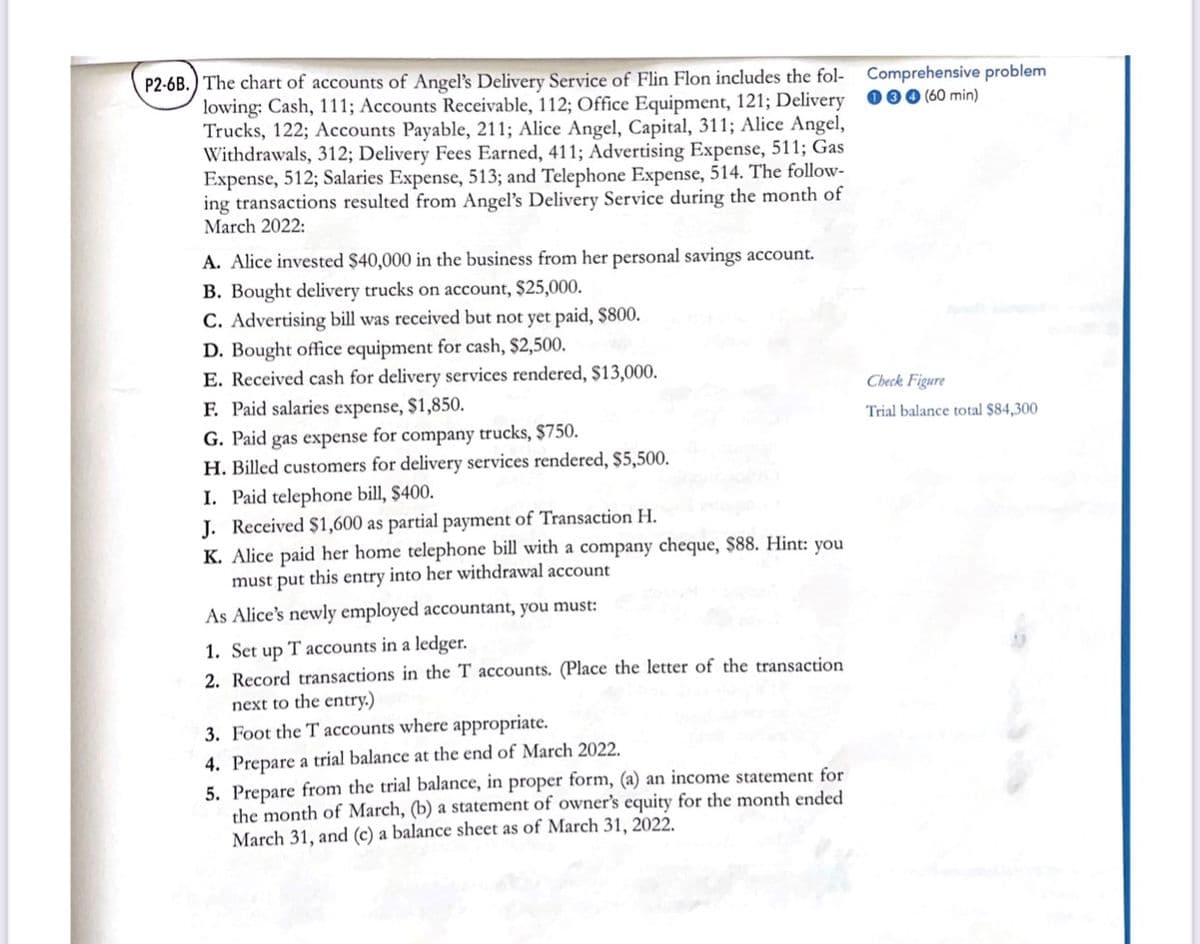

The chart of accounts of Angel's Delivery Service of Flin Flon includes the fol- lowing: Cash, 111; Accounts Receivable, 112; Office Equipment, 121; Delivery Trucks, 122; Accounts Payable, 211; Alice Angel, Capital, 311; Alice Angel, Withdrawals, 312; Delivery Fees Earned, 411; Advertising Expense, 511; Gas Expense, 512; Salaries Expense, 513; and Telephone Expense, 514. The follow- ing transactions resulted from Angel's Delivery Service during the month of March 2022: A. Alice invested $40,000 in the business from her personal savings account. B. Bought delivery trucks on account, $25,000. C. Advertising bill was received but not yet paid, $800. D. Bought office equipment for cash, $2,500. E. Received cash for delivery services rendered, $13,000. F. Paid salaries expense, $1,850. G. Paid gas expense for company trucks, $750. H. Billed customers for delivery services rendered, $5,500. I. Paid telephone bill, $400. J. Received $1,600 as partial payment of Transaction H. K. Alice paid her home telephone bill with a company cheque, $88. Hint: you must put this entry into her withdrawal account As Alice's newly employed accountant, you must: 1. Set up T accounts in a ledger. 2. Record transactions in the T accounts. (Place the letter of the transaction next to the entry.) 3. Foot the T accounts where appropriate. 4. Prepare a trial balance at the end of March 2022. 5. Prepare from the trial balance, in proper form, (a) an income statement for the month of March, (b) a statement of owner's equity for the month ended March 31, and (c) a balance sheet as of March 31, 2022. Che Tria

The chart of accounts of Angel's Delivery Service of Flin Flon includes the fol- lowing: Cash, 111; Accounts Receivable, 112; Office Equipment, 121; Delivery Trucks, 122; Accounts Payable, 211; Alice Angel, Capital, 311; Alice Angel, Withdrawals, 312; Delivery Fees Earned, 411; Advertising Expense, 511; Gas Expense, 512; Salaries Expense, 513; and Telephone Expense, 514. The follow- ing transactions resulted from Angel's Delivery Service during the month of March 2022: A. Alice invested $40,000 in the business from her personal savings account. B. Bought delivery trucks on account, $25,000. C. Advertising bill was received but not yet paid, $800. D. Bought office equipment for cash, $2,500. E. Received cash for delivery services rendered, $13,000. F. Paid salaries expense, $1,850. G. Paid gas expense for company trucks, $750. H. Billed customers for delivery services rendered, $5,500. I. Paid telephone bill, $400. J. Received $1,600 as partial payment of Transaction H. K. Alice paid her home telephone bill with a company cheque, $88. Hint: you must put this entry into her withdrawal account As Alice's newly employed accountant, you must: 1. Set up T accounts in a ledger. 2. Record transactions in the T accounts. (Place the letter of the transaction next to the entry.) 3. Foot the T accounts where appropriate. 4. Prepare a trial balance at the end of March 2022. 5. Prepare from the trial balance, in proper form, (a) an income statement for the month of March, (b) a statement of owner's equity for the month ended March 31, and (c) a balance sheet as of March 31, 2022. Che Tria

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 3BE: Transactions Interstate Delivery Service is owned and operated by Katie Wyer. The following selected...

Related questions

Question

PLEASE DO QUESTIONS 4-5

Transcribed Image Text:P2-6B.) The chart of accounts of Angel's Delivery Service of Flin Flon includes the fol-

lowing: Cash, 111; Accounts Receivable, 112; Office Equipment, 121; Delivery

Trucks, 122; Accounts Payable, 211; Alice Angel, Capital, 311; Alice Angel,

Withdrawals, 312; Delivery Fees Earned, 411; Advertising Expense, 511; Gas

Expense, 512; Salaries Expense, 513; and Telephone Expense, 514. The follow-

ing transactions resulted from Angel's Delivery Service during the month of

March 2022:

A. Alice invested $40,000 in the business from her personal savings account.

B. Bought delivery trucks on account, $25,000.

C. Advertising bill was received but not yet paid, $800.

D. Bought office equipment for cash, $2,500.

E. Received cash for delivery services rendered, $13,000.

F. Paid salaries expense, $1,850.

G. Paid gas expense for company trucks, $750.

H. Billed customers for delivery services rendered, $5,500.

I. Paid telephone bill, $400.

J. Received $1,600 as partial payment of Transaction H.

K. Alice paid her home telephone bill with a company cheque, $88. Hint: you

must put this entry into her withdrawal account

As Alice's newly employed accountant, you must:

1. Set up T accounts in a ledger.

2. Record transactions in the T accounts. (Place the letter of the transaction

next to the entry.)

3. Foot the T accounts where appropriate.

4. Prepare a trial balance at the end of March 2022.

5. Prepare from the trial balance, in proper form, (a) an income statement for

the month of March, (b) a statement of owner's equity for the month ended

March 31, and (c) a balance sheet as of March 31, 2022.

Comprehensive problem

000 (60 min)

Check Figure

Trial balance total $84,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning