fair value of the land in Subsid plc was £3,000 above book value. During the year Parent plc sold some of its inventory to Subsid plc for £8,400, which represented cost plus a mark-up of 40%. Some of these goods, 80%, are still in the inventory of Subsid plc at 31 December 2014. The statements of financial position of the two companies as at 31 December 2014 are shown below. Parent plc Subsid plc 63,000 Non-Current Assets 50,000 Investment in Subsid plc 72,000 Current Assets Inventories 3,800 9,600 Parent Current Account 19,200 Other Current Assets 9,600 32,400 Current Liabilities Subsid. Current Account 19,200 15.000 7,800 Other Current Liabilities 25.000 7,600 Net Current Assets Net Assets 129.600 70,800 Equity Share Capital Retained Earnings 57,600 50,400 72,000 20,400 129.600 70.800 Required: Prepare a consolidated statement of financial position for Parent plc as at 31 December 2014.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter8: Investing Activities

Section: Chapter Questions

Problem 23PC

Related questions

Question

Be sure to also add parent and subs columns aswell

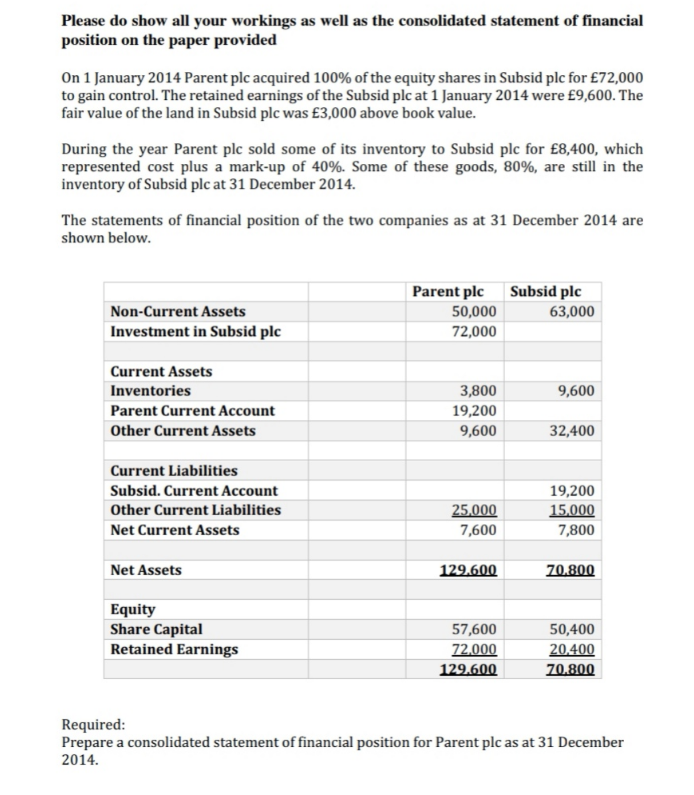

Transcribed Image Text:Please do show all your workings as well as the consolidated statement of financial

position on the paper provided

On 1 January 2014 Parent plc acquired 100% of the equity shares in Subsid plc for £72,000

to gain control. The retained earnings of the Subsid plc at 1 January 2014 were £9,600. The

fair value of the land in Subsid plc was £3,000 above book value.

During the year Parent plc sold some of its inventory to Subsid plc for £8,400, which

represented cost plus a mark-up of 40%. Some of these goods, 80%, are still in the

inventory of Subsid plc at 31 December 2014.

The statements of financial position of the two companies as at 31 December 2014 are

shown below.

Parent plc

Subsid plc

Non-Current Assets

50,000

63,000

Investment in Subsid plc

72,000

Current Assets

Inventories

3,800

9,600

Parent Current Account

19,200

Other Current Assets

9,600

32,400

Current Liabilities

Subsid. Current Account

19,200

Other Current Liabilities

25,000

7,600

15,000

7,800

Net Current Assets

Net Assets

129.600

70.800

Equity

Share Capital

Retained Earnings

57,600

50,400

72,000

20,400

129.600

Ζ0.800

Required:

Prepare a consolidated statement of financial position for Parent plc as at 31 December

2014.

Expert Solution

Consolidation

Consolidation refers to combining the financial statement of subsidiary company in the financial statement of holding company.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub