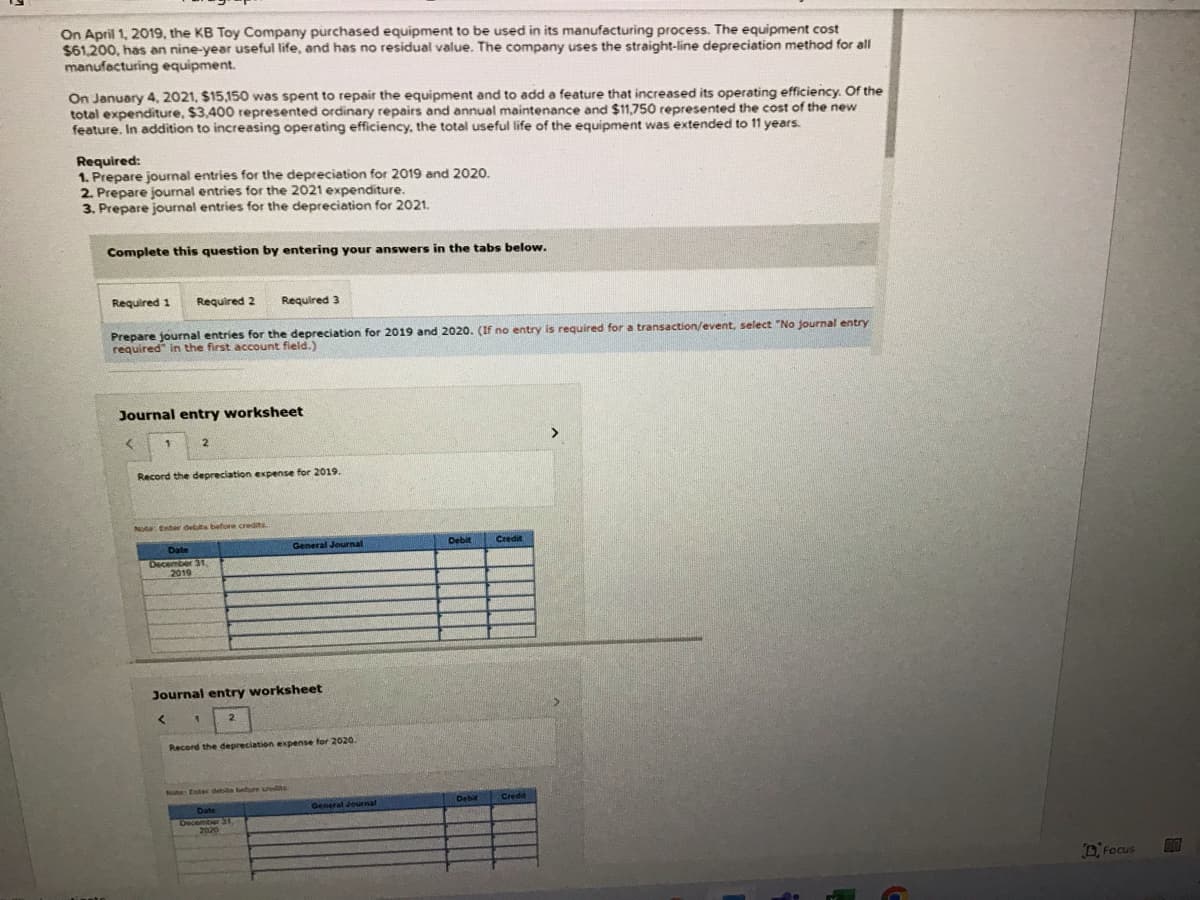

On April 1, 2019, the KB Toy Company purchased equipment to be used in its manufacturing process. The equipment cost $61,200, has an nine-year useful life, and has no residual value. The company uses the straight-line depreciation method for all manufecturing equipment. On January 4, 2021, $15,150 was spent to repair the equipment and to add a feature that increased its operating efficiency. Of the total expenditure, $3,400 represented ordinary repairs and annual maintenance and $11,750 represented the cost of the new feature. In addition to increasing operating efficiency, the total useful life of the equipment was extended to 11 years. Required: 1. Prepare journal entries for the depreciation for 2019 and 2020. 2. Prepare journal entries for the 2021 expenditure. 3. Prepare journal entries for the depreciation for 2021. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare journal entries for the depreciation for 2019 and 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) cheet

On April 1, 2019, the KB Toy Company purchased equipment to be used in its manufacturing process. The equipment cost $61,200, has an nine-year useful life, and has no residual value. The company uses the straight-line depreciation method for all manufecturing equipment. On January 4, 2021, $15,150 was spent to repair the equipment and to add a feature that increased its operating efficiency. Of the total expenditure, $3,400 represented ordinary repairs and annual maintenance and $11,750 represented the cost of the new feature. In addition to increasing operating efficiency, the total useful life of the equipment was extended to 11 years. Required: 1. Prepare journal entries for the depreciation for 2019 and 2020. 2. Prepare journal entries for the 2021 expenditure. 3. Prepare journal entries for the depreciation for 2021. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare journal entries for the depreciation for 2019 and 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) cheet

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11E: On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an...

Related questions

Question

Transcribed Image Text:On April 1, 2019, the KB Toy Company purchased equipment to be used in its manufacturing process. The equipment cost

$61,200, has an nine-year useful life, and has no residual value. The company uses the straight-line depreciation method for all

manufecturing equipment.

On January 4, 2021, $15,150 was spent to repair the equipment and to add a feature that increased its operating efficiency. Of the

total expenditure, $3,400 represented ordinary repairs and annual maintenance and $11,750 represented the cost of the new

feature. In addition to increasing operating efficiency, the total useful life of the equipment was extended to 11 years.

Required:

1. Prepare journal entries for the depreciation for 2019 and 2020.

2. Prepare journal entries for the 2021 expenditure.

3. Prepare journal entries for the depreciation for 2021.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Prepare journal entries for the depreciation for 2019 and 2020. (If no entry is required for a transaction/event, select "No journal entry

required" in the first account field.)

Journal entry worksheet

2.

>

Record the depreciation expense for 2019.

Na Eater debts before credits

Date

General Journal

Debit

Credit

Dscember231.

2019

Journal entry worksheet

Record the depreciation expense for 202o.

te Enter detts befure uedits

Date

General Journal

2020

DFocus

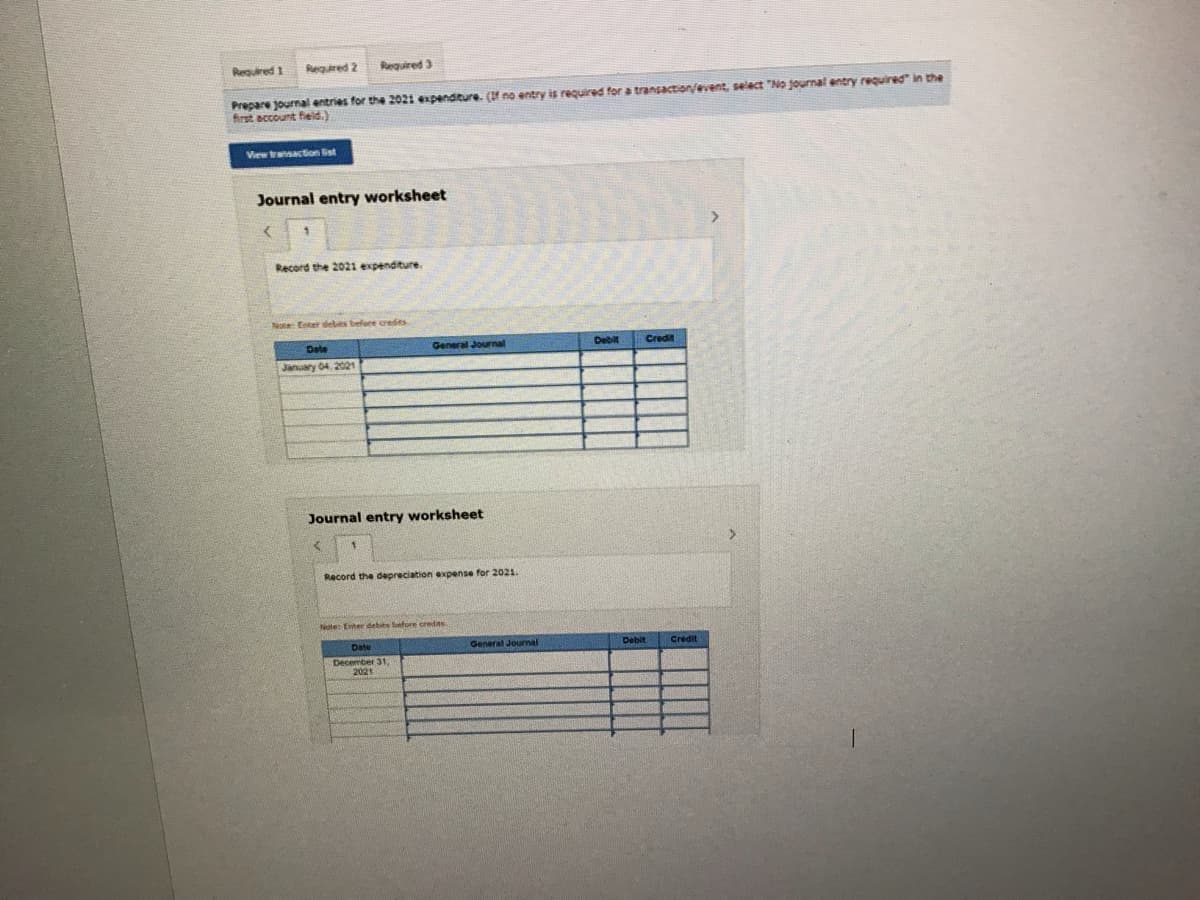

Transcribed Image Text:Reguired 1

Required 2

Required 3

Prepare journal entries for the 2021 expenditure. (f no entry is required for a transaction/event, select "No journal entry required" in the

first account field.)

View transaction Bist

Journal entry worksheet

Record the 2021 expenditure.

Noe Enter debts befare credits

Date

General Journal

Debit

Credit

January 04, 2021

Journal entry worksheet

Record the depreciation expense for 2021.

Note Enter debits betore credias

Date

General Journal

Debit

Credit

December 31,

2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT