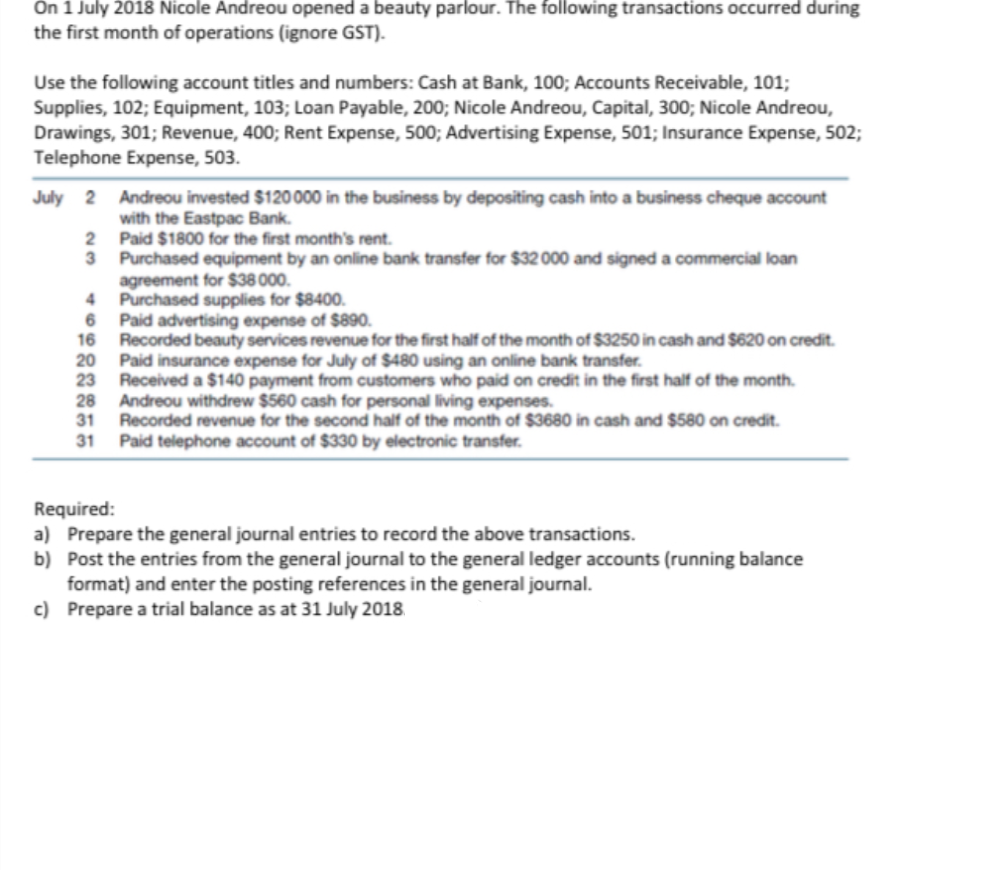

On 1 July 2018 Nicole Andreou opened a beauty parlour. The following transactions occurred during the first month of operations (ignore GST). Use the following account titles and numbers: Cash at Bank, 100; Accounts Receivable, 101; Supplies, 102; Equipment, 103; Loan Payable, 200; Nicole Andreou, Capital, 300; Nicole Andreou, Drawings, 301; Revenue, 400; Rent Expense, 500; Advertising Expense, 501; Insurance Expense, 502; Telephone Expense, 503. July 2 Andreou invested $120000 in the business by depositing cash into a business cheque account with the Eastpac Bank. Paid $1800 for the first month's rent. 3 Purchased equipment by an online bank transfer for $32 000 and signed a commercial loan agreement for $38 000. Purchased supplies for $8400. 6 Paid advertising expense of $890. 16 Recorded beauty services revenue for the first half of the month of $3250 in cash and $620 on credit. 20 Paid insurance expense for July of $480 using an online bank transfer. 23 Received a $140 payment from customers who paid on credit in the first half of the month. 28 Andreou withdrew $560 cash for personal living expenses. 31 Recorded revenue for the second half of the month of $3680 in cash and $580 on credit. 31 Paid telephone account of $330 by electronic transfer. Required: a) Prepare the general journal entries to record the above transactions. b) Post the entries from the general journal to the general ledger accounts (running balance format) and enter the posting references in the general journal. c) Prepare a trial balance as at 31 July 2018

On 1 July 2018 Nicole Andreou opened a beauty parlour. The following transactions occurred during the first month of operations (ignore GST). Use the following account titles and numbers: Cash at Bank, 100; Accounts Receivable, 101; Supplies, 102; Equipment, 103; Loan Payable, 200; Nicole Andreou, Capital, 300; Nicole Andreou, Drawings, 301; Revenue, 400; Rent Expense, 500; Advertising Expense, 501; Insurance Expense, 502; Telephone Expense, 503. July 2 Andreou invested $120000 in the business by depositing cash into a business cheque account with the Eastpac Bank. Paid $1800 for the first month's rent. 3 Purchased equipment by an online bank transfer for $32 000 and signed a commercial loan agreement for $38 000. Purchased supplies for $8400. 6 Paid advertising expense of $890. 16 Recorded beauty services revenue for the first half of the month of $3250 in cash and $620 on credit. 20 Paid insurance expense for July of $480 using an online bank transfer. 23 Received a $140 payment from customers who paid on credit in the first half of the month. 28 Andreou withdrew $560 cash for personal living expenses. 31 Recorded revenue for the second half of the month of $3680 in cash and $580 on credit. 31 Paid telephone account of $330 by electronic transfer. Required: a) Prepare the general journal entries to record the above transactions. b) Post the entries from the general journal to the general ledger accounts (running balance format) and enter the posting references in the general journal. c) Prepare a trial balance as at 31 July 2018

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter2: T Accounts, Debits And Credits, Trial Balance, And Financial Statements

Section: Chapter Questions

Problem 1PB: During February of this year, H. Rose established Rose Shoe Hospital. The following asset,...

Related questions

Question

Transcribed Image Text:On 1 July 2018 Nicole Andreou opened a beauty parlour. The following transactions occurred during

the first month of operations (ignore GST).

Use the following account titles and numbers: Cash at Bank, 100; Accounts Receivable, 101;

Supplies, 102; Equipment, 103; Loan Payable, 200; Nicole Andreou, Capital, 300; Nicole Andreou,

Drawings, 301; Revenue, 400; Rent Expense, 500; Advertising Expense, 501; Insurance Expense, 502;

Telephone Expense, 503.

July 2

Andreou invested $120000 in the business by depositing cash into a business cheque account

with the Eastpac Bank.

Paid $1800 for the first month's rent.

3 Purchased equipment by an online bank transfer for $32 000 and signed a commercial loan

agreement for $38 000.

Purchased supplies for $8400.

6 Paid advertising expense of $890.

16

Recorded beauty services revenue for the first half of the month of $3250 in cash and $620 on credit.

20

Paid insurance expense for July of $480 using an online bank transfer.

23

Received a $140 payment from customers who paid on credit in the first half of the month.

28 Andreou withdrew $560 cash for personal living expenses.

31

Recorded revenue for the second half of the month of $3680 in cash and $580 on credit.

31

Paid telephone account of $330 by electronic transfer.

Required:

a) Prepare the general journal entries to record the above transactions.

b) Post the entries from the general journal to the general ledger accounts (running balance

format) and enter the posting references in the general journal.

c) Prepare a trial balance as at 31 July 2018

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning