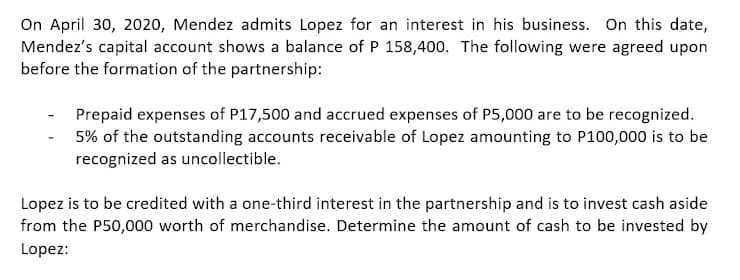

On April 30, 2020, Mendez admits Lopez for an interest in his business. On this date, Mendez's capital account shows a balance of P 158,400. The following were agreed upon before the formation of the partnership: Prepaid expenses of P17,500 and accrued expenses of P5,000 are to be recognized. 5% of the outstanding accounts receivable of Lopez amounting to P100,000 is to be recognized as uncollectible. Lopez is to be credited with a one-third interest in the partnership and is to invest cash aside from the P50,000 worth of merchandise. Determine the amount of cash to be invested by Lopez:

On April 30, 2020, Mendez admits Lopez for an interest in his business. On this date, Mendez's capital account shows a balance of P 158,400. The following were agreed upon before the formation of the partnership: Prepaid expenses of P17,500 and accrued expenses of P5,000 are to be recognized. 5% of the outstanding accounts receivable of Lopez amounting to P100,000 is to be recognized as uncollectible. Lopez is to be credited with a one-third interest in the partnership and is to invest cash aside from the P50,000 worth of merchandise. Determine the amount of cash to be invested by Lopez:

Chapter11: Invest Or Losses

Section: Chapter Questions

Problem 38P

Related questions

Question

Transcribed Image Text:On April 30, 2020, Mendez admits Lopez for an interest in his business. On this date,

Mendez's capital account shows a balance of P 158,400. The following were agreed upon

before the formation of the partnership:

Prepaid expenses of P17,500 and accrued expenses of P5,000 are to be recognized.

5% of the outstanding accounts receivable of Lopez amounting to P100,000 is to be

recognized as uncollectible.

Lopez is to be credited with a one-third interest in the partnership and is to invest cash aside

from the P50,000 worth of merchandise. Determine the amount of cash to be invested by

Lopez:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT