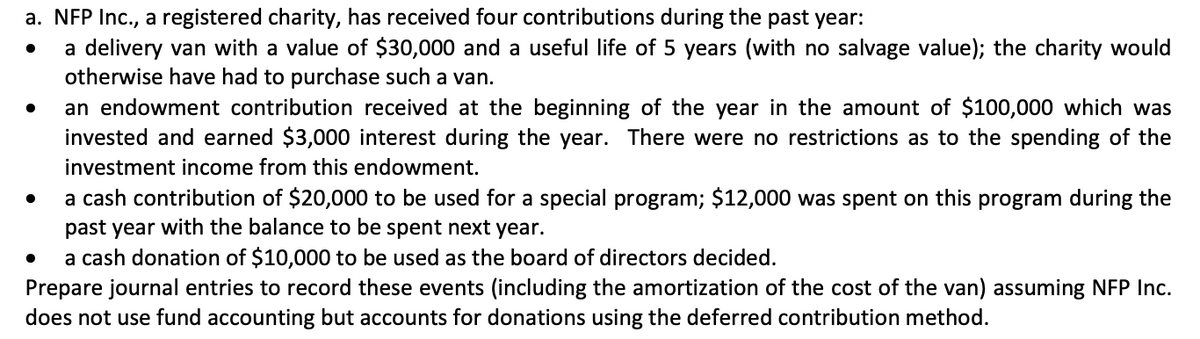

Prepare journal entries to record these events (including the amortization of the cost of the van) assuming NFP Inc. does not use fund accounting but accounts for donations using the deferred contribution method.

Q: Challenger Factory produces two similar products: regular widgets and deluxe widgets. The total…

A: As per the information given in the question a single plant wide factory overhead rate based on…

Q: On January 1, Mitzu Company pays a lump-sum amount of $2,600,000 for land, Building 1, Building 2,…

A: The fixed assets if the business include land, building, etc. The costs incurred such as demolish of…

Q: The following information relates to Wilson, Inc.’s equipment lease with an inception date of…

A: Lease liability is the amount of obligation that has arisen from the leased asset. In a lease…

Q: ABC Inc. agreed with DEF Corp. a franchise agreement that allows DEF the right to access an online…

A:

Q: When budgeting, how do we go about figuring out what our costs are for the coming year?

A: A budget is a schedule that shows estimated revenues and expenses for a specific future period.…

Q: On June 30, Pronghorn Corp discontinued its operations in Mexico. During the year, the operating…

A: Income statement is one of the financial statements. It is prepared to depict the profitability…

Q: Make accounting entries for following perpetual inventory transaction Jan17,2018 business received…

A: In the given case, the money received in full from debtor. it doesn't involve any inventory.

Q: Blue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single…

A: Overhead expenses are those expenses which are indirect expenses and not directly relateable to the…

Q: mpany P has the following inventory information: Date cember 31, 2021 cember 31, 2022 B. $112,884 C.…

A: LIFO stands for Last In First Out. Dollar value LIFO method is method of inventory valuation where…

Q: National Quality Paint Inc. (NQPI) produces paints in Geelong, Victoria. The accountant has…

A: Sales budget is one of the important budget which shows estimated sales units with expected sales…

Q: Integrity Company is a publicly held company whose shares are traded in the over-the-counter market.…

A:

Q: Jan1, 2018 business purchased $3200 of inventory from MCA inc. Paid in cash

A: Journal entries are passed to record transaction in books of accounts and summaries the same after a…

Q: Martinez Co. borrowed $69,569 on March 1 of the current year by signing a 60-day, 7%,…

A: From March 1 to April 30 = 60 days Interest is paid on the funds used by the business to generate…

Q: The City of Portland has the following budget data for one of its Special Revenue Funds for the…

A: Answer:- Journal entry meaning:- A journal entry is done to maintain or produce records of any…

Q: Ace Hardware is adding a new product line that will require an investment of $1,454,000. Managers…

A: Calculation of Accounting rate of return(ARR):- Accounting rate of return(ARR) = 13.15%…

Q: What is involved in the legal requirements of financial governance? Select an answer: having a…

A: According to the given question, we are required to find out the correct option from the available…

Q: On January 6, Year 1, Mount Jackson Corporation purchased a tract of land for a factory site for…

A: The capitalization cost of land includes the cost of demolition of the building, real estate, and…

Q: 4. Explain how interest income is deemed to be derived from Malaysia under the Income Tax Act 1967.

A: The sum of interest generated over a given time period is known as interest income. It can be…

Q: An asset was purchased three years ago at a cost of P5,000. It was estimated to have a useful life…

A: Straight-line method- Depreciation expense remains constant in this method throughout an asset's…

Q: Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority…

A: Since the manager of the club is able to increase sales by $72,000 and net operating income…

Q: supplies adirance aid equipme lated depreciation store equipment s payable id Capital a returns and…

A: The closing entries are prepared at year-end to close the temporary accounts of the business. The…

Q: Lucia Company has set the following standard cost per unit for direct materials and direct labor.…

A: The variance is calculated by comparing the actual cost with the standard cost . If the actual cost…

Q: ted data for the fourth quarter of 2021. Sales are forecasted to be 60,000 cans at a price of $40…

A: Direct material purchase budget and Direct labour budget calculates the cost of material and…

Q: The following information relates to production activities of Mercer Manufacturing for the year.…

A: When the standard costs are compared with the actual costs there occurs either a favorable or…

Q: 10-2 (Algo) Reporting Bonds Issued at Par LO 10-2 The following information applies to the questions…

A: Price of bond is the present value of coupon payment and present value of par value of bond taken on…

Q: Test Company uses a normal, process costing system to determine product cost. The company uses the…

A: The process costing can be defined as costing of products processed in their respective departments.…

Q: 2. Record employer payroll taxes.

A: Payroll Tax :— It is the tax that is levied on payroll of the employers.

Q: Fogel Company expects to produce and sell 111,000 units for the period. The company’s flexible…

A: The flexible budget is prepared on the basis of estimated costs for the period. The controllable…

Q: Jan1,2018 business purchased $3200 of inventory from MCA inc. Paid in cash

A: The journal keeps the record of business transactions on daily basis. The assets and expenses are…

Q: On October 20, 2021, ABC Co. consigned 40 freezers in Holden Co. for sale P1,000 each and paid P800…

A: Consignor will recognition revenue when the goods will sold by consignee to customer. Revenue won't…

Q: XYZ Corporation has a lower and an upper limit for its savings account at P40,000 and P70,000…

A: Additional funds refers to the concept where the business or person looks to expand the operations…

Q: Privett Company Accounts payable Accounts receivable Accrued liabilities Cash $36,632 72,986 6,134…

A: Quick assets can be converted into cash quickly. Inventory and prepaid expenses are current assets…

Q: Alejandro Kirk

A: The main advantage of using the ABC method is its impact on profitability, it helps in improving…

Q: In 20x1, ABC Co. enters into a contract to construct a building for a customer. ABC identifies its…

A: The profit for contract is calculated as revenue recognized during the year and costs incurred…

Q: Integrity Company computed a pre-tax financial income of P2,200,000 for its first year of operations…

A: According to the given question, we are required to compute the total income tax expense in 2021.…

Q: 3 FYE Dec Cash & Cash Equivalents 5 Loans Held For Sale - Other 6 Loans Held for Sale Allowance for…

A: According to the given question, we are going to determine the total current asset for capital from…

Q: On June 1, one company collected total subscriptions of $22,800 in which they promise to deliver of…

A: From June 1 to December 31 = 7 months Subscription revenue has been earned for 7 months and remains…

Q: Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare…

A: Lump-sum asset purchase refers to the purchase of different class of assets like plant, equipment,…

Q: On December 1, 20x4, ABC Co enters into a contract to deliver 10 cars to XYZ company which is to be…

A: As per the provision of PFRS 115 Revenue from contracts with customer. Revenue can be recognize as…

Q: Determine the amount of accounts receivable reported on the company’s budgeted balance sheet as of…

A: Sales Budget is prepared by the Business Entities to estimate the sales required to achieve the…

Q: The payroll register of Sara Company indicates $5,850 of social security tax withheld and $1,600 of…

A: Introduction: Payroll tax expense account is indeed the holding account used to keep track of the…

Q: Assuming no other transactions occured, what would be the total revenues? Retained earnings as of…

A: Revenues are added to the beginning retained earnings and expenses and dividends are deducted to…

Q: Starbright manufactures child car seats, strollers, and baby swings. Starbright's manufacturing…

A: Introduction: In the manufacturing industry, setup cost is the cost of preparing equipment to…

Q: A building with an appraisal value of $133,629 is made available at an offer price of $158,926. The…

A: The cost basis recorded in the buyer's accounting records to recognize this purchase is $111820…

Q: Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the…

A: Depreciation represents the reduction in the value of an asset over a useful life of the asset. It…

Q: Rodriguez Company pays $326,430 for real estate with land, land improvements, and a building. Land…

A: Introduction: A journal entry records a business transaction in the accounting system of an…

Q: entity, a contractor, enters into a contract to build a hospital r a customer. The entity is…

A: in case of the construction contact it is paramount in order to be calculate the estimated sales…

Q: K Luigi's Restaurant offers a "buy one dinner get the other dinner for half price sale. The "half…

A: Markdown is the amount of discount is given from original price. Mark down ℅ is (Original selling…

Q: For the following question, reconcile the bank statement and check register. Would they need to make…

A: Lets understand the basics. Bank reconciliation is need to prepare to calculate the difference and…

Q: giver have the following information: He has total agriculture productions valued at market value of…

A: In Islam there is concepts of Zakat that means you need to pay some part of income as Zakat to help…

Step by step

Solved in 2 steps

- A private not-for-profit entity is working to create a cure for a deadly disease. The charity starts the year with cash of $709,000. Of this amount, unrestricted net assets total $403,000, temporaril restricted net assets total $203,000, and permanenetly restricted net assets total $103,000. Within the temporarily restricted net assets, the entity must use 80 percent for equipment and the rest for salaries . No implied time restriction has been designated for the equipment when purchased. For the permanently restricted net assets, 70 percent of resulting income must be used to cover the purchase of advertising for fund-raising purposes and the rest is unrestricted. During the current year, the organization has the following transactions: 1. Received unrestricted cash gifts of $213,000. 2. Paid salaries of $83,000 with $23,000 of that amount coming from restricted funds. Of the total salaries, 40 percent is for administrative personnel and the remainder is evenly divided among…A private not-for-profit entity is working to create a cure for a deadly disease. The charity starts the year with cash of $700,000. Of this amount, unrestricted net assets total $400,000, temporarily restricted net assets total $200,000, and permanently restricted net assets total $100,000. Within the temporarily restricted net assets, the entity must use 80 percent for equipment and the rest for salaries. No implied time restriction has been designated for the equipment when purchased. For the permanently restricted net assets, 70 percent of resulting income must be used to cover the purchase of advertising for fund-raising purposes and the rest is unrestricted.During the current year, the organization has the following transactions:∙ Received unrestricted cash gifts of $210,000.∙ Paid salaries of $80,000 with $20,000 of that amount coming from restricted funds. Of the total salaries, 40 percent is for administrative personnel and the remainder is evenly divided among individuals…Maple Corp. owns several pieces of highly valued paintings that are on display in the corporation's headquarters. This year, it donated one of the paintings valued at $100,000 (adjusted basis of $25,000) to a local museum for the museum to display. b. What would be Maple's deduction if the museum sold the painting one month after it received it from Maple? Charitable contribution deduction

- A private not-for-profit entity receives two gifts. One is $80,000 and is restricted for paying salaries of teachers who help children learn to read. The other is $110,000, which is restricted for purchasing playground equipment. Both amounts are properly spent by the end of this year. Because the purchase of the playground equipment was made at the end of the year, the organization records no depreciation this period. It has elected to view the equipment as having a time restriction. On the statement of activities, what is reported for unrestricted net assets? An increase of $80,000 and a decrease of $80,000. An increase of $190,000 and a decrease of $190,000. An increase of $190,000 and a decrease of $80,000. An increase of $80,000 and no decrease.A private not-for-profit entity receives two gifts. One is $80,000 and is restricted for paying salaries of teachers who help children learn to read. The other is $110,000, which is restricted for purchasing playground equipment. Both amounts are properly spent by the end of this year. Because the purchase of the playground equipment was made at the end of the year, the organization records no depreciation this period. It has elected to view the equipment as having a time restriction. On the statement of activities, what is reported for unrestricted net assets?a. An increase of $80,000 and a decrease of $80,000.b. An increase of $190,000 and a decrease of $190,000.c. An increase of $190,000 and a decrease of $80,000.d. An increase of $80,000 and no decreaseThe Watson Foundation, a private not-for-profit entity, starts 2017 with cash of $100,000; contributions receivable (net) of $200,000; investments of $300,000; and land, buildings, and equipment of $200,000. In addition, its unrestricted net assets were $400,000, temporarily restricted net assets were $100,000, and permanently restricted net assets were $300,000. Of the temporarily restricted net assets, 50 percent must be used to help pay for a new building; the remainder is restricted for salaries. No implied time restriction was designated for the building when purchased. For the permanently restricted net assets, all income is unrestricted.During the current year, the entity has the following transactions:∙ Computed interest of $20,000 on the contributions receivable.∙ Received cash of $100,000 on the contributions and wrote off another $4,000 as uncollectible.∙ Received unrestricted cash gifts of $180,000.∙ Paid salaries of $90,000 with $15,000 of that amount coming from…

- The Watson Foundation, a private not-for-profit entity, starts 2017 with cash of $100,000; contributions receivable (net) of $200,000; investments of $300,000; and land, buildings, and equipment of $200,000. In addition, its unrestricted net assets were $400,000, temporarily restricted net assets were $100,000, and permanently restricted net assets were $300,000. Of the temporarily restricted net assets, 50 percent must be used to help pay for a new building; the remainder is restricted for salaries. No implied time restriction was designated for the building when purchased. For the permanently restricted net assets, all income is unrestricted. During the current year, the entity has the following transactions: Computed interest of $20,000 on the contributions receivable. Received cash of $100,000 on the contributions and wrote off another $4,000 as uncollectible. Received unrestricted cash gifts of $180,000. Paid salaries of $90,000 with $15,000 of that amount coming from…Aquamarine Corporation, a calendar year C corporation, makes the following donations to qualified charitable organizations during the current year: Adjusted Basis Fair Market Value Painting held four years as an investment, to a church, which sold it immediately $6,000 $10,000 Apple stock held two years as an investment, to United Way, which sold it immediately 15,750 35,000 Canned groceries held one month as inventory, to Catholic Meals for the Poor 2,520 4,200 Determine the amount of Aquamarine Corporation's charitable deduction for the current year. (Ignore the taxable income limitation.) Painting: The amount of the contribution is . Stock: The amount of the contribution is . Groceries: The amount of the contribution is . Therefore, the total charitable contribution is $fill in the blank 4. Feedback Area please do not provide solution in image format thank you!Good Charity is a new not-for-profit organization that opened in January 2020. It is funded by government grants and private donations. It prepares its annual financial statements using the deferral method of accounting for contributions and uses only one fund to account for all activities. Required: 1) Prepare all related journal entries for the following transactions for Good Charity for 2020: a) Jan 1: a donor contributes land for a future operations site. Land has a fair value of $32,000. b) Feb 1: A donor contributes $60,000 on the condition that the principal amount be invested in marketable securities and that only the income earned from the investment be spent on operations. Income of $2,000 was earned and received during 2020 on these investments. c) General donations of $85,000 were received during 2020. d) Feb 1: the government gave $80,000 to Good Charity to purchase equipment and furniture with a useful life of 10 years. This was all used to…