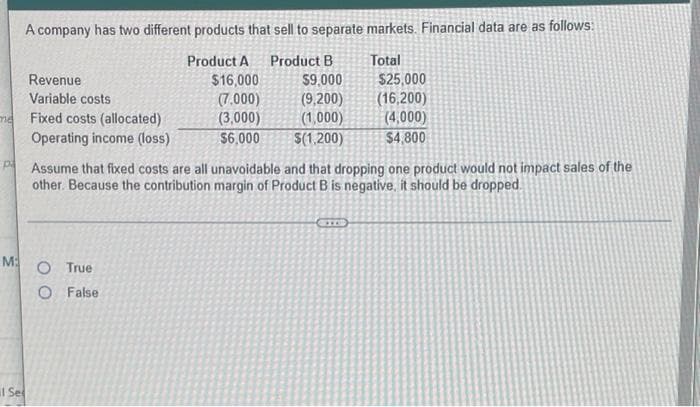

A company has two different products that sell to separate markets. Financial data are as follows: Product A Product B Total Revenue $16,000 $9,000 $25,000 Variable costs Fixed costs (allocated) Operating income (loss) (7.000) (3,000) $6,000 (9,200) (1,000) S(1,200) (16,200) (4,000) $4,800 me Assume that fixed costs are all unavoidable and that dropping one product would not impact sales of the other. Because the contribution margin of Product B is negative, it should be dropped. M: O True O False il Se

A company has two different products that sell to separate markets. Financial data are as follows: Product A Product B Total Revenue $16,000 $9,000 $25,000 Variable costs Fixed costs (allocated) Operating income (loss) (7.000) (3,000) $6,000 (9,200) (1,000) S(1,200) (16,200) (4,000) $4,800 me Assume that fixed costs are all unavoidable and that dropping one product would not impact sales of the other. Because the contribution margin of Product B is negative, it should be dropped. M: O True O False il Se

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 1SEQ: Mario Company is considering discontinuing a product. The costs of the product consist of $20,000...

Related questions

Question

100%

Please Solve In 20mins

Transcribed Image Text:A company has two different products that sell to separate markets. Financial data are as follows:

Product A

Product B

Total

Revenue

$16,000

$9,000

$25,000

Variable costs

Fixed costs (allocated)

Operating income (loss)

(7.000)

(3,000)

$6,000

(9,200)

(1,000)

S(1,200)

(16,200)

(4,000)

me

$4,800

Assume that fixed costs are all unavoidable and that dropping one product would not impact sales of the

other. Because the contribution margin of Product B is negative, it should be dropped.

M:

O True

O False

il Se

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College