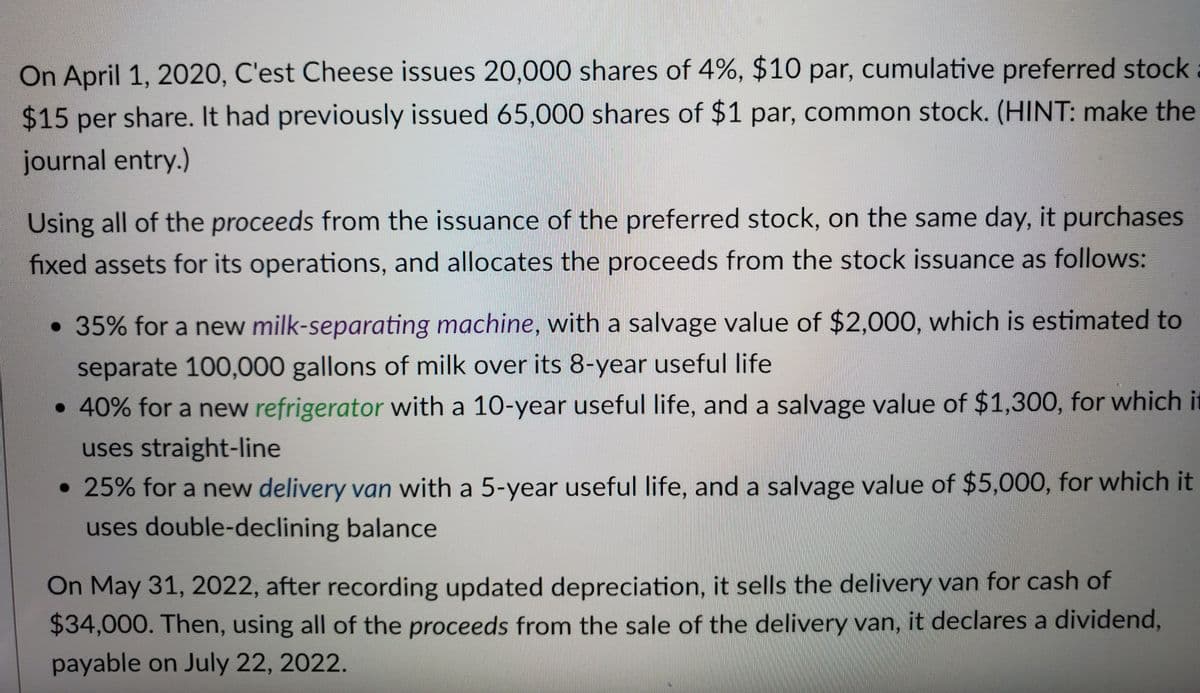

On April 1, 2020, C'est Cheese issues 20,000 shares of 4%, $10 par, cumulative preferred stock $15 per share. It had previously issued 65,000 shares of $1 par, common stock. (HINT: make the journal entry.) Using all of the proceeds from the issuance of the preferred stock, on the same day, it purchases fixed assets for its operations, and allocates the proceeds from the stock issuance as follows: • 35% for a new milk-separating machine, with a salvage value of $2,000, which is estimated to separate 100,000 gallons of milk over its 8-year useful life • 40% for a new refrigerator with a 10-year useful life, and a salvage value of $1,300, for which i uses straight-line • 25% for a new delivery van with a 5-year useful life, and a salvage value of $5,000, for which it uses double-declining balance On May 31, 2022, after recording updated depreciation, it sells the delivery van for cash of $34,000. Then, using all of the proceeds from the sale of the delivery van, it declares a dividend, payable on July 22, 2022.

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

1.If the milk-separating machine processes 10,400 gallons of milk in 2022, What is the balance in

Step by step

Solved in 2 steps with 6 images