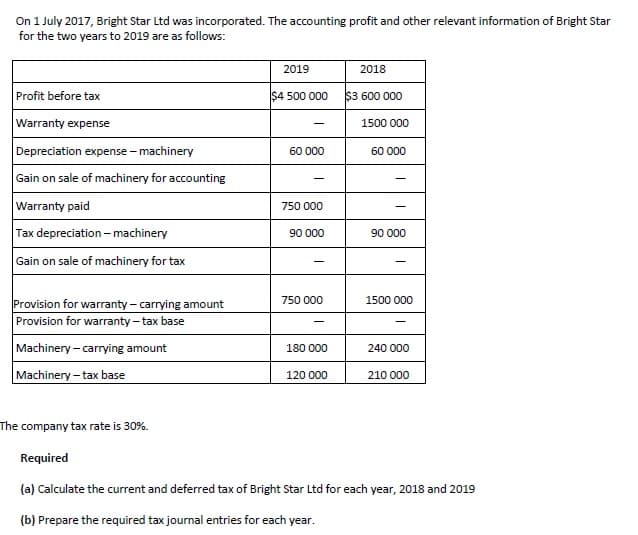

On 1 July 2017, Bright Star Ltd was incorporated. The accounting profit and other relevant information of Bright Star for the two years to 2019 are as follows: 2019 2018 Profit before tax $4 500 000 $3 600 000 Warranty expense 1500 000 Depreciation expense - machinery 60 000 60 000 Gain on sale of machinery for accounting Warranty paid Tax depreciation – machinery Gain on sale of machinery for tax 750 000 90 000 90 000 1500 000 Provision for warranty - carrying amount Provision for warranty-tax base Machinery- carrying amount 750 000 180 000 240 000 Machinery - tax base 120 000 210 000 ne company tax rate is 30%. Required (a) Calculate the current and deferred tax of Bright Star Ltd for each year, 2018 and 2019 (b) Prepare the required tax journal entries for each year.

On 1 July 2017, Bright Star Ltd was incorporated. The accounting profit and other relevant information of Bright Star for the two years to 2019 are as follows: 2019 2018 Profit before tax $4 500 000 $3 600 000 Warranty expense 1500 000 Depreciation expense - machinery 60 000 60 000 Gain on sale of machinery for accounting Warranty paid Tax depreciation – machinery Gain on sale of machinery for tax 750 000 90 000 90 000 1500 000 Provision for warranty - carrying amount Provision for warranty-tax base Machinery- carrying amount 750 000 180 000 240 000 Machinery - tax base 120 000 210 000 ne company tax rate is 30%. Required (a) Calculate the current and deferred tax of Bright Star Ltd for each year, 2018 and 2019 (b) Prepare the required tax journal entries for each year.

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 15DQ

Related questions

Question

CAn you please solve this question. the answer posted on your website has wrong answer. because the solution says Provision warranty paid $ 150,000.00 although in question the warranty paid is 1,500,000

Transcribed Image Text:On 1 July 2017, Bright Star Ltd was incorporated. The accounting profit and other relevant information of Bright Star

for the two years to 2019 are as follows:

2019

2018

Profit before tax

$4 500 000

$3 600 000

Warranty expense

1500 000

-

Depreciation expense - machinery

60 000

60 000

Gain on sale of machinery for accounting

Warranty paid

750 000

Tax depreciation - machinery

90 000

90 000

Gain on sale of machinery for tax

Provision for warranty - carrying amount

Provision for warranty - tax base

750 000

1500 000

Machinery - carrying amount

180 000

240 000

Machinery - tax base

120 000

210 000

The company tax rate is 30%.

Required

(a) Calculate the current and deferred tax of Bright Star Ltd for each year, 2018 and 2019

(b) Prepare the required tax journal entries for each year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning